State Income Tax Law Changes for the Third Quarter of 2022

Understanding the State Income Tax Law Changes for the Third Quarter

The State Income Tax Law changes for the third quarter can significantly impact taxpayers. These changes may include adjustments to tax rates, deductions, and credits that affect how individuals and businesses calculate their tax liabilities. It is essential to stay informed about these updates to ensure compliance and optimize tax planning strategies.

Steps to Complete the State Income Tax Law Changes for the Third Quarter

To effectively navigate the State Income Tax Law changes for the third quarter, follow these steps:

- Review the official state tax authority announcements regarding the changes.

- Gather necessary documentation, including previous tax returns and current income statements.

- Update your tax preparation software or consult with a tax professional to reflect the new rates and rules.

- Complete the required forms accurately, ensuring all information aligns with the updated tax laws.

- Submit your forms by the specified deadlines to avoid penalties.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for compliance with the State Income Tax Law changes. Key dates typically include:

- Initial filing deadline for quarterly returns.

- Extended deadlines for those who file for extensions.

- Due dates for any estimated tax payments required under the new law.

Required Documents for Compliance

To comply with the State Income Tax Law changes, taxpayers should prepare the following documents:

- W-2 forms from employers, reflecting income earned.

- 1099 forms for any freelance or contract work.

- Receipts and records for deductions and credits claimed.

- Previous tax returns for reference and accuracy.

IRS Guidelines Related to State Income Tax Changes

The IRS provides guidelines that can help clarify how state tax changes may affect federal tax obligations. Taxpayers should review:

- IRS publications that discuss state tax deductions and credits.

- Guidance on how to report state tax refunds or liabilities on federal returns.

- Updates on any federal tax law changes that may coincide with state adjustments.

Penalties for Non-Compliance with State Income Tax Laws

Failure to comply with the State Income Tax Law changes can result in penalties. Common penalties include:

- Late filing penalties for returns submitted after the deadline.

- Interest charges on unpaid taxes.

- Additional fines for inaccuracies or fraudulent reporting.

Quick guide on how to complete state income tax law changes for the third quarter of 2022

Manage State Income Tax Law Changes For The Third Quarter Of effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle State Income Tax Law Changes For The Third Quarter Of on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and electronically sign State Income Tax Law Changes For The Third Quarter Of with ease

- Find State Income Tax Law Changes For The Third Quarter Of and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for that function.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device of your choice. Modify and electronically sign State Income Tax Law Changes For The Third Quarter Of and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state income tax law changes for the third quarter of 2022

Create this form in 5 minutes!

People also ask

-

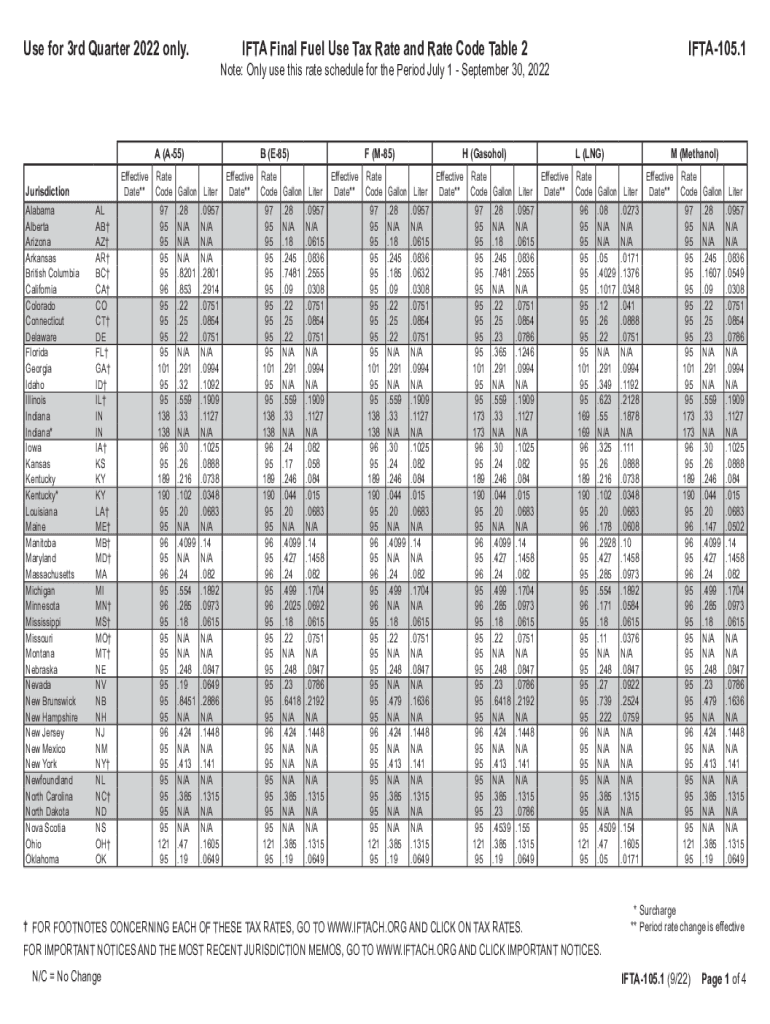

What are IFTA quarters and why are they important?

IFTA quarters refer to the reporting periods for the International Fuel Tax Agreement, which helps streamline fuel tax regulation across states and provinces. Properly filing IFTA quarters is essential for maintaining compliance and avoiding penalties for vehicle operators who travel across state lines.

-

How does airSlate SignNow help with IFTA quarter submissions?

airSlate SignNow simplifies the process of submitting IFTA quarters by allowing users to eSign and send necessary documents quickly and securely. Our platform provides a user-friendly interface that ensures timely submissions, helping businesses stay compliant without hassle.

-

What features does airSlate SignNow offer for managing IFTA quarters?

airSlate SignNow offers features such as document templates, customizable workflows, and cloud storage to manage IFTA quarters efficiently. You can easily create, edit, and sign IFTA-related documents, ensuring that all your paperwork is organized and accessible whenever needed.

-

Is there a trial available for airSlate SignNow's IFTA quarters solution?

Yes, airSlate SignNow provides a free trial for users to explore our features designed for streamlined IFTA quarter management. This trial allows businesses to assess the ease of use and effectiveness of our solution before committing to a subscription plan.

-

Can airSlate SignNow integrate with other accounting software for IFTA quarters?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software to enhance IFTA quarter management. This integration ensures that your data flows smoothly between systems, allowing for accurate calculations and timely submissions.

-

What are the pricing options for airSlate SignNow's IFTA quarters services?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes for managing IFTA quarters. Whether you’re a small fleet or a large enterprise, our pricing ensures you receive the best value for comprehensive eSigning and document management.

-

How does airSlate SignNow ensure the security of IFTA quarters data?

Security is a priority at airSlate SignNow, and we use advanced encryption and secure storage to protect your IFTA quarters data. Our compliance with industry standards ensures that your documents remain confidential and secure throughout the signing process.

Get more for State Income Tax Law Changes For The Third Quarter Of

- Nm landlord tenant form

- Notice of default on residential lease new mexico form

- Landlord tenant lease co signer agreement new mexico form

- Application for sublease new mexico form

- Inventory and condition of leased premises for pre lease and post lease new mexico form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out new mexico form

- Property manager agreement new mexico form

- Agreement for delayed or partial rent payments new mexico form

Find out other State Income Tax Law Changes For The Third Quarter Of

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure