Irs Form 6252 2016

What is the IRS Form 6252

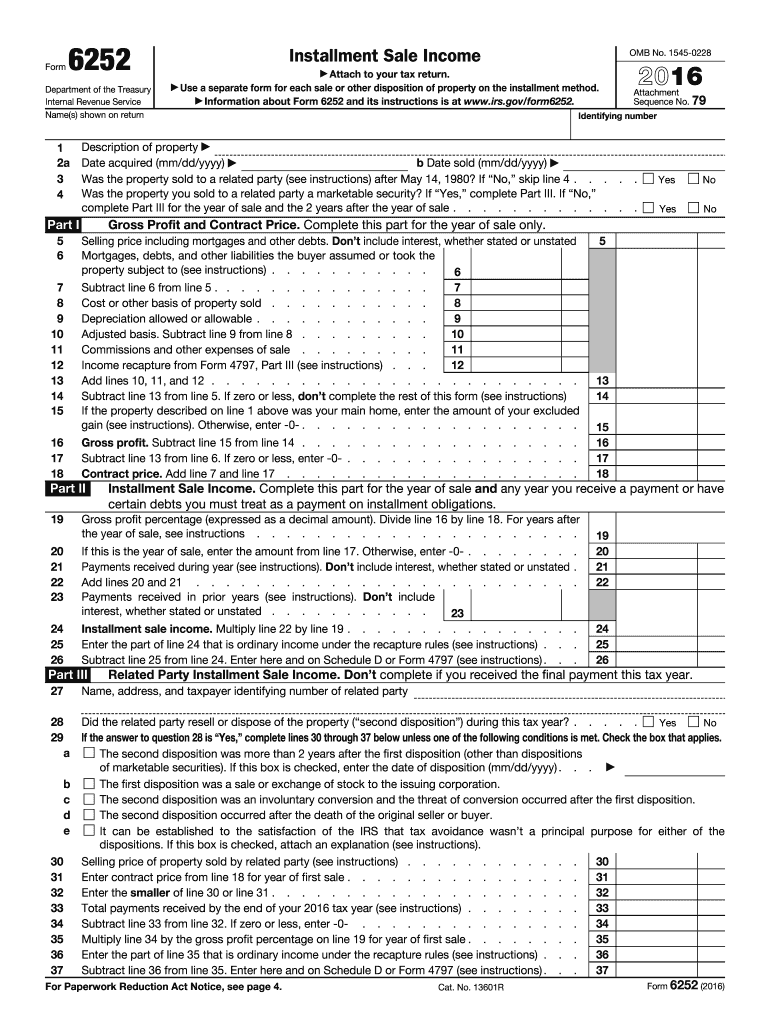

The IRS Form 6252 is a tax document used to report the sale of property when the seller receives at least one payment after the year of sale. This form is primarily associated with the installment method of reporting income, which allows taxpayers to spread the recognition of income over multiple years. It is essential for individuals and businesses that sell property and choose to report the gain from the sale in this manner.

How to use the IRS Form 6252

To use the IRS Form 6252 effectively, taxpayers must first determine if they are eligible to report the sale of property using the installment method. Once eligibility is confirmed, the seller must fill out the form to report the details of the sale, including the total selling price, the adjusted basis of the property, and any expenses related to the sale. The form helps in calculating the gain on the sale and the amount of gain to be reported for each year payments are received.

Steps to complete the IRS Form 6252

Completing the IRS Form 6252 involves several key steps:

- Gather necessary information, including the selling price, basis, and selling expenses.

- Complete Part I of the form to report the sale details and calculate the total gain.

- Fill out Part II to determine the amount of gain to report for the current tax year.

- Ensure all calculations are accurate and review the form for completeness.

- Submit the form with your tax return for the year in which you received the first payment.

Legal use of the IRS Form 6252

The legal use of the IRS Form 6252 is governed by federal tax laws. To ensure compliance, taxpayers must accurately report all required information and adhere to IRS guidelines regarding installment sales. Failure to properly complete and submit the form can result in penalties or additional taxes owed. It is advisable to consult a tax professional if there are uncertainties about the legal implications of using this form.

Key elements of the IRS Form 6252

Key elements of the IRS Form 6252 include:

- Part I: Details of the sale, including the selling price and adjusted basis.

- Part II: Calculation of the gain to report for the current year.

- Installment sale information: This includes the terms of the sale and payment schedule.

- Signature: The form must be signed and dated by the taxpayer to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 6252 align with the general tax return deadlines. Taxpayers must submit the form along with their annual tax return, typically due on April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that the form is still submitted by the extended deadline to avoid penalties.

Quick guide on how to complete 2016 irs form 6252

Complete Irs Form 6252 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It provides an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Irs Form 6252 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Irs Form 6252 with ease

- Find Irs Form 6252 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in a few clicks from any device. Modify and electronically sign Irs Form 6252 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 6252

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 6252

How to create an electronic signature for the 2016 Irs Form 6252 in the online mode

How to make an electronic signature for the 2016 Irs Form 6252 in Google Chrome

How to make an eSignature for putting it on the 2016 Irs Form 6252 in Gmail

How to make an eSignature for the 2016 Irs Form 6252 straight from your smartphone

How to make an eSignature for the 2016 Irs Form 6252 on iOS

How to make an eSignature for the 2016 Irs Form 6252 on Android devices

People also ask

-

What is IRS Form 6252 and how does it relate to airSlate SignNow?

IRS Form 6252 is used to report income from the sale of property when the payment is received in installments. By using airSlate SignNow, you can easily prepare, sign, and send this form electronically, ensuring a streamlined process for managing your tax obligations.

-

How can airSlate SignNow help me with IRS Form 6252?

airSlate SignNow empowers users to electronically sign and send IRS Form 6252, making it easier to manage tax-related documents. With our intuitive interface, you can quickly complete and share this form, ensuring compliance and efficiency in your tax reporting.

-

Is there a cost associated with using airSlate SignNow for IRS Form 6252?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution allows you to manage important documents, including IRS Form 6252, at a competitive price, making it accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with other accounting software for IRS Form 6252?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to efficiently manage IRS Form 6252 alongside your financial documents. This integration simplifies the process of handling your tax forms and ensures accuracy.

-

What features does airSlate SignNow offer for completing IRS Form 6252?

airSlate SignNow provides a range of features, including customizable templates, secure eSigning, and document tracking for IRS Form 6252. These features enhance your workflow, ensuring that all necessary steps are completed efficiently and securely.

-

Is airSlate SignNow secure for sending sensitive documents like IRS Form 6252?

Yes, airSlate SignNow prioritizes security with industry-standard encryption and compliance measures. When sending sensitive documents like IRS Form 6252, you can trust that your information is protected throughout the signing process.

-

How can I access IRS Form 6252 templates in airSlate SignNow?

To access IRS Form 6252 templates in airSlate SignNow, simply navigate to our template library within the platform. This allows you to quickly find and customize the form, making it easy to prepare for eSigning and submission.

Get more for Irs Form 6252

- Casomb application 2011 form

- Ombudsman dialog program dialog form

- Sw 256 application for a permit to construct modify or dhhr wvdhhr form

- Bwp sw 02 form

- Computer repair fillable form

- California qdro form

- Prior authorization form cat health benefits caterpillar

- Pdf the roland morris low back pain and disability questionnaire form

Find out other Irs Form 6252

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer