Schedule I Form 1041 Alternative Minimum Tax Estates and Trusts Irs Ustreas 2021

What is the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas

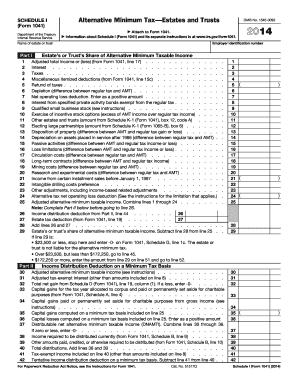

The Schedule I Form 1041 is a crucial document for estates and trusts that are subject to the Alternative Minimum Tax (AMT). This form is used to calculate the AMT liability for estates and trusts, ensuring compliance with Internal Revenue Service (IRS) regulations. The AMT is designed to ensure that high-income individuals, including estates and trusts, pay a minimum amount of tax, regardless of deductions and credits. Understanding this form is essential for fiduciaries managing estates and trusts to accurately report income and tax obligations.

How to use the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas

Using the Schedule I Form 1041 involves several steps to ensure accurate reporting of the Alternative Minimum Tax. First, gather all relevant financial information for the estate or trust, including income, deductions, and credits. Next, complete the form by following the instructions provided by the IRS, ensuring that all calculations are precise. Once completed, the form should be attached to the main Form 1041 when filing. It is advisable to keep a copy for your records. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas

Completing the Schedule I Form 1041 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to the estate or trust.

- Calculate the adjusted gross income (AGI) for the estate or trust.

- Determine the alternative minimum taxable income (AMTI) by adding back certain deductions.

- Calculate the AMT exemption amount applicable to the estate or trust.

- Complete the form by entering the calculated figures in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas

The Schedule I Form 1041 is legally binding when completed accurately and submitted in accordance with IRS guidelines. To ensure its legal validity, the form must include the correct signatures and dates as required. Additionally, using an electronic signature through a compliant platform can enhance the legitimacy of the submission. It is important to adhere to all filing deadlines and maintain records of the submitted forms for potential audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule I Form 1041 align with the general deadlines for Form 1041. Typically, the form must be filed by the fifteenth day of the fourth month following the close of the estate or trust's tax year. For estates and trusts operating on a calendar year basis, this means the deadline is April 15. If additional time is needed, a six-month extension can be requested. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Schedule I Form 1041 or inaccuracies in the form can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically calculated based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes. It is crucial for fiduciaries to ensure that all forms are completed accurately and submitted on time to avoid these financial repercussions.

Quick guide on how to complete 2014 schedule i form 1041 alternative minimum tax estates and trusts irs ustreas

Complete Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas effortlessly

- Obtain Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 schedule i form 1041 alternative minimum tax estates and trusts irs ustreas

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule i form 1041 alternative minimum tax estates and trusts irs ustreas

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas?

The Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas is a tax form used by estates and trusts to calculate their alternative minimum tax. It ensures that these entities pay a minimum amount of tax on their income if certain conditions are met. Understanding this form is crucial for proper tax compliance.

-

How does airSlate SignNow assist with the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas?

airSlate SignNow provides an efficient platform for securely signing and sending tax documents, including the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas. Its user-friendly interface enables users to easily manage their documents and streamline the process, ensuring timely submission to the IRS.

-

What are the pricing plans for using airSlate SignNow for tax documents?

airSlate SignNow offers a range of pricing plans to fit different needs, including options for individuals and businesses that may need to handle the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas. These plans provide flexible features, ensuring you can choose the best solution based on your volume and requirements.

-

What are the key features of airSlate SignNow related to the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas?

Key features of airSlate SignNow include secure eSigning, document templates, and real-time collaboration, all beneficial for managing the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas. Additionally, the platform simplifies document tracking, ensuring you stay compliant throughout the filing process.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow can integrate with various tax management software and accounting tools, making it easier to handle the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas. This integration enhances workflow efficiency, allowing you to manage all related tasks in one place.

-

What benefits does airSlate SignNow offer for filing the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas?

airSlate SignNow offers signNow benefits for filing the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas, including reduced turnaround times, increased security, and enhanced accuracy. By using this solution, you can ensure your tax documents are completed correctly and submitted on time.

-

Is it easy to use airSlate SignNow for new users unfamiliar with online eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for new users to navigate the platform. Whether you are signing the Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas or sending documents for signature, the step-by-step process and helpful resources will guide you through.

Get more for Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497428983 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497428984 form

- Vt llc 497428985 form

- Living trust for husband and wife with no children vermont form

- Vermont living trust form

- Vermont trust form

- Living trust for husband and wife with one child vermont form

- Living trust for husband and wife with minor and or adult children vermont form

Find out other Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts Irs Ustreas

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form