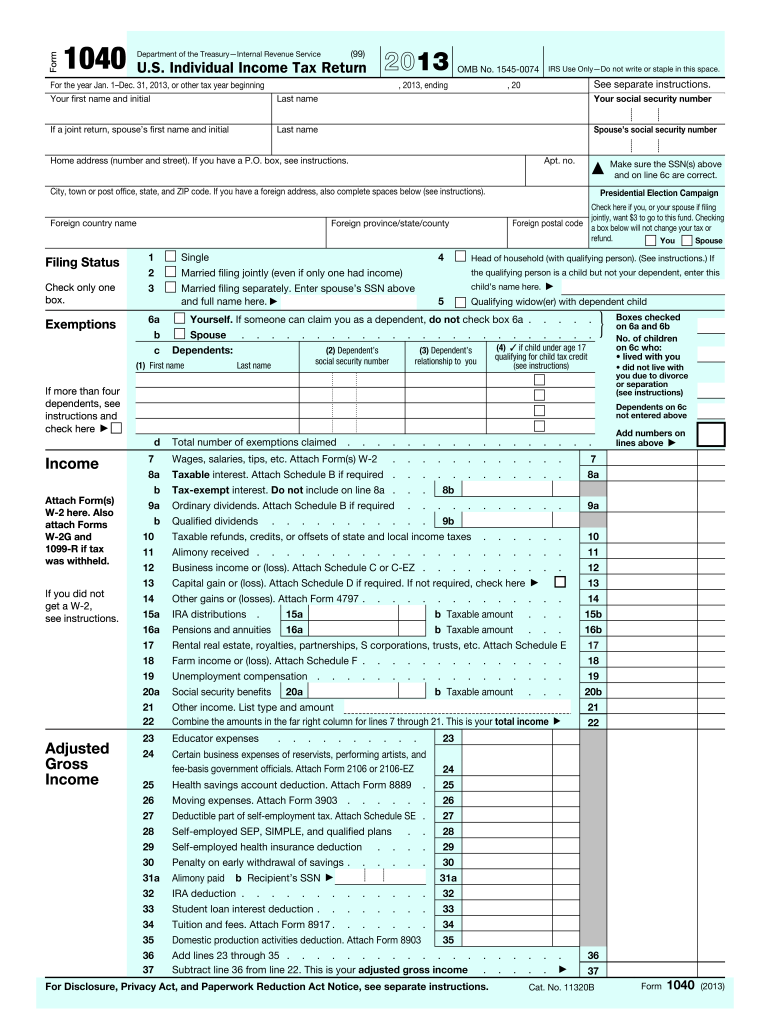

Forms 2013

What is the Forms

Forms are standardized documents used to collect information or facilitate processes in various contexts, including legal, tax, and administrative matters. In the United States, forms serve as essential tools for individuals and businesses to communicate information to government agencies, financial institutions, and other organizations. They may include applications, tax returns, or compliance documents, each designed to gather specific data required for processing requests or fulfilling legal obligations.

How to use the Forms

Using forms effectively involves several key steps. First, identify the specific form required for your needs. This could be a tax form, application, or other document. Next, ensure you have the most current version of the form, as outdated forms may not be accepted. Carefully read the instructions provided with the form to understand the information required. Fill out the form completely, ensuring all necessary fields are completed accurately. Finally, submit the form according to the specified submission methods, whether online, by mail, or in person.

Steps to complete the Forms

Completing forms accurately is crucial for successful processing. Follow these steps:

- Gather necessary information and documents needed to fill out the form.

- Review the instructions carefully to understand what is required.

- Fill in the form, ensuring clarity and accuracy in your responses.

- Double-check all entries for completeness and correctness before submission.

- Submit the form through the designated method, keeping a copy for your records.

Legal use of the Forms

Forms must be completed and submitted in accordance with legal requirements to be considered valid. This includes using the correct version of the form and providing accurate information. In many cases, forms may need to be notarized or accompanied by supporting documents. Understanding the legal implications of the information provided is essential, as inaccuracies or omissions can lead to penalties or delays in processing.

Form Submission Methods (Online / Mail / In-Person)

Forms can typically be submitted through various methods, depending on the type of form and the requirements of the receiving agency. Common submission methods include:

- Online: Many forms can be completed and submitted electronically through official websites.

- Mail: Forms may be printed, completed, and sent via postal service to the appropriate address.

- In-Person: Some forms require in-person submission at designated offices or agencies.

Examples of using the Forms

Forms are utilized in a wide range of scenarios. For instance, individuals may use tax forms like the W-2 to report income, while businesses might complete forms such as the LLC formation documents to establish a legal entity. Other examples include application forms for permits, licenses, or government assistance programs, each tailored to specific needs and requirements.

Quick guide on how to complete 2013 forms

Discover the easiest method to complete and endorse your Forms

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to fill out and sign your Forms and similar forms for public services. Our intelligent eSignature solution provides you with all the tools necessary to handle documentation swiftly and comply with official standards - robust PDF editing, managing, securing, signing, and sharing capabilities all accessible through a user-friendly interface.

Only a few steps are needed to complete and endorse your Forms:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to include in your Forms.

- Move through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Select Sign to create a legally binding eSignature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized Forms in the Documents folder of your profile, download it, or export it to your preferred cloud service. Our solution also facilitates flexible file sharing. There’s no need to print your forms when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2013 forms

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How do I close a newly formed private limited company?

Under Companies Act 2013, a Company can be closed in two ways.Winding UpWinding up is a tedious process and can be done either voluntary by calling up a meeting of all stakeholders and passing a special resolution or can be done on the order of Court or Tribunal. Strike Off” mode was introduced by the MCA to give the opportunity to the defunct companies to get their names struck off from the Register of Companies. On 27th December 2016, MCA has notified new rules i.e. Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 prescribing rule for winding up or closure of private limited company under companies act 2013. By releasing the form STK 2, ministry of Corporate Affairs has brought the Section 248- 252 of 2013 act into force.Fast track ExitThis is the most awaited procedure, that got active again on 5thApril 2017. This procedure was introduced in Section 248 of Companies Act 2013.Fast Track exit can be done in two ways:Suo Moto by RegistrarThe registrar may strike off the name of Company on its own if:Company has failed to commence any business in a year of its incorporationCompany is not carrying out any business or Activity for preceding 2 financial years and has not sought the status of Dormant Company.The Registrar sends a notice (STK-1) of his intention to remove the name and seeks the representation of Company in 30 days.Note: Liability on the Directors of the company still exists. ROC can invoke penalty clauses anytime, and the penalty may range from INR 50K to INR 5Lakhs per director.Voluntary Removal of Name using Form STK 2Company can also move an application to Registrar of Companies for striking off the name by filing form STK-2 along with a fee of Rs 5000/-. Once form is filed, the Registrar has power and duty to satisfy him that all amount due by the company for the discharge of its liabilities and obligations has been realized. ROC can also issue a show cause notice in case of default in filing returns or other obligations.After above formalities, ROC issues a public notice and strike off the name of Company after its expiry.Note: The form is in approval route. Therefore, concerned ROC can ask for the completion of the fillings.Details Required:Incorporation CertificateDirector Identification NumberPending Litigation Proceedings if anyDocuments Required:Application in form STK-2Government filing fees: INR 5,000/-Copy of Board resolution authorizing the filing of this application;A statement of accounts showing the assets and liabilities of the Company made up to a day, not more than thirty days before the date of application and certified by a Chartered AccountantShareholder’s approval by way of Special ResolutionIn the case of a company regulated by any other authority, approval of such authority shall also be required.Copy of relevant order for delisting, if any, from the concerned Stock Exchange;Indemnity bond [to be given individually or collectively by the director(s)] in Form No. STK-3;Affidavit in Form No. STK-4Note: This form must be signed by a practicing CA or CSCompanies that cannot file for voluntary strike-offA company cannot fill the form STK 2 at any time in the previous 3 months if the company hasHas changed its name or shifted its registered office from one State to another;Has made a disposal for value of property or rights held by it, immediatelyBefore cesser of trade or otherwise carrying on of business, for the purpose of disposal for gain in the normal course of trading or otherwise carrying on of business;Has engaged in any other activity except the one which is necessary or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company or complying with any statutory requirement;Has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; orIs being wound up under Chapter XX of Companies Act or under the Insolvency and Bankruptcy code, 2016Companies that cannot use Fast Track Exit option:Companies Registered Under Section 8Listed companies;Companies that have been delisted due to non-compliance of listing regulations or listing agreement or any other statutory laws;Vanishing companies;Companies where inspection or investigation is ordered and being carried out or actions on such order are yet to be taken up or were completed but prosecutions arising out of such inspection or investigation are pending in the Court;Companies where notices have been issued by the Registrar or Inspector (under Section 234 of the Companies Act, 1956 (old Act) or section 206 or section 207 of the Act)and reply thereto is pending;Companies against which any prosecution for an offense is pending in any court;Companies whose application for compounding is pending;Companies which have accepted public deposits which are either outstanding or the company is in default in repayment of the same;Companies having charges which are pending for satisfaction.,After you Strike off your company:As soon as the name of company is removed from Register, from the date mentioned in the notice under sub-section (5) of section 248 cease to operate as a company and the Certificate of Incorporation issued to it shall be deemed to have been cancelled from such date except for the purpose of realizing the amount due to the company and for the payment or discharge of the liabilities or obligations of the company.- See more at: Different ways to Close a Company in India - WazzeerFor any Legal and Accounting support, Happy to help you, let us talkPS: Wazzeer Loves entrepreneurs #GoGetItIn case, you are thinking of getting some free advise from an experienced Lawyer (and Accountant), checkout Counselapplication of Wazzeer.#WazzeerKACounsel**For any Legal and Accounting support, Happy to help you, let us talkPS: Wazzeer Loves entrepreneurs #GoGetIt

-

How do radio stations know how many listeners they have?

Radio ratings, which give some idea about how many listeners a station has, have been around since 1930. A researcher named Archibald Crossley ran the first company to use survey methods to determine audience size, although only on network programs— the so-called “Crossley Ratings.” There were other companies too— some used telephone surveys, some used mail-in surveys, others used in-person interviews, etc. Until fairly recently (2013), the vast majority of US radio stations (both AM and FM) were rated by a company called Arbitron. For many years, Arbitron used a “diary method”, where random users in major, medium and small markets were surveyed as to what they listened to during the specific period of the survey; they wrote down their listening habits on a form, and then they submitted the completed diary to Arbitron, which compiled the results into what was called “the Book” by radio stations. (“How did you do in the Book?” was radio talk for “Did you get good ratings during this rating period?”)In 2013, Nielsen, which had previously been known for television ratings, purchased Arbitron. Now, radio stations are surveyed by Nielsen, which does not use a paper diary any more. The preferred survey method now is “portable people meters” (PPM) which compile a person’s listening habits electronically. Individuals are still surveyed randomly; a specific number are contacted in each major, large, medium, and small market (city). Many people think the PPM is more accurate and easier to use than asking people to fill out a diary for a week or two. But others believe the PPM results are not as accurate, or that they favor younger formats (where the diary method favored older formats, since older people were more likely to fill their diaries out). Here is a link to a 2015 article about all of this, written by a very knowledgeable radio colleague of mine: Inconsistent Nielsen data vexes public radio stations and inspires a commercial solution

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I join for a full-time PhD in IITB? I have a GATE 2013 score and am appearing in the GATE 2018 and completed an MTech in 2015.

A2A. GATE is a mandatory requirement for Ph.D entrance if you wish to join the Ph.D programme having only a Bachelor’s degree. If you have a Masters’, then as far as I recall, there is no need for a GATE score— you simply need to fill out the online form. There are two call cycles— one in December, and the other in May/June.Read the IITB website for more details. If shortlisted, you will be subjected to a two-level screening process. First, a written examination, followed by an interview if you clear the written paper.Hope this helps.DG

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

Create this form in 5 minutes!

How to create an eSignature for the 2013 forms

How to generate an electronic signature for the 2013 Forms in the online mode

How to generate an electronic signature for the 2013 Forms in Chrome

How to create an electronic signature for signing the 2013 Forms in Gmail

How to create an eSignature for the 2013 Forms straight from your smart phone

How to make an electronic signature for the 2013 Forms on iOS devices

How to make an electronic signature for the 2013 Forms on Android OS

People also ask

-

What are Forms in airSlate SignNow?

Forms in airSlate SignNow are customizable templates that allow users to collect information seamlessly. These forms can include fields for signatures, dates, and other essential data, making it easier for businesses to gather the necessary information from clients or team members.

-

How can I create Forms using airSlate SignNow?

Creating Forms in airSlate SignNow is straightforward. Users can start from scratch or choose from a variety of pre-designed templates. The intuitive drag-and-drop interface enables you to add fields and customize the layout to suit your business needs.

-

Are there any costs associated with using Forms in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to Forms. Depending on the plan you choose, you can benefit from additional features like advanced analytics and integrations, ensuring you get the best value for your business's needs.

-

Can Forms be integrated with other applications?

Yes, airSlate SignNow allows you to integrate Forms with various applications for enhanced functionality. Popular integrations include CRM systems, project management tools, and cloud storage services, enabling seamless workflows and data management.

-

What security measures are in place for Forms in airSlate SignNow?

Security is a top priority for airSlate SignNow. Forms are protected with encryption and comply with industry standards to ensure that your data is safe. Additionally, you can set access controls and permissions to manage who can view or edit your Forms.

-

How can Forms improve my business processes?

Using Forms in airSlate SignNow streamlines information collection and approval processes. This efficiency reduces paperwork, speeds up transactions, and enhances customer satisfaction, allowing your business to operate more smoothly and effectively.

-

Can I track submissions from my Forms?

Absolutely! airSlate SignNow provides tracking and analytics tools that allow you to monitor submissions and responses from your Forms. This feature helps you stay informed about the status of documents and ensures timely follow-ups with clients.

Get more for Forms

- Atestado de escolaridade pdf form

- Dd 2807 2 mar fillable form

- How to use this activity cdn scope scholastic com form

- Affidavit of support form 81577067

- Computershare com brighthouse forms

- Frg family member information survey fort bragg

- Self assessment keypreceptor sign off key pih health form

- Sole trader agreement template form

Find out other Forms

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple