Form Ct 1041 K 1t 2016

What is the Form Ct 1041 K 1t

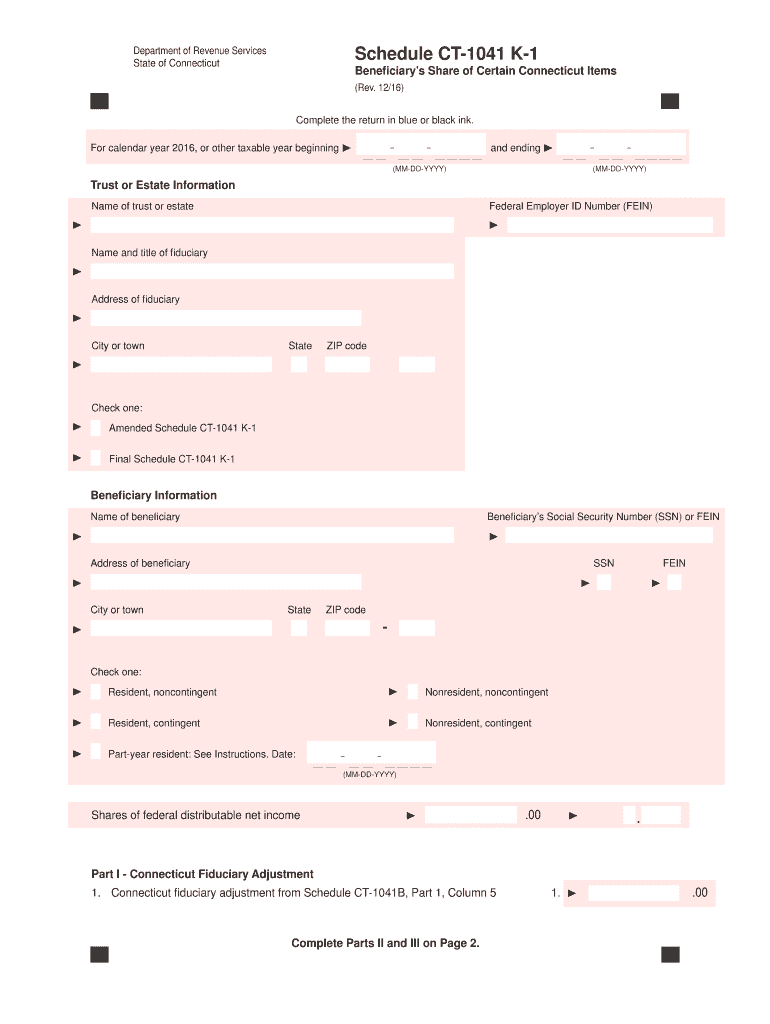

The Form Ct 1041 K 1t is a tax document used in the state of Connecticut. It is specifically designed for fiduciaries to report income, gains, losses, deductions, and credits for estates and trusts. This form is essential for ensuring compliance with state tax regulations and is typically filed by the fiduciary responsible for managing the estate or trust. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance.

How to use the Form Ct 1041 K 1t

Using the Form Ct 1041 K 1t involves several steps. First, gather all necessary financial information related to the estate or trust, including income, expenses, and deductions. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to follow the instructions provided with the form carefully. Once completed, the form can be submitted either electronically or by mail, depending on the preferences and capabilities of the fiduciary. Always retain a copy for your records.

Steps to complete the Form Ct 1041 K 1t

Completing the Form Ct 1041 K 1t requires attention to detail. Begin by entering the identifying information for the estate or trust, including the name, address, and taxpayer identification number. Next, report all sources of income, such as interest, dividends, and capital gains. Deduct any allowable expenses, including administrative costs and taxes paid. Finally, calculate the total tax liability and ensure all calculations are accurate. Review the form thoroughly before submission to avoid errors.

Legal use of the Form Ct 1041 K 1t

The legal use of the Form Ct 1041 K 1t is governed by Connecticut state tax laws. It is crucial for fiduciaries to understand their responsibilities when filing this form. The form must be completed in accordance with state regulations, and any inaccuracies can lead to penalties or legal issues. Additionally, the form must be filed by the appropriate deadlines to avoid late fees. Compliance with these legal requirements ensures that the fiduciary fulfills their obligations and protects the interests of the beneficiaries.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 1041 K 1t are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this typically falls on April 15. It is important to mark these dates on your calendar to ensure timely submission. Failure to file by the deadline can result in penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Form Ct 1041 K 1t can be submitted through various methods, offering flexibility for fiduciaries. The form may be filed electronically through the Connecticut Department of Revenue Services website, which provides a secure and efficient way to submit tax documents. Alternatively, fiduciaries can choose to mail the completed form to the appropriate state address. In-person submissions are typically not required but may be available for specific circumstances. Always check the latest guidelines for submission methods to ensure compliance.

Quick guide on how to complete form ct 1041 k 1t 2016

Your assistance manual on how to prepare your Form Ct 1041 K 1t

If you're looking to understand how to finalize and submit your Form Ct 1041 K 1t, here are some brief guidelines to streamline your tax filing process.

To start, simply register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, generate, and finalize your tax papers with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and revisit sections to make changes as necessary. Simplify your tax processing with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Form Ct 1041 K 1t in just a few minutes:

- Establish your account and start editing PDFs within moments.

- Browse our catalog to locate any IRS tax form; navigate through various versions and schedules.

- Select Get form to launch your Form Ct 1041 K 1t in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessitated).

- Examine your document and correct any discrepancies.

- Save your modifications, print a copy, transmit it to your intended recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to return inaccuracies and postpone refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041 k 1t 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041 k 1t 2016

How to create an electronic signature for the Form Ct 1041 K 1t 2016 online

How to generate an eSignature for the Form Ct 1041 K 1t 2016 in Chrome

How to generate an eSignature for signing the Form Ct 1041 K 1t 2016 in Gmail

How to make an eSignature for the Form Ct 1041 K 1t 2016 right from your smart phone

How to create an eSignature for the Form Ct 1041 K 1t 2016 on iOS devices

How to create an eSignature for the Form Ct 1041 K 1t 2016 on Android OS

People also ask

-

What is Form Ct 1041 K 1t and who needs it?

Form Ct 1041 K 1t is a tax form used for reporting income from estates and trusts in Connecticut. It is essential for fiduciaries who manage estates or trusts, ensuring compliance with state tax regulations. Understanding how to complete this form can help you accurately report income and avoid penalties.

-

How can airSlate SignNow help me with Form Ct 1041 K 1t?

airSlate SignNow streamlines the process of completing and eSigning Form Ct 1041 K 1t. With our user-friendly interface, you can fill out the form electronically, securely send it for signatures, and store it for easy access. This not only saves time but also enhances document accuracy.

-

What are the pricing options for using airSlate SignNow for Form Ct 1041 K 1t?

airSlate SignNow offers flexible pricing plans that cater to various business needs, starting from a free trial to premium subscriptions. Our pricing is designed to provide value, allowing you to eSign and manage documents like Form Ct 1041 K 1t without compromising on quality. You can choose a plan that best fits your usage and budget.

-

Is airSlate SignNow compliant with legal standards for Form Ct 1041 K 1t?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, making it a reliable choice for signing Form Ct 1041 K 1t. Our platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your electronically signed documents are legally binding and secure.

-

What features does airSlate SignNow offer for managing Form Ct 1041 K 1t?

airSlate SignNow provides comprehensive features for managing Form Ct 1041 K 1t, including templates, automated workflows, and secure storage. You can create a template for the form, customize it as needed, and send it out for signatures in just a few clicks, enhancing your efficiency.

-

Can I integrate airSlate SignNow with other software for Form Ct 1041 K 1t?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enabling you to enhance your workflow for Form Ct 1041 K 1t. Whether you’re using CRM systems, cloud storage, or accounting software, our integrations ensure a smooth process and data synchronization.

-

What are the benefits of using airSlate SignNow for Form Ct 1041 K 1t over traditional methods?

Using airSlate SignNow for Form Ct 1041 K 1t offers numerous benefits over traditional paper-based methods. It eliminates the need for printing, scanning, and mailing documents, thus saving you time and reducing costs. Additionally, the platform provides enhanced security features and tracking capabilities for your documents.

Get more for Form Ct 1041 K 1t

- Application for occupancy february arizona association of form

- Mconline form

- Blank fillable da form 1687

- Public facility use certification form humana military

- Whitby campus form

- Pptc 153 e adult general passport application for canadians 16 years of age or over applying in canada or the usa 780422799 form

- Family member family loan agreement template form

- Crowdfund contract template form

Find out other Form Ct 1041 K 1t

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy