Ucc 2 Form

What is the UCC 2 Form

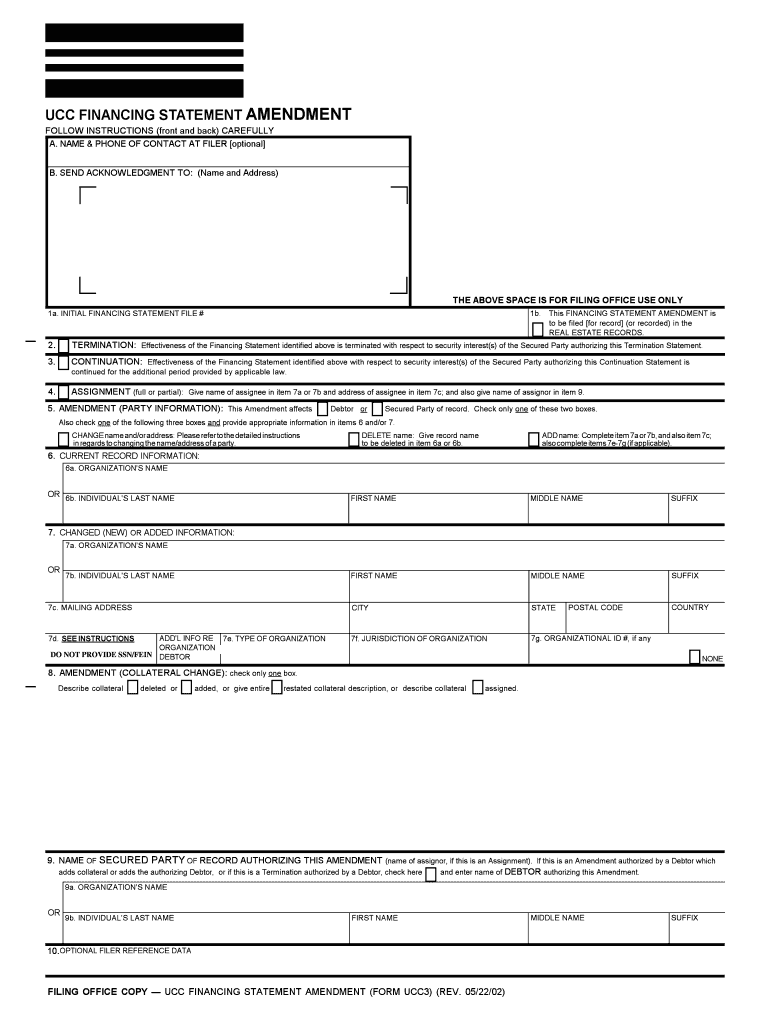

The UCC 2 form, also known as the UCC-2 financing statement, is a legal document used in the United States to register a security interest in personal property. This form is essential for creditors to establish their rights over collateral in the event of a debtor's default. By filing a UCC 2 form, creditors can publicly declare their interest, which helps protect their investment and priority in the collateral. The UCC 2 form is part of the Uniform Commercial Code, which standardizes commercial transactions across states.

How to Use the UCC 2 Form

Using the UCC 2 form involves several steps. First, identify the debtor and the secured party. The debtor is the individual or entity that owes a debt, while the secured party is the lender or creditor. Next, provide a description of the collateral that secures the loan. This description must be clear and specific to ensure enforceability. After completing the form, it can be filed with the appropriate state authority, usually the Secretary of State's office. This filing establishes the security interest and makes it public.

Steps to Complete the UCC 2 Form

Completing the UCC 2 form requires attention to detail. Start by entering the debtor's name and address accurately. Then, include the secured party's information. The next crucial step is to describe the collateral, ensuring it is detailed enough to identify the property. After filling out these sections, review the form for accuracy. Once confirmed, submit the form to the relevant state office, either online or via mail. Retain a copy for your records, as it serves as proof of filing.

Legal Use of the UCC 2 Form

The UCC 2 form is legally binding once filed correctly. It provides legal protection to creditors by establishing their rights to the collateral specified. In case of default, the secured party can enforce their rights to the collateral without needing further legal action, as long as they comply with state laws regarding repossession. Understanding the legal implications of the UCC 2 form is essential for both creditors and debtors to navigate their rights and responsibilities effectively.

State-Specific Rules for the UCC 2 Form

Each state in the U.S. may have specific rules regarding the UCC 2 form. While the basic structure and purpose remain consistent, variations can exist in filing fees, submission methods, and additional requirements. It is important to check with the local Secretary of State’s office for any state-specific regulations or forms that may need to accompany the UCC 2 filing. This ensures compliance and helps avoid potential legal issues.

Form Submission Methods

The UCC 2 form can typically be submitted through various methods. Most states offer online filing options, which are often the quickest and most efficient way to submit the form. Alternatively, the form can be mailed to the appropriate state office. In some cases, in-person submission may also be an option. Each method may have different processing times and fees, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete ucc 2 form

Complete Ucc 2 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Ucc 2 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Ucc 2 Form with ease

- Find Ucc 2 Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Ucc 2 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a UCC-1 form?

Usually you fill it out online through the Secretary of State’s website, but paper forms are used in some jurisdictions. In Louisiana, you file it at the local parish.Be certain to know exactly who the debtor is and spell the debtor’s legal name perfectly. Any minor clerical error can be fatal to protecting your security interest. Oddly spelling your own name correctly is not critical (shrug).

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

Can I fill out the form for the JEE Main 2 still? How?

No! You cannot fill the form now.The official authorities allowed candidates to fill the JEE Main application forms till 1st January 2018 and submit their fees till 2nd January 2018.Now, as the last date is over, you won’t be allowed to fill the form. As you would not like to waster your whole year, you must try other Engineering Exams such as BITSAT, VITEE etc.Go for it! Good Luck!

Create this form in 5 minutes!

How to create an eSignature for the ucc 2 form

How to make an eSignature for your Ucc 2 Form online

How to create an electronic signature for the Ucc 2 Form in Chrome

How to create an eSignature for signing the Ucc 2 Form in Gmail

How to generate an eSignature for the Ucc 2 Form right from your smartphone

How to generate an electronic signature for the Ucc 2 Form on iOS devices

How to generate an eSignature for the Ucc 2 Form on Android

People also ask

-

What are the main features of airSlate SignNow that help with applying the UCC with your name?

airSlate SignNow offers a user-friendly platform for eSigning and document management. Features like templates, customizable workflows, and secure storage streamline the process of how to apply the UCC with your name. You can easily edit, share, and track documents, making it simple to stay organized.

-

How does airSlate SignNow improve the process of applying the UCC with your name?

Using airSlate SignNow simplifies the process of how to apply the UCC with your name by automating document workflows. This means less time spent on paperwork and more time focusing on your business. The intuitive interface allows users to quickly familiarize themselves with the system.

-

Is airSlate SignNow a cost-effective solution for applying the UCC with your name?

Yes, airSlate SignNow provides a cost-effective solution for businesses. With flexible pricing plans, you can select the one that fits your budget while still being able to efficiently manage how to apply the UCC with your name. Many users find signNow time and cost savings after implementing the software.

-

Can I integrate airSlate SignNow with other tools to assist in applying the UCC with my name?

Absolutely! airSlate SignNow integrates with various productivity tools to enhance your workflow. This means that you can easily connect with CRM systems, cloud storage, and other applications to facilitate how to apply the UCC with your name seamlessly.

-

What support does airSlate SignNow provide for users learning how to apply the UCC with their names?

airSlate SignNow offers comprehensive support resources to assist users. This includes detailed documentation, tutorials, and customer support to guide you in learning how to apply the UCC with your name effectively. Our team is committed to ensuring your success.

-

Are there any limitations to consider when applying the UCC with my name using airSlate SignNow?

While airSlate SignNow is designed to be user-friendly, it's essential to ensure that all documents meet the specific legal requirements for how to apply the UCC with your name. Users should verify that their documents are complete and compliant with local regulations. Legal consultation may be advisable in complex cases.

-

How secure is airSlate SignNow when applying the UCC with your name?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security measures to protect sensitive information. When you learn how to apply the UCC with your name through our solution, you can rest assured that your documents are handled safely.

Get more for Ucc 2 Form

- Form 8932 rev december 2021 credit for employer differential wage payments

- 2021 instructions for form 1099 k internal revenue service

- Form 8689 allocation of individual income tax to the us

- Form 8846 credit for employer social security and

- Fillable online 2008 form 990 schedule n liquidation

- Appsirsgov app picklistforms and publications pdf irs tax forms

- Boone county ky occupational tax jobs ecityworks form

- Revenuekygovforms62a300062a3000 4 20 original to ky department of revenue

Find out other Ucc 2 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors