Form 6252 Installment Sale Income 2024-2026

What is the Form 6252 Installment Sale Income

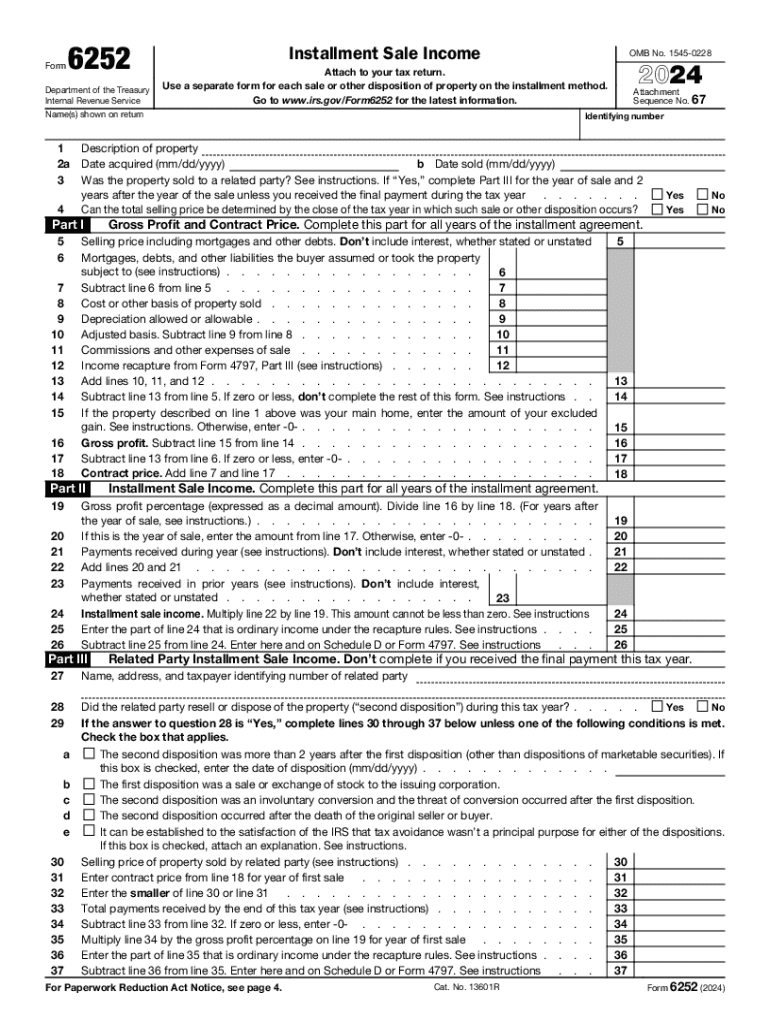

The Form 6252 is used to report income from an installment sale, which occurs when a seller allows the buyer to pay for property over time. This form is essential for taxpayers who sell property and receive payments in multiple installments rather than a lump sum. It helps in calculating the taxable income from the sale, ensuring that sellers report their income accurately over the period they receive payments.

How to use the Form 6252 Installment Sale Income

To use Form 6252, begin by filling out the seller's information, including name, address, and taxpayer identification number. Next, report details about the property sold, including the sale price and the amount received in the current tax year. The form also requires you to calculate the gross profit percentage, which is crucial for determining the taxable income from each installment. Ensure that all calculations are accurate to avoid potential issues with the IRS.

Steps to complete the Form 6252 Installment Sale Income

Completing Form 6252 involves several key steps:

- Gather all necessary information about the sale, including the total sale price and payment schedule.

- Calculate the gross profit from the sale by subtracting the adjusted basis of the property from the sale price.

- Determine the gross profit percentage by dividing the gross profit by the sale price.

- Fill in the amounts received during the tax year and apply the gross profit percentage to calculate the taxable income for that year.

- Review the form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for using Form 6252. It is important to follow these guidelines to ensure compliance with tax regulations. Taxpayers should refer to the IRS instructions for Form 6252, which outline how to report installment sales, what qualifies as an installment sale, and any exceptions that may apply. Adhering to these guidelines helps in accurately reporting income and avoiding penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 6252 align with the general tax return deadlines. Typically, taxpayers must submit their forms by April 15 of the following year, unless an extension is filed. It is crucial to keep track of these dates to avoid late filing penalties. If the sale occurs late in the year, it may be beneficial to consult with a tax professional to ensure timely and accurate reporting.

Required Documents

To complete Form 6252, certain documents are necessary. These include:

- Sales contract or agreement detailing the terms of the sale.

- Records of payments received during the tax year.

- Documentation of the property's adjusted basis, including purchase price and any improvements made.

- Any previous tax returns related to the property, if applicable.

Create this form in 5 minutes or less

Find and fill out the correct form 6252 installment sale income

Create this form in 5 minutes!

How to create an eSignature for the form 6252 installment sale income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What IRS form do I need to report the sale of my home?

To report the sale of your home, you will need to use IRS Form 8949. This form is specifically designed for reporting capital gains and losses, including those from the sale of real estate. Make sure to include all relevant details about the sale to ensure accurate reporting.

-

How can airSlate SignNow help me with IRS forms?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including IRS forms. You can quickly prepare and send Form 8949 or any other necessary documents securely and efficiently. This streamlines the process of reporting the sale of your home.

-

Are there any fees associated with using airSlate SignNow for IRS forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs. While there may be a subscription fee, the cost is often outweighed by the convenience and efficiency of managing your IRS forms, including what IRS form to report the sale of home. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage. These tools make it easy to manage your documents, including IRS forms like Form 8949. With our platform, you can ensure that your reporting process is seamless and organized.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Yes, airSlate SignNow integrates with various software applications, enhancing your workflow for tax reporting. You can connect it with accounting software to streamline the process of preparing and submitting what IRS form to report the sale of home. This integration helps keep your documents organized and accessible.

-

What are the benefits of using airSlate SignNow for IRS form submissions?

Using airSlate SignNow for IRS form submissions offers numerous benefits, including time savings and enhanced security. You can easily eSign and send your Form 8949 without the hassle of printing and mailing. This not only speeds up the process but also reduces the risk of lost documents.

-

Is airSlate SignNow suitable for individuals selling their homes?

Absolutely! airSlate SignNow is designed for both businesses and individuals. If you're selling your home and need to report it using what IRS form to report the sale of home, our platform provides the tools you need to manage your documents efficiently and securely.

Get more for Form 6252 Installment Sale Income

Find out other Form 6252 Installment Sale Income

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy