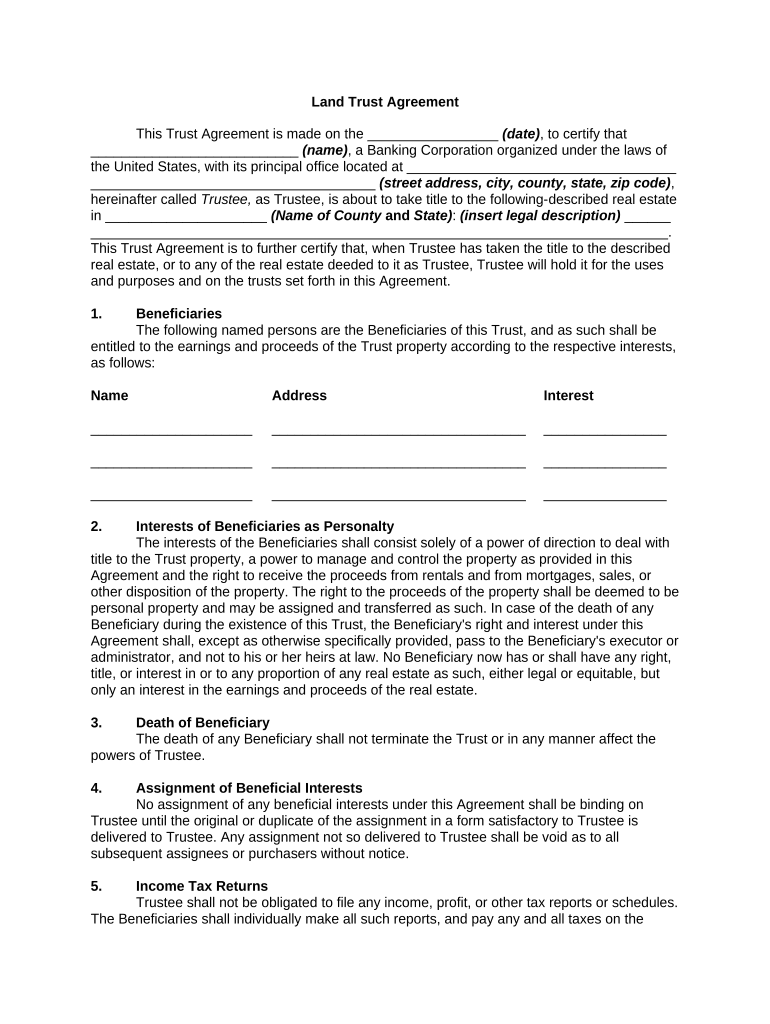

Trust Agreement Form

What is the Trust Agreement

A trust agreement is a legal document that establishes a trust, outlining the terms under which assets will be managed and distributed. This document typically identifies the grantor, the trustee, and the beneficiaries. The grantor is the individual who creates the trust, the trustee is responsible for managing the trust assets, and the beneficiaries are those who will benefit from the trust. Trust agreements can be used for various purposes, including estate planning, asset protection, and charitable giving. They provide a clear framework for how assets should be handled, ensuring that the grantor's wishes are followed after their passing.

Key elements of the Trust Agreement

Understanding the key elements of a trust agreement is essential for its effective use. Important components include:

- Grantor: The person who creates the trust and contributes assets.

- Trustee: The individual or entity responsible for managing the trust according to its terms.

- Beneficiaries: Individuals or organizations entitled to receive benefits from the trust.

- Trust property: The assets placed into the trust, which can include real estate, cash, stocks, and more.

- Terms of the trust: Specific instructions regarding how the trust property should be managed and distributed.

Steps to complete the Trust Agreement

Completing a trust agreement involves several important steps to ensure it is legally binding and accurately reflects the grantor's intentions:

- Identify the assets to be placed in the trust.

- Choose a trustworthy individual or institution to act as the trustee.

- Clearly define the beneficiaries and their respective shares.

- Draft the trust agreement, detailing the terms and conditions.

- Review the document with legal counsel to ensure compliance with state laws.

- Sign the trust agreement in the presence of a notary public to validate it.

- Fund the trust by transferring assets into it.

Legal use of the Trust Agreement

The legal use of a trust agreement is governed by state laws, which can vary significantly. It is important to ensure that the trust complies with relevant regulations to be enforceable. Trusts can serve various legal purposes, such as avoiding probate, minimizing estate taxes, and providing for minor children or dependents. Additionally, certain types of trusts, like irrevocable trusts, can offer asset protection from creditors. Consulting with a legal professional is advisable to navigate the complexities of trust law and ensure that the agreement is properly executed.

How to obtain the Trust Agreement

Obtaining a trust agreement typically involves drafting the document, which can be done through various means. Individuals may choose to use legal templates available online, consult with an attorney specializing in estate planning, or utilize software designed for creating legal documents. It is crucial to ensure that any template or software used complies with state-specific laws. Once the trust agreement is drafted, it should be reviewed for accuracy and completeness before being signed and notarized.

State-specific rules for the Trust Agreement

Each state in the United States has its own set of rules and regulations governing trust agreements. These rules can affect various aspects, such as the requirements for creating a trust, the powers of the trustee, and the rights of beneficiaries. Some states may have specific forms or filing requirements, while others may not require any formal registration. It is essential for individuals to familiarize themselves with their state's laws to ensure that their trust agreement is valid and enforceable.

Quick guide on how to complete trust agreement

Complete Trust Agreement seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Trust Agreement on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Trust Agreement without hassle

- Find Trust Agreement and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight key sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your choice. Edit and eSign Trust Agreement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust agreement and why is it important?

A trust agreement is a legal document that establishes a trust, outlining the terms and conditions under which assets are managed by a trustee for the benefit of beneficiaries. It is important because it provides clarity on how assets will be distributed, ensuring that your wishes are fulfilled. Having a trust agreement can also help avoid probate, saving time and money.

-

How can airSlate SignNow help me create a trust agreement?

With airSlate SignNow, you can easily create and customize a trust agreement using our user-friendly document editor. Our platform allows you to add necessary clauses, designated beneficiaries, and trustee details ensuring your document meets legal standards. Moreover, the digital signing feature ensures that your trust agreement is executed quickly and securely.

-

Is airSlate SignNow a secure option for signing trust agreements?

Yes, airSlate SignNow prioritizes the security of your documents, including trust agreements. Our platform employs industry-standard encryption and complies with regulatory requirements to protect your sensitive information. You can confidently eSign your trust agreement knowing it is secure and confidential.

-

What are the benefits of using airSlate SignNow for trust agreements?

Using airSlate SignNow for your trust agreement provides several benefits, including speed, efficiency, and cost-effectiveness. Our platform allows you to manage, send, and sign documents from anywhere at any time, streamlining the entire process. Additionally, you reduce paper usage and associated costs by transitioning to an electronic format.

-

Can I track the status of my trust agreement with airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking for all your documents, including trust agreements. You can easily monitor when the document was sent, viewed, signed, and completed, providing you with complete visibility over the signing process and ensuring timely execution.

-

What integrations does airSlate SignNow offer for managing trust agreements?

airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for managing trust agreements. You can connect with CRM systems, cloud storage services, and productivity tools, allowing for easy access and management of your important documents. This makes it simple to incorporate eSigning into your existing processes.

-

Is there a mobile app for airSlate SignNow to handle trust agreements on the go?

Yes, airSlate SignNow offers a mobile app that allows you to manage your trust agreements anytime, anywhere. With the app, you can create, edit, and eSign documents right from your smartphone or tablet, ensuring that you can handle important transactions even when you are out of the office.

Get more for Trust Agreement

- It 2663 department of taxation and finance form

- South carolina sc department of revenue form

- New york form it 201 att other tax credits and taxes

- Fillable michigan department of treasury 518 rev 02 18 form

- Form ct 3 m general business corporation mta surcharge return tax year 2020

- Form it 21059 underpayment of estimated income tax by individuals and fiduciaries tax year 2020

- Form ct 399 depreciation adjustment schedule tax year 2020

- Form ct 3 s new york s corporation franchise tax return tax year 2020

Find out other Trust Agreement

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation