Form 6252 2023

What is the Form 6252

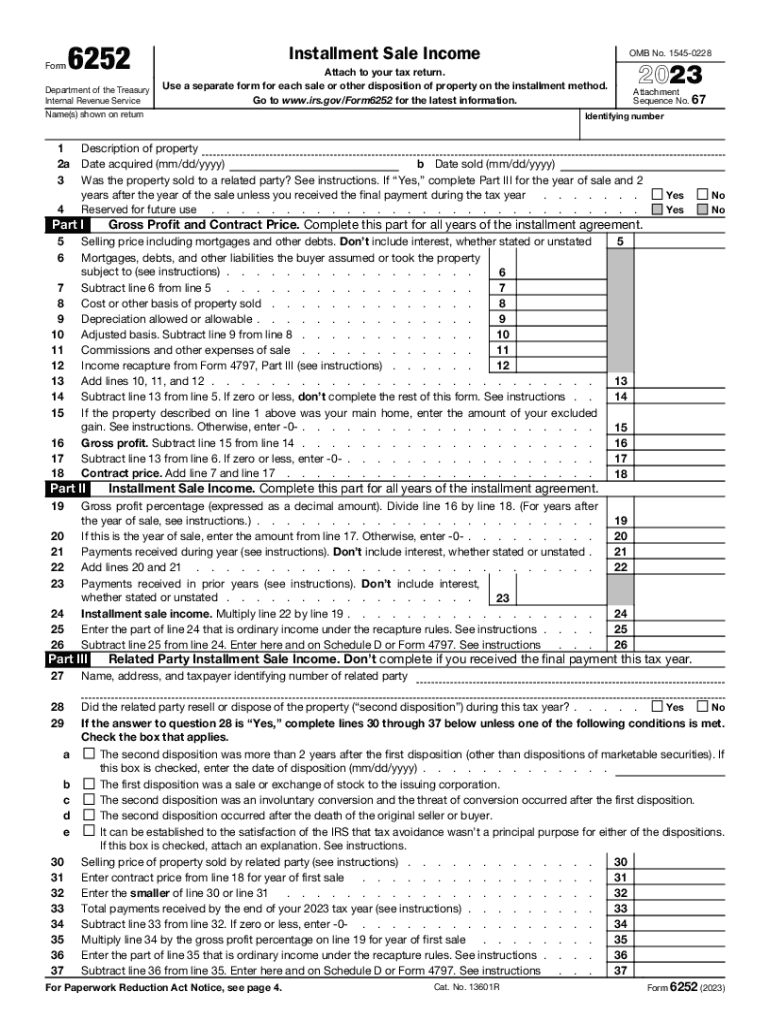

IRS Form 6252 is used to report the sale of property when the seller receives payments over time, commonly known as an installment sale. This form allows taxpayers to report income from the sale in a way that aligns with the cash received, rather than recognizing the entire gain in the year of sale. It is particularly relevant for individuals selling real estate or other significant assets, enabling them to spread the tax liability over the years they receive payments.

How to use the Form 6252

To use Form 6252, taxpayers must first determine if their sale qualifies as an installment sale. If it does, they will need to complete the form to report the sale and the payments received. The form requires information about the property sold, the selling price, the adjusted basis, and the amount of payments received during the tax year. Taxpayers should also refer to IRS Publication 537 for detailed instructions on how to report installment sales correctly.

Steps to complete the Form 6252

Completing Form 6252 involves several key steps:

- Gather necessary information about the property, including the selling price and adjusted basis.

- Calculate the total gain from the sale and determine the amount of gain to report for the current tax year.

- Fill out the form, ensuring all sections are completed accurately, including details about the buyer and payment terms.

- Attach the completed form to your tax return when filing.

Key elements of the Form 6252

Form 6252 includes several important sections that taxpayers must complete:

- Part I: Information about the sale, including the date of sale and the selling price.

- Part II: Details about the buyer and the terms of the installment agreement.

- Part III: Calculation of the gain from the sale and the amount to report as income for the year.

Filing Deadlines / Important Dates

Taxpayers must file Form 6252 along with their annual tax return. The standard deadline for filing individual tax returns is April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing Form 6252, which can be found in IRS Publication 537. This publication outlines the rules governing installment sales, including what qualifies as an installment sale, how to calculate gain, and the reporting requirements. Taxpayers are encouraged to review these guidelines to ensure compliance and accurate reporting.

Quick guide on how to complete form 6252

Effortlessly Prepare Form 6252 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents rapidly, without delays. Handle Form 6252 on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Edit and Electronically Sign Form 6252 with Ease

- Obtain Form 6252 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which requires only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Form 6252 and ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6252

Create this form in 5 minutes!

How to create an eSignature for the form 6252

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS form 6252 and why is it important?

IRS form 6252 is used to report income from the sale of property where the seller receives payments in installments. This form is crucial for tax compliance, as it helps taxpayers accurately report their income over several years. Understanding how to properly fill out and submit IRS form 6252 is essential for both individuals and businesses.

-

How can airSlate SignNow help with completing IRS form 6252?

airSlate SignNow streamlines the process of completing IRS form 6252 by allowing users to fill out and electronically sign the document with ease. Our platform ensures that the form is securely sent and received, minimizing errors and facilitating timely submission to the IRS. By using airSlate SignNow, you can focus on accuracy and compliance.

-

What features does airSlate SignNow offer for managing IRS form 6252?

With airSlate SignNow, users have access to features such as customizable templates, secure eSignature capabilities, and tracking tools that simplify the management of IRS form 6252. Our intuitive interface allows for easy editing and sharing, ensuring that all parties can collaborate efficiently. The platform also provides audit trails for precise record-keeping.

-

Is airSlate SignNow cost-effective for handling IRS forms?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS forms like form 6252. Our pricing plans cater to businesses of all sizes, providing flexible options to meet your specific needs. By utilizing our platform, you can save both time and money while ensuring compliance with tax regulations.

-

What integrations does airSlate SignNow provide for tax management?

airSlate SignNow integrates seamlessly with various accounting and tax management software, allowing users to easily incorporate IRS form 6252 into their existing workflows. These integrations enhance productivity and streamline the documentation process. By connecting with tools you already use, we simplify file management and improve efficiency.

-

Can multiple users collaborate on IRS form 6252 with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on IRS form 6252 in real-time. This feature is particularly useful for teams working together on tax filings or for accountants managing several clients' forms. The platform facilitates smooth communication and ensures everyone stays on the same page.

-

How secure is the information shared through airSlate SignNow for IRS form 6252?

Security is a top priority at airSlate SignNow. All documents, including IRS form 6252, are encrypted and stored securely to protect sensitive information. Our platform follows industry-standard security protocols, ensuring that your data remains confidential and safe throughout the signing and submission process.

Get more for Form 6252

Find out other Form 6252

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple