Colorado Corporate Llc Form

What is the Colorado Corporate LLC?

The Colorado Corporate LLC is a legal business structure that combines the benefits of a corporation and a limited liability company (LLC). This formation allows owners, known as members, to enjoy limited liability protection while maintaining operational flexibility. It is particularly appealing for small to medium-sized businesses in Colorado, as it provides a straightforward way to manage taxes and protect personal assets from business liabilities.

How to Obtain the Colorado Corporate LLC

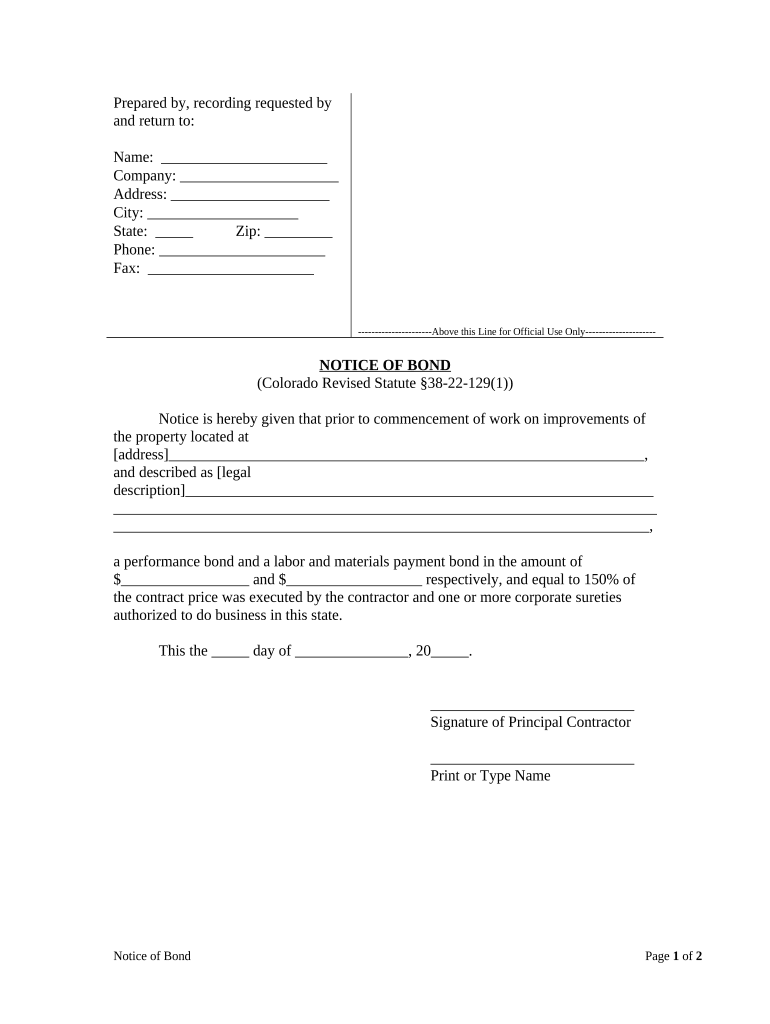

To obtain a Colorado Corporate LLC, you must file the necessary formation documents with the Colorado Secretary of State. This typically involves submitting the Articles of Organization, which outlines the basic details of your business, including its name, address, and the registered agent. There is also a filing fee that must be paid at the time of submission. It is advisable to check the Secretary of State's website for the most current forms and fees.

Steps to Complete the Colorado Corporate LLC

Completing the Colorado Corporate LLC involves several key steps:

- Choose a unique name for your LLC that complies with Colorado naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- Prepare and file the Articles of Organization with the Colorado Secretary of State.

- Obtain any necessary business licenses or permits based on your industry and location.

- Draft an operating agreement to outline the management structure and operating procedures of your LLC.

Legal Use of the Colorado Corporate LLC

The Colorado Corporate LLC is legally recognized as a separate entity, which means it can enter contracts, incur debts, and be sued in its own name. This legal status provides members with limited liability protection, meaning their personal assets are generally protected from business liabilities. It is essential to maintain compliance with state regulations and file annual reports to uphold this legal status.

Key Elements of the Colorado Corporate LLC

Several key elements define the Colorado Corporate LLC:

- Limited Liability: Members are not personally liable for the debts and obligations of the LLC.

- Pass-Through Taxation: Income is typically taxed at the member level, avoiding double taxation.

- Flexible Management Structure: Members can choose to manage the LLC themselves or appoint managers.

- Compliance Requirements: Regular filings and adherence to state laws are necessary to maintain the LLC status.

Filing Deadlines / Important Dates

When forming a Colorado Corporate LLC, it is crucial to be aware of filing deadlines and important dates:

- Initial Articles of Organization must be filed before conducting business.

- Annual reports are due on the anniversary of the LLC's formation date.

- Any changes in business structure or registered agent must be reported promptly to the Secretary of State.

Quick guide on how to complete colorado corporate llc

Effortlessly prepare Colorado Corporate Llc on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Colorado Corporate Llc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Colorado Corporate Llc with ease

- Locate Colorado Corporate Llc and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Colorado Corporate Llc to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado corporate LLC and how does it work?

A Colorado corporate LLC, or Limited Liability Company, is a popular business structure that provides liability protection to its owners while allowing for flexible management. It combines the benefits of a corporation with those of a partnership, which makes it an attractive option for many business owners in Colorado. By forming a Colorado corporate LLC, you can protect your personal assets while enjoying potential tax advantages.

-

How much does it cost to set up a Colorado corporate LLC?

The cost of establishing a Colorado corporate LLC includes state filing fees, which are typically around $50, and potential costs for legal or accounting assistance. Additionally, there may be ongoing expenses such as renewal fees and business licenses. Investing in a Colorado corporate LLC is a cost-effective way to protect your business and personal assets.

-

What are the benefits of choosing a Colorado corporate LLC?

One of the primary benefits of a Colorado corporate LLC is limited liability protection, which keeps your personal assets safe from business debts and claims. Moreover, this structure offers flexible management and tax options that can be customized to fit your needs. This combination of features makes the Colorado corporate LLC a viable choice for many entrepreneurs.

-

What documents are needed to form a Colorado corporate LLC?

To form a Colorado corporate LLC, you typically need to file Articles of Organization with the Colorado Secretary of State and create an Operating Agreement. Additional documents may include licenses and permits depending on your business type. Having all necessary paperwork prepared ensures a smoother registration process for your Colorado corporate LLC.

-

Can I manage my Colorado corporate LLC remotely?

Yes, you can manage your Colorado corporate LLC remotely, as there are no specific state requirements for in-person meetings. Many business owners take advantage of digital tools and software to facilitate management tasks, which can include eSigning documents and handling communications. This flexibility is a signNow advantage of operating a Colorado corporate LLC.

-

Are there any tax advantages of a Colorado corporate LLC?

A Colorado corporate LLC offers several potential tax advantages, including pass-through taxation where profits and losses can be reported on your personal tax return. This structure may help you avoid double taxation typically associated with corporations. Additionally, certain business expenses may be deductible, further enhancing the tax benefits of a Colorado corporate LLC.

-

How can I integrate eSigning into my Colorado corporate LLC processes?

Integrating eSigning into your Colorado corporate LLC processes is straightforward with platforms like airSlate SignNow. You can easily send, sign, and manage documents securely and efficiently, streamlining operations and improving document turnaround times. This capability enhances your Colorado corporate LLC by promoting a more agile and responsive business environment.

Get more for Colorado Corporate Llc

- Complaint personal injury sample form

- Personal injury accident 497426638 form

- Complaint court form 497426639

- Notice removal form

- Affirmative defenses slip fall form

- Complaint personal injury 497426642 form

- Defendants answers to plaintiffs first set of interrogatories and requests for production of documents form

- Motion for judgement form

Find out other Colorado Corporate Llc

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy