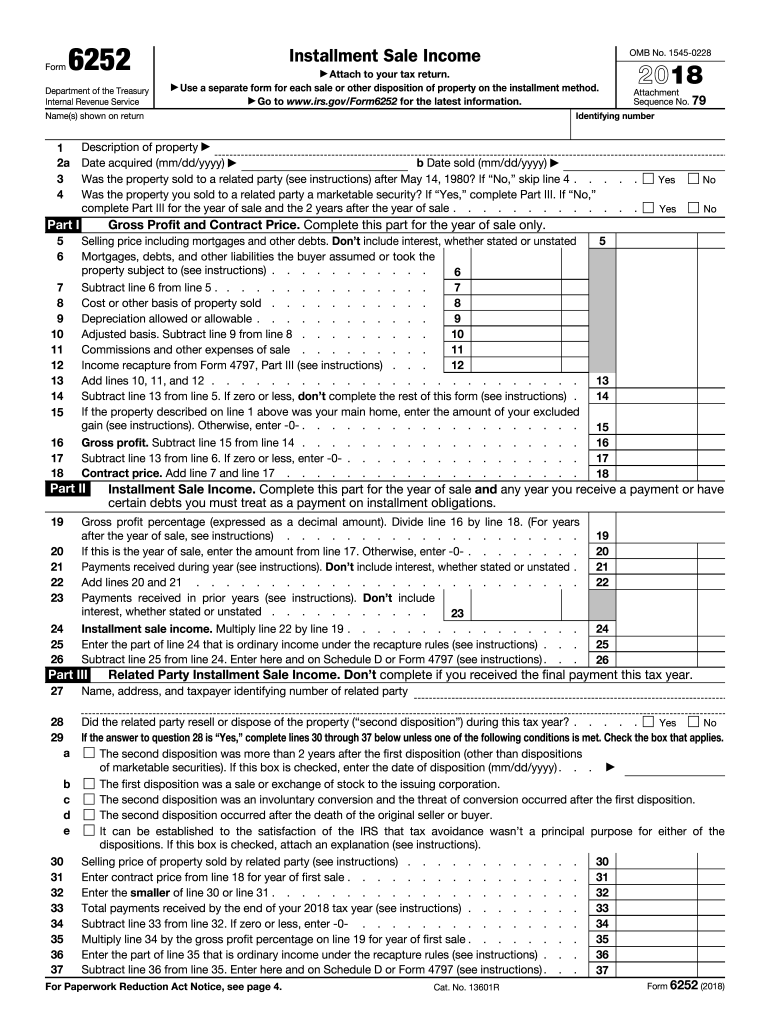

Irs Form 6252 2018

What is the IRS Form 6252

The IRS Form 6252 is used to report the sale of a home where the seller is receiving payments over time, commonly referred to as an installment sale. This form is essential for individuals who have sold property and are not receiving the full payment upfront. Instead, they will receive payments in installments over a period of time. This method can provide tax benefits, allowing sellers to spread their capital gains tax liability over multiple years.

How to use the IRS Form 6252

Using the IRS Form 6252 involves several steps to ensure accurate reporting of your installment sale. First, you will need to gather all relevant information about the sale, including the selling price, the adjusted basis of the property, and any selling expenses. Once you have this information, you can complete the form by entering the required details in the appropriate sections. After filling out the form, it must be included with your tax return for the year in which the sale occurred.

Steps to complete the IRS Form 6252

Completing the IRS Form 6252 requires attention to detail. Follow these steps:

- Start by entering your name and Social Security number at the top of the form.

- Provide the details of the property sold, including the address and date of sale.

- Calculate the selling price and any selling expenses, then determine the gross profit from the sale.

- Fill in the installment sale income for the year, which is the amount you received during that tax year.

- Complete the calculations for the gain on the sale and the tax liability associated with it.

- Review the form for accuracy before submitting it with your tax return.

Filing Deadlines / Important Dates

Understanding the filing deadlines for IRS Form 6252 is crucial for compliance. Generally, the form must be filed with your tax return by the standard deadline, which is April fifteenth of the following year. If you are unable to file by this date, you may request an extension, but it's important to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Legal use of the IRS Form 6252

The IRS Form 6252 must be used in accordance with IRS guidelines to ensure its legal validity. This means that the form should only be submitted for legitimate installment sales and must accurately reflect the terms of the sale. Misreporting or using outdated forms can lead to issues with the IRS, including penalties for non-compliance. Always ensure that you are using the most current version of the form and that all information is complete and accurate.

Required Documents

When completing the IRS Form 6252, several documents are necessary to support your claims. These may include:

- Closing statements from the sale of the property.

- Documentation of the purchase price and any improvements made to the property.

- Records of any selling expenses incurred during the sale.

- Payment records showing the amounts received in installments.

Key elements of the IRS Form 6252

The IRS Form 6252 contains several key elements that are essential for accurate reporting. These include:

- Basic information about the seller and the property.

- Details of the sale, including the selling price and expenses.

- Calculations for the gross profit and the gain from the sale.

- Information on the installment payments received during the tax year.

Quick guide on how to complete 2016 irs form 6252 2018 2019

Discover the simplest method to complete and endorse your Irs Form 6252

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior way to finalize and sign your Irs Form 6252 and similar forms for public services. Our intelligent eSignature platform equips you with everything necessary to manage paperwork swiftly and in accordance with official standards - robust PDF editing, organizing, securing, signing, and sharing tools all available through an intuitive interface.

Only a few steps are needed to fill out and endorse your Irs Form 6252:

- Insert the fillable template into the editor using the Get Form button.

- Review what information you need to enter in your Irs Form 6252.

- Move between the fields using the Next option to ensure you don’t overlook anything.

- Utilize Text, Check, and Cross tools to fill in the gaps with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure sections that are no longer relevant.

- Press Sign to generate a legally binding eSignature using any method you prefer.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finished Irs Form 6252 in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides adaptable file sharing. There’s no necessity to print your forms when you need to submit them to a relevant public office - accomplish this via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 6252 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 6252 2018 2019

How to make an eSignature for your 2016 Irs Form 6252 2018 2019 online

How to generate an eSignature for the 2016 Irs Form 6252 2018 2019 in Google Chrome

How to create an eSignature for putting it on the 2016 Irs Form 6252 2018 2019 in Gmail

How to generate an eSignature for the 2016 Irs Form 6252 2018 2019 from your mobile device

How to make an eSignature for the 2016 Irs Form 6252 2018 2019 on iOS devices

How to create an electronic signature for the 2016 Irs Form 6252 2018 2019 on Android devices

People also ask

-

What is the IRS gov form 6252?

The IRS gov form 6252 is used to report income from an installment sale of property. This form helps taxpayers detail the payment received and the gain recognized over time. Using airSlate SignNow to eSign this form streamlines document management, ensuring accuracy and compliance.

-

How can airSlate SignNow help with completing the IRS gov form 6252?

airSlate SignNow offers an intuitive platform to eSign and manage your IRS gov form 6252 efficiently. The platform allows you to fill out the form electronically, ensuring satisfaction with reduced errors. Plus, you can securely send it out for signatures, enhancing your experience.

-

Is there a cost associated with using airSlate SignNow for the IRS gov form 6252?

Yes, airSlate SignNow provides various subscription plans to accommodate different needs and budgets. Choosing the right plan ensures you can efficiently eSign documents like the IRS gov form 6252 without overspending. Our cost-effective solution delivers signNow value for businesses of all sizes.

-

What features does airSlate SignNow provide for eSigning the IRS gov form 6252?

airSlate SignNow offers features such as customizable templates, cloud storage, and real-time tracking for signed documents, including the IRS gov form 6252. This ensures that you can manage your documents easily and stay organized. Simplifying the eSigning process makes handling tax documents more efficient.

-

Can I integrate airSlate SignNow with other applications for handling the IRS gov form 6252?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and more. This enables you to access, edit, and eSign the IRS gov form 6252 from platforms you already use, streamlining your workflow and saving time.

-

How secure is my information when using airSlate SignNow for the IRS gov form 6252?

airSlate SignNow prioritizes data security through advanced encryption and compliance with industry standards. When eSigning the IRS gov form 6252 or any sensitive documents, you can trust that your information remains protected. Comprehensive security measures help ensure your peace of mind.

-

Can I track the status of my IRS gov form 6252 sent via airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking capabilities for all your signed documents. You can monitor the status of your IRS gov form 6252 and receive notifications once it's completed. This transparency helps manage deadlines and ensures accountability in the signing process.

Get more for Irs Form 6252

Find out other Irs Form 6252

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy