Forms 1040 2015

What is the Forms 1040

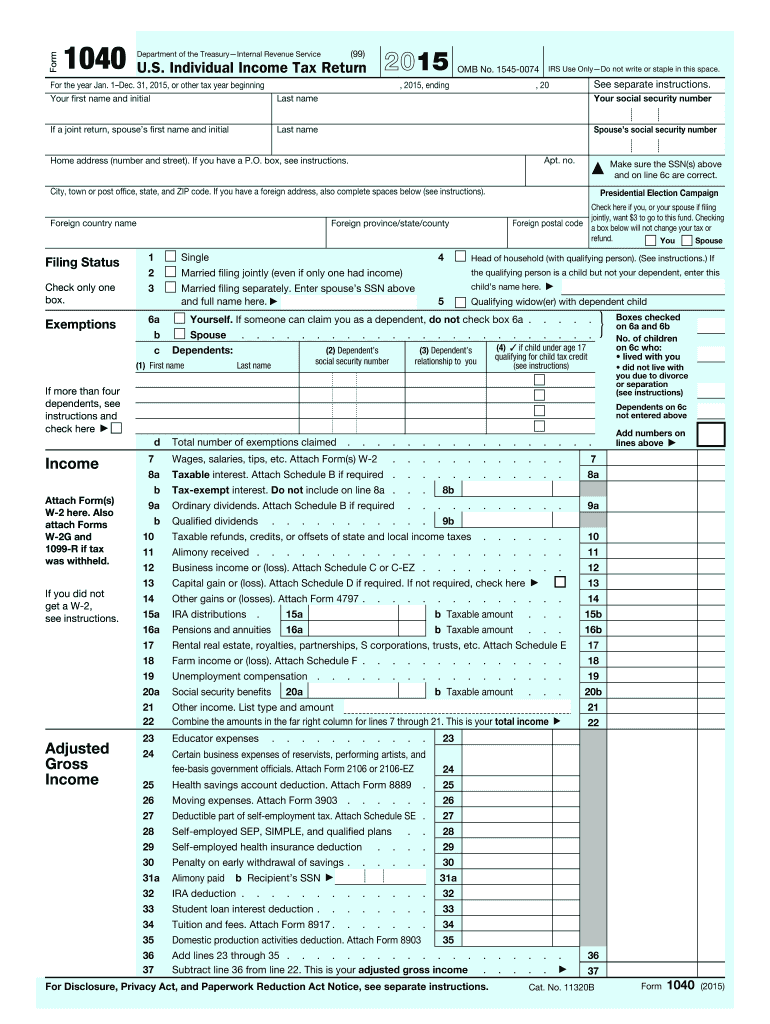

The Forms 1040 is a crucial tax document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating the amount of tax owed or the refund due. The primary purpose of the Forms 1040 is to provide a comprehensive overview of an individual's financial situation, including wages, dividends, capital gains, and other sources of income. It also allows taxpayers to claim deductions and credits that can reduce their overall tax liability.

Steps to complete the Forms 1040

Completing the Forms 1040 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Choose the appropriate version of the form based on your tax situation, such as the standard Form 1040 or the simplified Form 1040-SR for seniors.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include all relevant financial documents.

- Claim deductions and credits that apply to you, such as the standard deduction or itemized deductions.

- Calculate your total tax liability and any refund or amount owed.

- Review your completed form for accuracy before submission.

Legal use of the Forms 1040

The Forms 1040 must be filled out accurately and submitted according to IRS guidelines to ensure legal compliance. Using outdated forms or providing incorrect information can lead to penalties or delays in processing. It is essential to keep copies of all submitted forms and supporting documents for your records. The IRS may require these documents for future reference or audits. Additionally, electronic filing of the Forms 1040 is accepted and offers a secure method for submission.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Forms 1040:

- Online: Many taxpayers choose to file electronically using IRS-approved software, which allows for faster processing and quicker refunds.

- Mail: You can also print and mail your completed Forms 1040 to the appropriate IRS address based on your location and whether you are enclosing payment.

- In-Person: Some taxpayers may opt to file in person at designated IRS offices, especially if they require assistance or have complex tax situations.

Filing Deadlines / Important Dates

Understanding filing deadlines is vital for compliance. The standard deadline for submitting the Forms 1040 is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension, allowing them to file by October 15, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Forms 1040 accurately, several documents are typically required:

- W-2 forms from employers, reporting wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Records of deductible expenses, such as mortgage interest, medical expenses, and charitable contributions.

- Social Security numbers for yourself and any dependents.

Quick guide on how to complete forms 1040 2015

Uncover the most efficient method to complete and endorse your Forms 1040

Are you still squandering time preparing your official documents on physical copies instead of doing it digitally? airSlate SignNow provides a superior way to complete and endorse your Forms 1040 and associated forms for public services. Our intelligent electronic signature solution equips you with everything you require to handle paperwork swiftly and in accordance with legal standards - powerful PDF editing, managing, protecting, endorsing, and sharing tools all readily accessible within an intuitive interface.

Only a few steps are necessary to finalize filling out and endorsing your Forms 1040:

- Incorporate the fillable template to the editor using the Get Form button.

- Assess what information you need to include in your Forms 1040.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Obscure areas that are no longer relevant.

- Click on Sign to produce a legally binding electronic signature using the option of your choice.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized Forms 1040 in the Documents folder within your profile, download it, or transfer it to your preferred cloud service. Our solution also offers versatile file sharing. There’s no need to print your templates when you need to submit them at the designated public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct forms 1040 2015

FAQs

-

How could I pay tax to the government after I earn money by my individual design work?

I'm not familiar with how you would be taxed under an OPT visa, but you may be able to use the 2015 IRS Tax Withholding Calculator. This calculator is for permanent residents/citizens and it may help you determine how much money you'll owe for the whole year once you put in all applicable information.You can submit tax payments every quarter by filling out these forms and including checks to the IRS and Massachusetts Department of Revenue:IRS Form 1040-ES - Estimated Tax for IndividualsMA Form 1-ES - Estimated Tax Payment

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

Create this form in 5 minutes!

How to create an eSignature for the forms 1040 2015

How to create an eSignature for your Forms 1040 2015 in the online mode

How to make an electronic signature for the Forms 1040 2015 in Chrome

How to create an eSignature for putting it on the Forms 1040 2015 in Gmail

How to make an electronic signature for the Forms 1040 2015 right from your mobile device

How to create an eSignature for the Forms 1040 2015 on iOS

How to create an eSignature for the Forms 1040 2015 on Android OS

People also ask

-

What are Forms 1040 and why are they important?

Forms 1040 are the standard tax forms used by individuals in the United States to file their annual income tax returns. They are essential for accurately reporting income, calculating taxes owed, and claiming any applicable deductions or credits. Understanding how to correctly fill out Forms 1040 can greatly impact your tax liabilities and refunds.

-

How can airSlate SignNow help with completing Forms 1040?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign Forms 1040 online. With our features, you can collaborate with tax professionals, ensuring all necessary sections are completed correctly and efficiently. Additionally, you can store and manage your completed Forms 1040 securely within our system.

-

What are the pricing options for using airSlate SignNow for Forms 1040?

airSlate SignNow offers a range of pricing plans to suit different needs, starting with a free trial for new users. Our competitive pricing allows individuals and businesses to access the tools necessary for completing Forms 1040 without breaking the bank. For a more detailed overview of our pricing, visit our website.

-

Can I integrate airSlate SignNow with other software for filing Forms 1040?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your ability to manage Forms 1040. This integration allows for smoother workflows, enabling you to import data directly into your Forms 1040 from your accounting software. Check our integration page for a complete list of compatible applications.

-

What security measures does airSlate SignNow implement for Forms 1040?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like Forms 1040. We utilize advanced encryption methods and secure cloud storage to protect your data. Additionally, our platform complies with industry standards to ensure your information remains confidential and secure.

-

Can multiple users collaborate on Forms 1040 using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Forms 1040 in real-time. This feature is particularly beneficial for tax professionals and their clients, as it enables easy communication and edits, ensuring that all necessary information is captured before submission.

-

Is there customer support available for assistance with Forms 1040 on airSlate SignNow?

Yes, we provide dedicated customer support to assist users with any questions or issues related to Forms 1040. Our knowledgeable support team is available via chat, email, or phone to ensure you have all the resources needed for a smooth experience with our platform.

Get more for Forms 1040

Find out other Forms 1040

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online