Form 1040 2010

What is the Form 1040

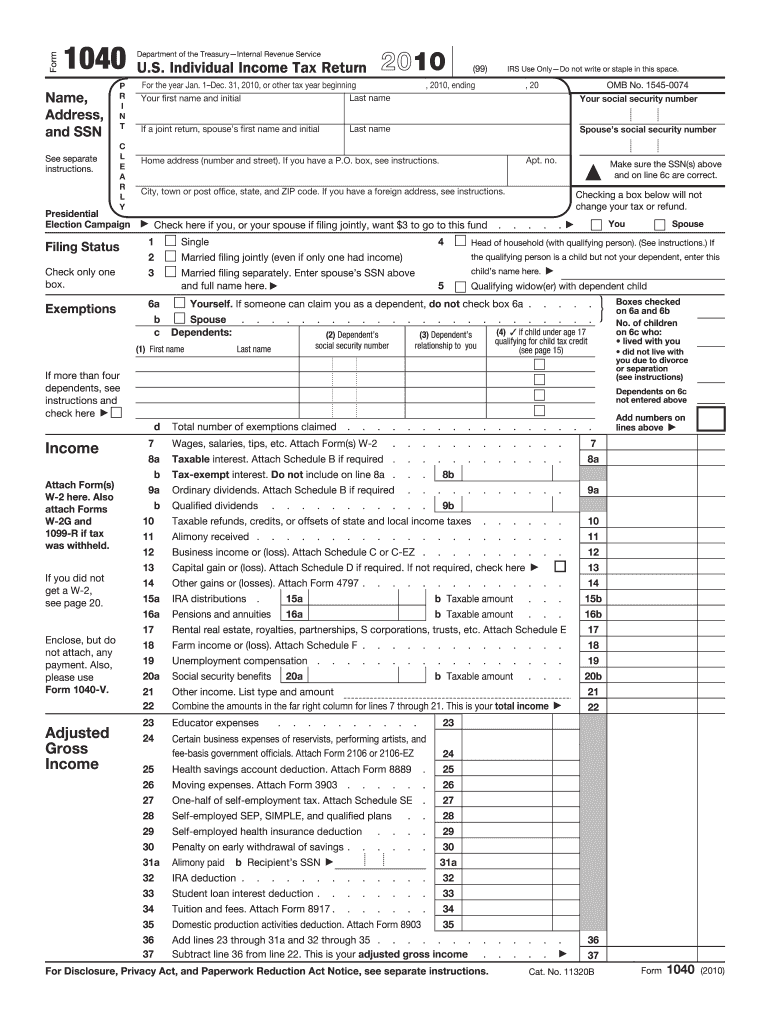

The Form 1040 is the standard individual income tax return form used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to calculate their tax liability, claim tax credits, and determine whether they owe additional taxes or are entitled to a refund. It is essential for ensuring compliance with federal tax laws and is used by a wide range of taxpayers, including employees, self-employed individuals, and retirees.

How to obtain the Form 1040

The Form 1040 can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, taxpayers can request a paper copy by calling the IRS or visiting a local IRS office. Many tax preparation software programs also include the Form 1040, allowing users to complete and file their returns electronically. It is important to ensure that the most current version of the form is used to avoid issues with filing.

Steps to complete the Form 1040

Completing the Form 1040 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and investment earnings.

- Claim deductions and credits to reduce taxable income, using the appropriate schedules if necessary.

- Calculate total tax liability and determine if additional payments are required or if a refund is due.

- Sign and date the form before submitting it to the IRS.

Form Submission Methods

The Form 1040 can be submitted to the IRS in several ways:

- Online: Taxpayers can e-file their Form 1040 using IRS-approved tax software, which often simplifies the process and speeds up refunds.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, depending on the taxpayer's state of residence.

- In-Person: Some taxpayers may choose to file their Form 1040 in person at a local IRS office, especially if they require assistance.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1040. Taxpayers should refer to the IRS instructions for the form, which detail eligibility requirements, filing procedures, and important deadlines. These guidelines help ensure that all necessary information is included and that the form is filed correctly to avoid delays or penalties.

Penalties for Non-Compliance

Failing to file the Form 1040 on time or submitting inaccurate information can result in penalties. The IRS may impose fines for late filing or late payment of taxes owed. Additionally, taxpayers who do not file may face more severe consequences, including interest on unpaid taxes and potential legal action. It is crucial to adhere to IRS deadlines and ensure that all information is accurate to avoid these penalties.

Quick guide on how to complete 2010 form 1040

Discover the Easiest Method to Complete and Sign Your Form 1040

Are you still spending time crafting your official paperwork on paper instead of online? airSlate SignNow offers a superior approach to finish and sign your Form 1040 and corresponding forms for public services. Our intelligent electronic signature solution equips you with all you require to handle documents swiftly and in line with official regulations - comprehensive PDF editing, management, protection, signing, and sharing tools all easily accessible within an intuitive interface.

There are just a few steps needed to fill out and sign your Form 1040:

- Upload the editable template to the editor using the Get Form button.

- Review the information you must provide in your Form 1040.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Blackout sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and complete your work with the Done button.

Store your finished Form 1040 in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your forms when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1040

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Why hasn't federal government mailed out 1040 tax forms for 2010 tax year? When will they?

Because of the explosion in E-filed returns the IRS has stopped mailing tax packets entirely unless the taxpayer specifically requests that they be mailed. If you need paper forms you need to call 800-829-3676.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1040

How to generate an electronic signature for your 2010 Form 1040 in the online mode

How to create an eSignature for your 2010 Form 1040 in Chrome

How to make an electronic signature for putting it on the 2010 Form 1040 in Gmail

How to make an eSignature for the 2010 Form 1040 straight from your smart phone

How to make an electronic signature for the 2010 Form 1040 on iOS

How to generate an eSignature for the 2010 Form 1040 on Android devices

People also ask

-

What is the Form 1040 and why is it important?

The Form 1040 is the standard individual income tax form used by taxpayers in the United States to report their annual income and calculate their tax obligations. Completing the Form 1040 accurately is crucial as it determines your tax refund or liability. Using airSlate SignNow can streamline the process of preparing and eSigning your Form 1040, ensuring you meet all deadlines.

-

How can airSlate SignNow help with completing Form 1040?

airSlate SignNow offers an intuitive platform to manage and eSign your Form 1040 efficiently. With features like document templates and automated workflows, you can fill out the form faster and ensure all necessary information is included. This not only saves time but also reduces the risk of errors when submitting your tax forms.

-

Is airSlate SignNow a cost-effective solution for managing Form 1040?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses needing to manage documents like the Form 1040. With flexible pricing plans, users can choose the option that best fits their needs without breaking the bank. Investing in this tool can ultimately save you time and potential penalties associated with incorrect tax filings.

-

What features does airSlate SignNow offer for Form 1040 management?

airSlate SignNow provides several features tailored for managing Form 1040, including eSignature capabilities, document sharing, and real-time collaboration. These features allow you to work with tax professionals or family members seamlessly, ensuring everyone involved can review and sign the form promptly. This enhances the overall efficiency of your tax preparation process.

-

Can I integrate airSlate SignNow with my accounting software for Form 1040 preparation?

Absolutely! airSlate SignNow integrates with various accounting software tools, enabling you to import data directly into your Form 1040. This integration simplifies the document preparation process and helps maintain accurate records, ensuring your tax submissions are precise and timely.

-

Is it safe to use airSlate SignNow for my Form 1040 documents?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 1040. The platform employs advanced encryption and security protocols to protect your sensitive information during the eSigning process. You can confidently manage your tax documents knowing they are secure.

-

How does airSlate SignNow simplify the eSigning process for Form 1040?

The eSigning process for Form 1040 is simplified with airSlate SignNow by allowing users to sign documents electronically from anywhere, on any device. This eliminates the need for printing, mailing, or scanning, making it more convenient to complete your tax forms. With just a few clicks, you can finalize your Form 1040 and submit it on time.

Get more for Form 1040

Find out other Form 1040

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now