Instructions for Form 1099 B 2023Internal Revenue Service 2022

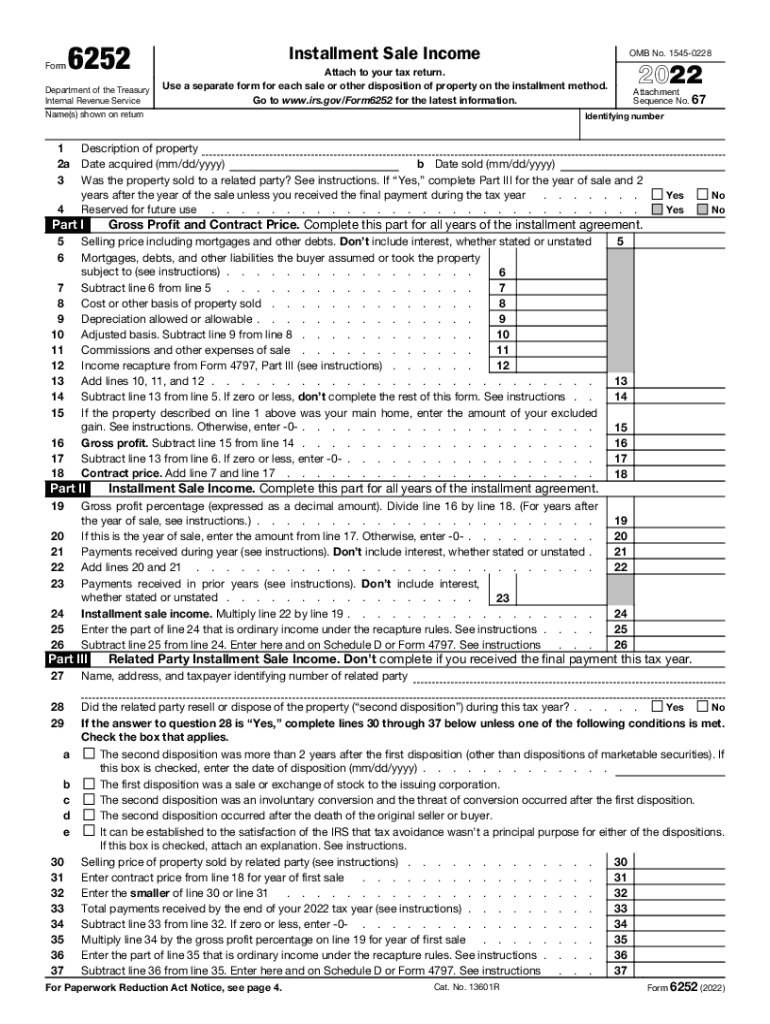

What is Form 6252?

Form 6252, also known as the Installment Sale Income form, is used by taxpayers to report income from the sale of property when payments are received in installments. This form is particularly relevant for individuals who sell real estate or other significant assets and choose to receive payments over time rather than in a lump sum. The Internal Revenue Service (IRS) requires this form to ensure that taxpayers accurately report their income as it is received, rather than all at once in the year of sale.

Key Elements of Form 6252 Instructions

The instructions for Form 6252 provide essential guidance on how to complete the form accurately. Key elements include:

- Reporting Requirements: Taxpayers must report the total sales price, the adjusted basis of the property sold, and any selling expenses.

- Installment Payments: Instructions detail how to calculate the gain from each installment payment received.

- Tax Implications: The form outlines how to report the income for tax purposes and any potential tax liabilities associated with installment sales.

Steps to Complete Form 6252

Completing Form 6252 involves several steps to ensure accuracy and compliance with IRS regulations:

- Gather necessary documents, including the sales contract and records of payments received.

- Calculate the total sales price and adjusted basis of the property sold.

- Determine the amount of gain realized from the sale and how much is attributable to each installment payment.

- Fill out the form according to the instructions, ensuring all calculations are accurate.

- Submit the completed form along with your tax return for the year in which the sale occurred.

Legal Use of Form 6252

Form 6252 is legally binding when completed correctly, as it reflects the taxpayer's income from an installment sale. Compliance with the IRS guidelines ensures that the form is accepted for tax reporting purposes. Taxpayers must retain documentation supporting the figures reported on the form, as the IRS may request this information during audits. Understanding the legal implications of installment sales is crucial for accurate reporting and avoiding penalties.

Filing Deadlines for Form 6252

Filing deadlines for Form 6252 align with the general tax return deadlines. Typically, taxpayers must submit their completed forms by April 15 of the year following the sale. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for taxpayers to be aware of these deadlines to avoid late fees and penalties.

Penalties for Non-Compliance with Form 6252

Failure to file Form 6252 or inaccuracies in reporting can lead to penalties imposed by the IRS. These penalties may include fines for late filing, underreporting income, or failing to provide necessary documentation. Taxpayers are encouraged to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete instructions for form 1099 b 2023internal revenue service

Complete Instructions For Form 1099 B 2023Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Form 1099 B 2023Internal Revenue Service on any platform using the airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

How to edit and eSign Instructions For Form 1099 B 2023Internal Revenue Service with ease

- Locate Instructions For Form 1099 B 2023Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Form 1099 B 2023Internal Revenue Service and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1099 b 2023internal revenue service

Create this form in 5 minutes!

People also ask

-

What is form 6252 and how does airSlate SignNow assist with it?

Form 6252 is used for reporting the sale of property where payments are received over time. airSlate SignNow makes it easy to complete and eSign form 6252 electronically, streamlining the process and ensuring that all required information is accurately captured and securely shared.

-

Is airSlate SignNow suitable for businesses needing form 6252?

Yes, airSlate SignNow is ideal for businesses that require form 6252. Its robust features, including templates and eSigning capabilities, help users quickly generate and send this form, ensuring compliance and efficiency in handling property transactions.

-

What features of airSlate SignNow enhance the experience of using form 6252?

AirSlate SignNow offers features like customizable templates, multi-party signing, and real-time tracking which signNowly improve the workflow associated with form 6252. These tools help reduce the time spent on document management and increase accuracy, making it easier to meet deadlines.

-

How much does it cost to use airSlate SignNow for handling form 6252?

AirSlate SignNow provides flexible pricing plans, making it affordable for businesses of any size to handle form 6252. Potential customers can choose a plan that suits their needs and budget while benefiting from the cost-effective solution for eSigning and document management.

-

Can I integrate airSlate SignNow with other software for form 6252?

Absolutely! AirSlate SignNow offers a variety of integrations with popular tools like Google Workspace, Salesforce, and more, which enhances the handling of form 6252. These integrations allow seamless data transfer and improve efficiency across different platforms.

-

What security measures are in place for eSigning form 6252 with airSlate SignNow?

AirSlate SignNow prioritizes security, employing encryption and compliant protocols to ensure that each eSigned form 6252 is protected. Users can trust that their sensitive information remains confidential and secure throughout the signing process.

-

How can airSlate SignNow help with the tracking of form 6252?

With airSlate SignNow, users can track the status of form 6252 in real-time, allowing for better management of deadlines and responses. Automated notifications keep users informed when the document is viewed, signed, or requires further action.

Get more for Instructions For Form 1099 B 2023Internal Revenue Service

- New mexico landlord form

- Landlord rent increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase new mexico form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant new mexico form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase new mexico form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services new mexico form

- Temporary lease agreement to prospective buyer of residence prior to closing new mexico form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction new 497319990 form

Find out other Instructions For Form 1099 B 2023Internal Revenue Service

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure