Schedule CT 1041 K 1 E Form RS Login 2022

Understanding the Schedule CT 1041 K-1

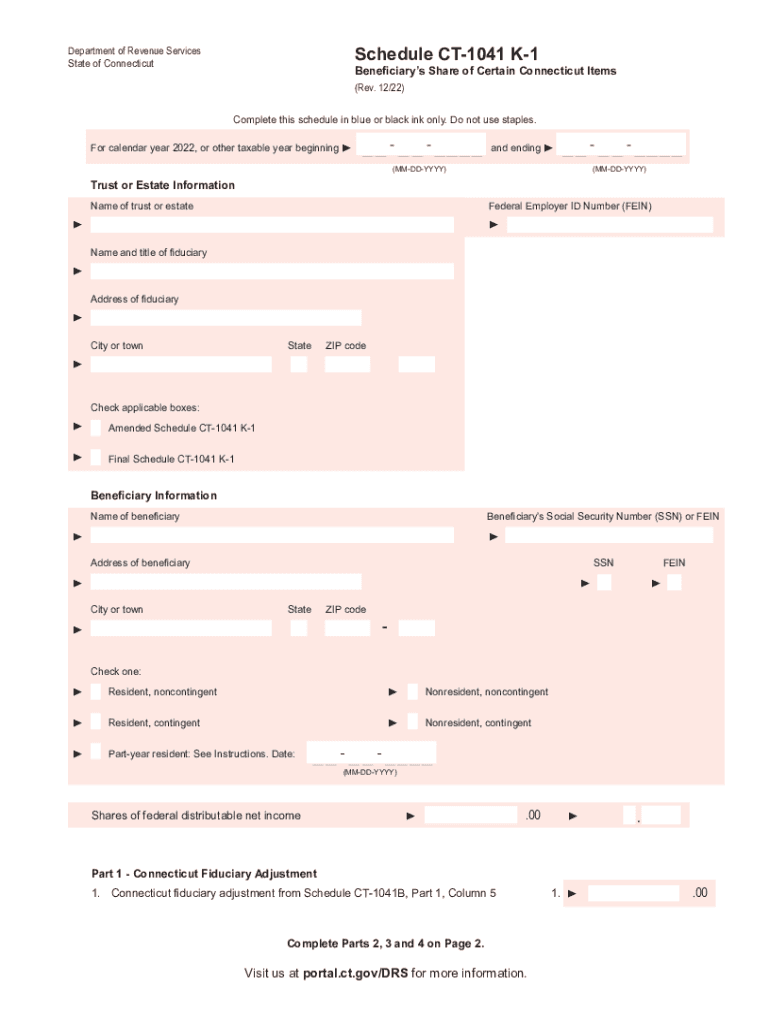

The Schedule CT 1041 K-1 is a tax form used in Connecticut for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information about each partner's or shareholder's share of the entity's income, which is crucial for accurate tax filing. It is essential for recipients to understand the components of the form, including the income distributed, tax credits, and any deductions that may apply.

Steps to Complete the Schedule CT 1041 K-1

Completing the Schedule CT 1041 K-1 involves several key steps:

- Gather necessary financial documents related to the partnership or entity.

- Identify the income, deductions, and credits allocated to you as a partner or shareholder.

- Fill out the form accurately, ensuring all amounts are reported correctly.

- Review the completed form for any errors before submission.

- Submit the form to the Connecticut Department of Revenue Services as required.

Filing Deadlines for Schedule CT 1041 K-1

It is important to be aware of the filing deadlines associated with the Schedule CT 1041 K-1. Typically, the form must be filed by the same deadline as the entity's tax return. For most entities, this is the fifteenth day of the fourth month following the end of the tax year. If the entity operates on a calendar year basis, the deadline would be April 15. Extensions may be available, but it is crucial to check specific guidelines to avoid penalties.

Legal Use of the Schedule CT 1041 K-1

The Schedule CT 1041 K-1 is legally binding and must be filled out in compliance with Connecticut tax laws. Each partner or shareholder is responsible for reporting their share of the income on their personal tax returns. Failure to accurately report income from this form can lead to penalties and interest on unpaid taxes. Therefore, understanding the legal implications of the information provided on the form is essential for compliance.

Key Elements of the Schedule CT 1041 K-1

The Schedule CT 1041 K-1 includes several key elements that are important for both the entity and the individual taxpayer:

- Entity Information: Name, address, and tax identification number of the partnership or entity.

- Partner/Shareholder Information: Name, address, and identifying information of the partner or shareholder receiving the K-1.

- Income and Deductions: Detailed breakdown of income, deductions, and credits allocated to the partner or shareholder.

- Signature: Required signature of the authorized person from the entity, confirming the accuracy of the information.

Form Submission Methods for Schedule CT 1041 K-1

The Schedule CT 1041 K-1 can be submitted through various methods. Taxpayers can file the form electronically via approved tax software or submit a paper version by mail. It is advisable to keep a copy of the submitted form for personal records. For electronic submissions, ensure that the software used is compatible with Connecticut tax regulations to avoid any compliance issues.

Quick guide on how to complete schedule ct 1041 k 1 e form rs login

Effortlessly Complete Schedule CT 1041 K 1 E Form RS Login on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly and without hindrance. Manage Schedule CT 1041 K 1 E Form RS Login on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

How to Edit and eSign Schedule CT 1041 K 1 E Form RS Login with Ease

- Find Schedule CT 1041 K 1 E Form RS Login and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule CT 1041 K 1 E Form RS Login and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ct 1041 k 1 e form rs login

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1041 k 1 e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 1041 K-1 and why is it important?

The CT 1041 K-1 form is used to report income, deductions, and credits for beneficiaries of trusts and estates in Connecticut. Understanding how to form CT 1041 K-1 is crucial for accurate tax reporting and compliance. It ensures that beneficiaries receive the correct tax information needed for their personal returns.

-

How can airSlate SignNow help me in preparing a CT 1041 K-1?

AirSlate SignNow simplifies the process of preparing a CT 1041 K-1 by allowing you to create, manage, and eSign all necessary documents efficiently. With its user-friendly interface, you can easily work through the steps of how to form CT 1041 K-1 without overwhelming complexity. This streamlines your workflow and saves valuable time.

-

Are there any features in airSlate SignNow specifically for K-1 forms?

Yes, airSlate SignNow offers features that make it easier to create and manage K-1 forms, including customizable templates and electronic signature capabilities. When looking at how to form CT 1041 K-1, these features play a vital role in enhancing efficiency and accuracy in your documentation process.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow provides several pricing options to accommodate different business needs. Each plan includes features that assist with processes like how to form CT 1041 K-1, ensuring you have the tools necessary for compliant and efficient form submission. Check the website for specific pricing details and available features.

-

Is airSlate SignNow compliant with IRS guidelines for form submissions?

Absolutely! AirSlate SignNow is designed to comply with all relevant IRS guidelines for electronic submissions, including the CT 1041 K-1 form. This ensures that when you're dealing with how to form CT 1041 K-1, the platform adheres to regulatory standards, contributing to a seamless filing process.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow seamlessly integrates with various software platforms to enhance your experience and productivity. This means you can streamline your workflow while learning how to form CT 1041 K-1, as it allows for the free flow of data between applications, ultimately saving you time.

-

What benefits does eSigning provide for CT 1041 K-1 forms?

eSigning with airSlate SignNow offers convenience, security, and speed when completing CT 1041 K-1 forms. This digital method eliminates the hassles of printing, signing, and scanning, making the question of how to form CT 1041 K-1 much easier. It ensures that your documents are signed quickly and securely, enhancing overall efficiency.

Get more for Schedule CT 1041 K 1 E Form RS Login

- Notice of assignment to living trust south dakota form

- Revocation of living trust south dakota form

- Letter to lienholder to notify of trust south dakota form

- South dakota timber sale contract south dakota form

- South dakota forest products timber sale contract south dakota form

- South dakota easement form

- Assumption agreement of mortgage and release of original mortgagors south dakota form

- Small estate heirship affidavit for estates under 50000 south dakota form

Find out other Schedule CT 1041 K 1 E Form RS Login

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors