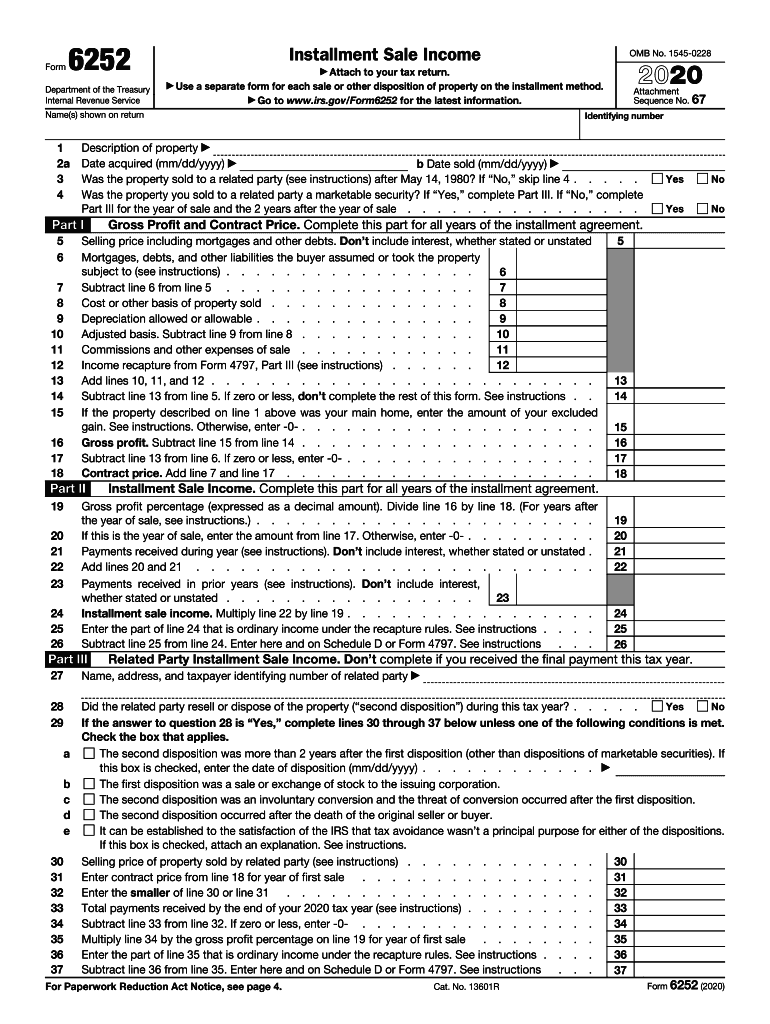

Form 6252 Installment Sale Income 2020

What is the Form 6252 Installment Sale Income

The Form 6252 is used to report income from an installment sale. An installment sale occurs when a seller allows the buyer to make payments over time, rather than requiring full payment upfront. The seller recognizes income as payments are received, which can spread the tax liability over several years. This form is essential for taxpayers who wish to report the income from such sales accurately, ensuring compliance with IRS regulations.

How to use the Form 6252 Installment Sale Income

To use the Form 6252, taxpayers need to gather relevant information about the sale, including the total sale price, the amount received in the current year, and the seller's basis in the property sold. The form calculates the taxable income from the installment sale based on these figures. Taxpayers should ensure they fill out each section accurately to reflect their installment sale transactions correctly.

Steps to complete the Form 6252 Installment Sale Income

Completing the Form 6252 involves several key steps:

- Begin by entering the seller's name and taxpayer identification number.

- Provide details about the property sold, including the date of sale and the total sale price.

- Calculate the seller's basis in the property, which is essential for determining taxable income.

- Report the amount received during the tax year and any prior payments received.

- Complete the calculations to determine the taxable income from the installment sale.

Legal use of the Form 6252 Installment Sale Income

The legal use of Form 6252 is crucial for ensuring that taxpayers comply with IRS guidelines. The form must be filed accurately to report income from installment sales properly. Failure to do so may result in penalties or additional taxes owed. It is important to retain records of the sale and any related documentation to support the information reported on the form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 6252. Taxpayers should refer to the IRS instructions for the form to understand the requirements fully. These guidelines cover eligibility, reporting procedures, and the necessary documentation to support the installment sale income. Adhering to these guidelines ensures compliance and minimizes the risk of errors in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for Form 6252 align with the general tax return deadlines. Typically, the form must be submitted by April 15 of the year following the tax year in which the installment sale occurred. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should mark their calendars to ensure timely submission and avoid penalties.

Quick guide on how to complete 2020 form 6252 installment sale income

Easily Prepare Form 6252 Installment Sale Income on Any Device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly option compared to traditional printed and signed paperwork, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 6252 Installment Sale Income on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

How to Modify and eSign Form 6252 Installment Sale Income Effortlessly

- Locate Form 6252 Installment Sale Income and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet-ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 6252 Installment Sale Income to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 6252 installment sale income

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 6252 installment sale income

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is form 6252 and how is it used?

Form 6252 is used to report the sale of property where you receive payments over time. This form allows you to report your income from the sale as it is received, rather than all at once. By using airSlate SignNow, you can easily eSign and manage form 6252, ensuring compliance and simplifying your tax reporting.

-

How can airSlate SignNow help with completing form 6252?

airSlate SignNow offers an intuitive platform that enables users to fill out and eSign form 6252 effortlessly. With our electronic signature solution, you can complete the form securely and send it directly to clients or tax professionals. This streamlines the process and ensures that all parties have access to the necessary documents.

-

Is there a cost to use airSlate SignNow for form 6252?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs. With our cost-effective solution, you can access all the features required to manage form 6252 efficiently. Consider trying our free trial to explore how our platform can enhance your form documentation process.

-

What features does airSlate SignNow provide for form 6252 management?

airSlate SignNow includes features like document templates, customizable workflows, and secure cloud storage specifically for form 6252 management. These tools help automate your document processes, ensuring that you can easily access and modify your forms as needed. This enhances accuracy and reduces the risk of errors.

-

Can I integrate airSlate SignNow with other applications for form 6252?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easier to manage form 6252 alongside your existing workflow. Popular integrations include cloud storage services and CRM platforms, allowing you to synchronize your documents. This ensures a smooth process from creation to submission.

-

What are the benefits of using airSlate SignNow for form 6252?

Using airSlate SignNow for form 6252 simplifies the documentation process, reducing time and effort. Our reliable platform ensures that your forms are signed, stored, and shared securely, promoting better compliance and organization. Additionally, the eSigning feature speeds up transactions by eliminating the need for physical signatures.

-

How secure is airSlate SignNow while handling form 6252?

Security is a top priority at airSlate SignNow. When managing form 6252, all data is encrypted and stored in secure cloud servers to protect your information. Our compliance with industry-standard regulations ensures your forms and signatures are safe from unauthorized access.

Get more for Form 6252 Installment Sale Income

- Radio frequency consent form

- Hydrafacial consent form

- International patient application dear international patient in order for a patient to be considered for treatment management form

- Scaffold checklist template form

- Canada application c a form

- Tilley hat guarantee claim form

- Building permit application saskatoon form

- Contractor pre qualification form st clair

Find out other Form 6252 Installment Sale Income

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online