Form Ct 1041 K 1t 2012

What is the Form Ct 1041 K 1t

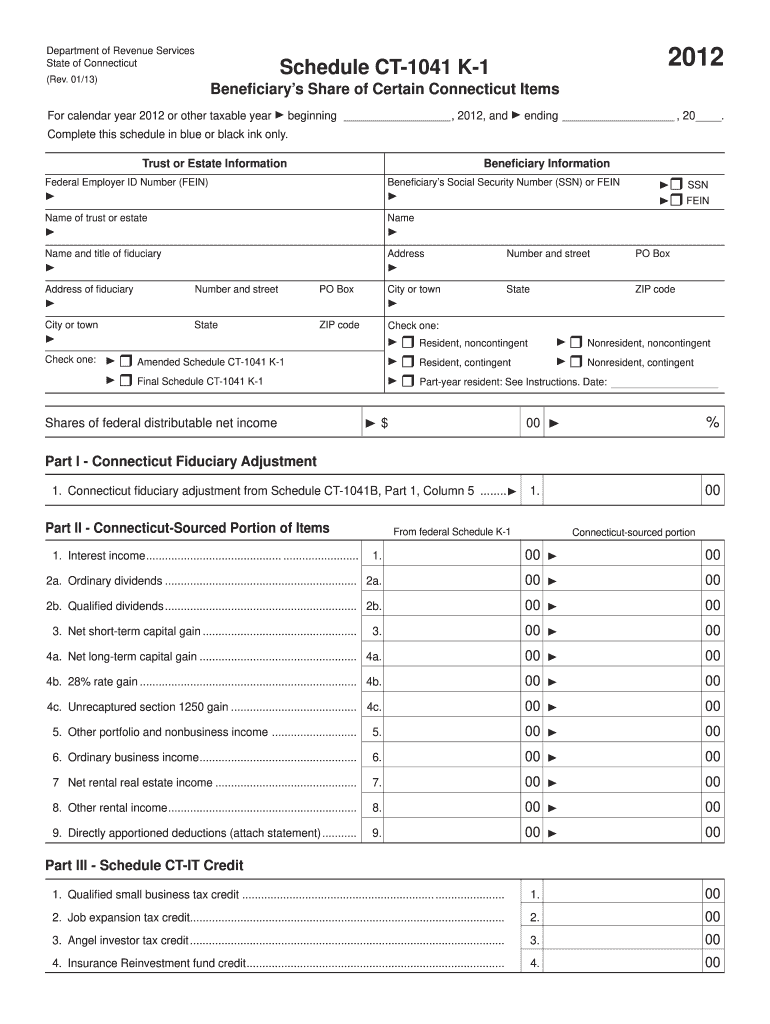

The Form Ct 1041 K 1t is a tax form used in the state of Connecticut for reporting income generated by estates and trusts. This form is essential for fiduciaries who manage the financial affairs of a deceased person's estate or a trust. It allows them to report the income earned during the tax year and distribute the income to beneficiaries. The form ensures compliance with state tax laws and helps in the accurate calculation of taxes owed by the estate or trust.

How to use the Form Ct 1041 K 1t

Using the Form Ct 1041 K 1t involves several steps. First, gather all necessary financial documents related to the estate or trust, including income statements, expenses, and distributions made to beneficiaries. Next, fill out the form accurately, ensuring that all income and deductions are reported correctly. After completing the form, it must be signed by the fiduciary and submitted to the Connecticut Department of Revenue Services. It is advisable to keep a copy for your records.

Steps to complete the Form Ct 1041 K 1t

Completing the Form Ct 1041 K 1t requires careful attention to detail. Follow these steps:

- Gather all relevant financial information, including income and expenses.

- Fill out the identification section with the estate or trust's name and tax identification number.

- Report all income earned during the tax year, including interest, dividends, and capital gains.

- List any deductions applicable to the estate or trust.

- Calculate the total taxable income and any tax owed.

- Sign and date the form, ensuring it is submitted by the deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form Ct 1041 K 1t to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts that operate on a calendar year, this means the form is generally due by April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Legal use of the Form Ct 1041 K 1t

The legal use of the Form Ct 1041 K 1t is governed by Connecticut state tax laws. It is required for any estate or trust that has taxable income. Filing this form accurately and on time is essential to fulfill legal obligations and avoid potential penalties. The form serves as a formal declaration of income and expenses, ensuring transparency and compliance with state regulations.

Required Documents

To complete the Form Ct 1041 K 1t, several documents are required:

- Financial statements showing income generated by the estate or trust.

- Records of expenses incurred during the tax year.

- Documentation of distributions made to beneficiaries.

- Any relevant tax documents, such as W-2s or 1099s.

Who Issues the Form

The Form Ct 1041 K 1t is issued by the Connecticut Department of Revenue Services. This state agency is responsible for the administration of tax laws and ensures that all forms comply with current regulations. The department provides resources and guidance for fiduciaries to assist with the accurate completion and submission of the form.

Quick guide on how to complete form ct 1041 k 1t 2012

Your assistance manual on how to prepare your Form Ct 1041 K 1t

If you're interested in learning how to generate and dispatch your Form Ct 1041 K 1t, here are some brief instructions on how to make tax filing simpler.

To start, all you need to do is set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend information as needed. Streamline your tax organization with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Form Ct 1041 K 1t in no time:

- Establish your account and start handling PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Tap Get form to access your Form Ct 1041 K 1t in our editor.

- Populate the necessary fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to submit your taxes electronically with airSlate SignNow. Keep in mind that filing by hand can lead to return errors and cause delays in refunds. Certainly, before e-filing your taxes, check the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041 k 1t 2012

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041 k 1t 2012

How to create an electronic signature for the Form Ct 1041 K 1t 2012 in the online mode

How to generate an eSignature for the Form Ct 1041 K 1t 2012 in Chrome

How to make an eSignature for putting it on the Form Ct 1041 K 1t 2012 in Gmail

How to create an eSignature for the Form Ct 1041 K 1t 2012 straight from your smart phone

How to make an eSignature for the Form Ct 1041 K 1t 2012 on iOS

How to generate an electronic signature for the Form Ct 1041 K 1t 2012 on Android

People also ask

-

What is Form Ct 1041 K 1t and how is it used?

Form Ct 1041 K 1t is a tax form used in Connecticut for reporting income that beneficiaries receive from estates or trusts. This form is essential for ensuring compliance with state tax regulations and helps beneficiaries accurately report their share of income. By utilizing airSlate SignNow, you can easily eSign and manage your Form Ct 1041 K 1t, streamlining your tax filing process.

-

How can airSlate SignNow help with Form Ct 1041 K 1t?

airSlate SignNow allows you to effortlessly eSign and send your Form Ct 1041 K 1t, making the process quick and efficient. With our secure platform, you can ensure that your tax documents are signed and submitted on time, helping you avoid penalties. Our user-friendly interface simplifies document management so you can focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for Form Ct 1041 K 1t?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Whether you're a small business or a larger enterprise, you can find a plan that suits your budget while providing the features needed for managing Form Ct 1041 K 1t efficiently. Explore our pricing options to choose the best fit for your organization.

-

What features does airSlate SignNow provide for handling Form Ct 1041 K 1t?

airSlate SignNow provides a range of features to facilitate the management of Form Ct 1041 K 1t, including customizable templates, secure eSigning, and document tracking. You can also collaborate with team members in real-time, ensuring that all necessary parties can review and sign the form promptly. Our platform enhances productivity and reduces paperwork.

-

Can I integrate airSlate SignNow with other software to manage Form Ct 1041 K 1t?

Absolutely! airSlate SignNow offers seamless integrations with popular software such as Google Drive, Dropbox, and various CRM systems. This allows you to manage your Form Ct 1041 K 1t alongside other business documents, creating a streamlined workflow. Our integrations help you save time and improve efficiency.

-

What are the benefits of using airSlate SignNow for tax forms like Form Ct 1041 K 1t?

Using airSlate SignNow for tax forms like Form Ct 1041 K 1t offers numerous benefits, including enhanced security for sensitive data, easy access to documents from anywhere, and reduced turnaround time for signatures. This digital solution not only simplifies the tax filing process but also ensures that you remain compliant with Connecticut tax regulations.

-

Is airSlate SignNow secure for signing Form Ct 1041 K 1t?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form Ct 1041 K 1t is signed in a secure environment. We use advanced encryption and authentication methods to protect your sensitive information throughout the signing process. Trust in our platform to keep your documents safe.

Get more for Form Ct 1041 K 1t

Find out other Form Ct 1041 K 1t

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself