Form Ct 1041 K 1t 2014

What is the Form Ct 1041 K-1T

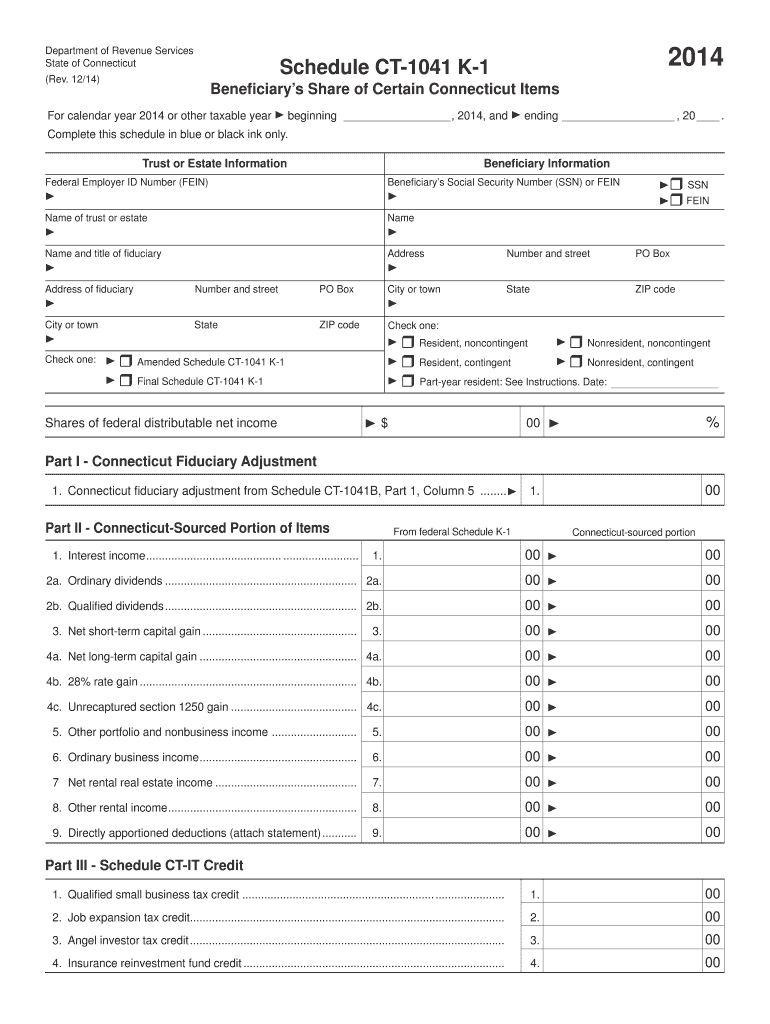

The Form Ct 1041 K-1T is a tax document used in the state of Connecticut for reporting income, deductions, and credits from estates and trusts. It serves as a schedule that beneficiaries receive, detailing their share of the trust's or estate's income. This form is essential for beneficiaries to accurately report their income on their personal tax returns. Understanding the components of this form can help ensure compliance with state tax regulations.

How to use the Form Ct 1041 K-1T

Using the Form Ct 1041 K-1T involves several key steps. Beneficiaries must first receive the form from the estate or trust administrator, which outlines the income allocated to them. Once received, beneficiaries should review the information for accuracy, including the amounts of income, deductions, and credits reported. It is crucial to incorporate this data into their personal tax returns accurately, as it impacts their overall tax liability. Proper usage of this form ensures that beneficiaries fulfill their tax obligations correctly.

Steps to complete the Form Ct 1041 K-1T

Completing the Form Ct 1041 K-1T requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the estate or trust administrator.

- Review the information provided, including your share of income, deductions, and credits.

- Ensure all amounts are accurate and match your records.

- Transfer the relevant information onto your personal tax return, typically on Schedule E.

- Keep a copy of the form for your records.

Following these steps will help ensure that the form is completed accurately and filed in compliance with tax regulations.

Legal use of the Form Ct 1041 K-1T

The legal use of the Form Ct 1041 K-1T is critical for beneficiaries of estates and trusts. This form is recognized by the Connecticut Department of Revenue Services and must be used to report income received from these entities. It is legally binding, meaning that the information reported must be accurate and truthful. Failure to comply with the legal requirements associated with this form can lead to penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 1041 K-1T are aligned with the overall tax filing schedule in Connecticut. Beneficiaries typically need to file their personal tax returns by April fifteenth of each year. However, if the estate or trust has a different fiscal year, the deadlines may vary. It is essential for beneficiaries to be aware of these dates to avoid late filing penalties. Keeping track of these important dates will ensure timely compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form Ct 1041 K-1T can be done through various methods. Beneficiaries can file their personal tax returns online using approved tax software that supports Connecticut forms. Alternatively, they can print the completed form and submit it by mail to the appropriate state tax office. In-person submissions are also possible at designated tax offices. Each method has its advantages, and beneficiaries should choose the one that best fits their needs and preferences.

Quick guide on how to complete form ct 1041 k 1t 2014

Your assistance manual on how to prepare your Form Ct 1041 K 1t

If you’re curious about how to complete and submit your Form Ct 1041 K 1t, here are a few brief tips to simplify tax processing.

To get going, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax papers effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, and revisit to change information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Form Ct 1041 K 1t in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our catalog to access any IRS tax form; browse through versions and schedules.

- Click Get form to display your Form Ct 1041 K 1t in our editor.

- Complete the required fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that filing on paper can lead to increased return errors and delays in reimbursements. Moreover, before electronically filing your taxes, confirm the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041 k 1t 2014

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041 k 1t 2014

How to make an eSignature for your Form Ct 1041 K 1t 2014 online

How to make an eSignature for the Form Ct 1041 K 1t 2014 in Google Chrome

How to make an eSignature for putting it on the Form Ct 1041 K 1t 2014 in Gmail

How to generate an eSignature for the Form Ct 1041 K 1t 2014 right from your smart phone

How to create an electronic signature for the Form Ct 1041 K 1t 2014 on iOS devices

How to generate an eSignature for the Form Ct 1041 K 1t 2014 on Android

People also ask

-

What is Form Ct 1041 K 1t and why is it important?

Form Ct 1041 K 1t is a tax form used in Connecticut for reporting income, deductions, and credits for estates and trusts. Understanding this form is crucial for compliance with state tax regulations and ensures that estates and trusts fulfill their tax obligations accurately. By using airSlate SignNow, you can easily eSign and submit Form Ct 1041 K 1t, streamlining your tax filing process.

-

How does airSlate SignNow help with completing Form Ct 1041 K 1t?

airSlate SignNow simplifies the process of completing Form Ct 1041 K 1t by providing templates that are easy to fill out and customize. You can quickly add necessary information, sign the document electronically, and share it with all relevant parties. This helps ensure that your form is filled out correctly and submitted on time.

-

What are the pricing options for using airSlate SignNow to manage Form Ct 1041 K 1t?

airSlate SignNow offers flexible pricing plans that cater to both individuals and businesses looking to manage Form Ct 1041 K 1t efficiently. Whether you need a basic plan for occasional use or a more comprehensive option for frequent document handling, airSlate SignNow provides cost-effective solutions to meet your needs.

-

Can I integrate airSlate SignNow with other software for managing Form Ct 1041 K 1t?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Form Ct 1041 K 1t alongside your existing tools. You can connect it with cloud storage services, CRMs, and other document management systems, ensuring a smooth workflow and efficient document handling.

-

What features does airSlate SignNow offer for eSigning Form Ct 1041 K 1t?

airSlate SignNow offers a range of features for eSigning Form Ct 1041 K 1t, including customizable signature fields, audit trails, and notifications. These features enhance the signing experience by ensuring that all parties are informed and that the document's integrity is maintained throughout the process.

-

Is airSlate SignNow secure for signing important documents like Form Ct 1041 K 1t?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption protocols to protect your data. When signing important documents like Form Ct 1041 K 1t, you can trust that your information is safeguarded, ensuring compliance and peace of mind.

-

How can I access support for issues related to Form Ct 1041 K 1t using airSlate SignNow?

airSlate SignNow provides comprehensive support for users encountering issues with Form Ct 1041 K 1t. You can access a range of resources, including tutorials, FAQs, and customer support representatives who can assist you in resolving any questions or concerns you may have.

Get more for Form Ct 1041 K 1t

Find out other Form Ct 1041 K 1t

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online