IFTA 105 IFTA Final Fuel Use Tax Rate and Rate Code Table 1 2024-2026

Understanding the IFTA 105 Final Fuel Use Tax Rate

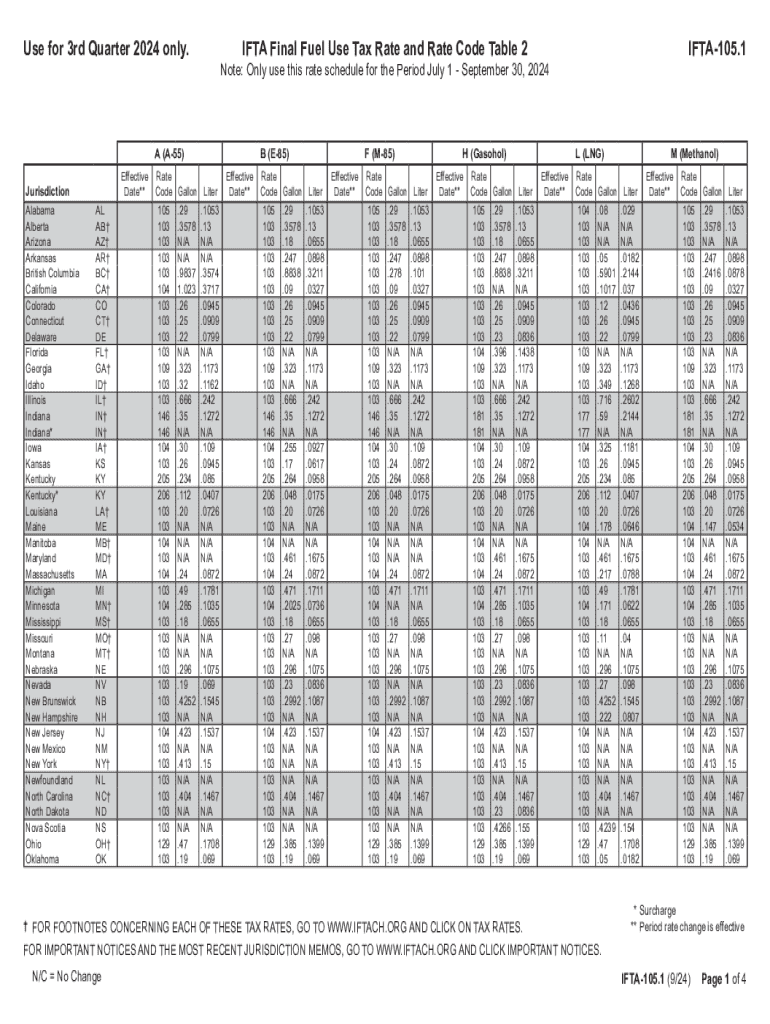

The IFTA 105 form is essential for reporting fuel use tax for interstate commercial vehicles. The IFTA Final Fuel Use Tax Rate is a critical component of this process, as it determines the tax rate applicable for each jurisdiction. This rate is updated quarterly, reflecting changes in fuel tax rates across various states. It is important for businesses to stay informed about these rates to ensure compliance and accurate reporting.

Steps to Complete the IFTA 105 Form

Completing the IFTA 105 form involves several key steps:

- Gather all necessary documentation, including mileage records and fuel purchase receipts.

- Calculate total miles traveled and total gallons of fuel purchased in each jurisdiction.

- Use the IFTA Final Fuel Use Tax Rate to determine the tax owed or credit available for each state.

- Fill out the IFTA 105 form accurately, ensuring all calculations are correct.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines for the IFTA 105

Filing deadlines for the IFTA 105 form are crucial for compliance. Typically, the form must be filed quarterly, with specific due dates for each quarter:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

Late submissions may result in penalties, so it is important to adhere to these deadlines.

Required Documents for IFTA 105 Submission

When preparing to submit the IFTA 105 form, certain documents are required:

- Mileage records for each jurisdiction traveled.

- Fuel purchase receipts, detailing the gallons purchased and the price paid.

- Previous IFTA returns, if applicable, for reference and accuracy.

Having these documents organized will streamline the filing process and help ensure compliance.

Examples of Using the IFTA 105 Form

Understanding how to use the IFTA 105 form can be enhanced by examining practical examples:

- A trucking company traveling through multiple states must report fuel use and mileage for each state based on the IFTA 105.

- A business that operates in one state but purchases fuel in another must accurately report these transactions to avoid discrepancies.

These examples illustrate the importance of accurate reporting for businesses operating across state lines.

Penalties for Non-Compliance with IFTA Regulations

Failure to comply with IFTA regulations can result in significant penalties. These may include:

- Fines for late filing or underreporting fuel use.

- Interest on unpaid taxes.

- Potential audits by state tax authorities.

Understanding these penalties can motivate businesses to maintain accurate records and timely submissions.

Quick guide on how to complete ifta 105 ifta final fuel use tax rate and rate code table 1

Effortlessly Prepare IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1 Seamlessly

- Obtain IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1 and select Get Form to begin.

- Utilize the instruments we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form navigation, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and eSign IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1 while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta 105 ifta final fuel use tax rate and rate code table 1

Create this form in 5 minutes!

How to create an eSignature for the ifta 105 ifta final fuel use tax rate and rate code table 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IFTA quarters and why are they important?

IFTA quarters refer to the quarterly reporting periods for the International Fuel Tax Agreement, which simplifies fuel tax reporting for interstate commercial carriers. Understanding IFTA quarters is crucial for compliance, as it ensures that businesses accurately report their fuel usage and pay the appropriate taxes. This helps avoid penalties and maintains good standing with tax authorities.

-

How can airSlate SignNow help with IFTA quarters?

airSlate SignNow streamlines the process of preparing and submitting IFTA quarter reports by allowing users to easily eSign and send necessary documents. With its user-friendly interface, businesses can efficiently manage their IFTA quarters without the hassle of paper forms. This not only saves time but also reduces the risk of errors in reporting.

-

What features does airSlate SignNow offer for managing IFTA quarters?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning, all of which are beneficial for managing IFTA quarters. These tools help businesses create accurate reports quickly and ensure that all necessary signatures are obtained efficiently. Additionally, the platform provides tracking capabilities to monitor the status of documents.

-

Is airSlate SignNow cost-effective for handling IFTA quarters?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage their IFTA quarters efficiently. With flexible pricing plans, companies can choose a package that fits their budget while still accessing powerful features. This affordability makes it an attractive option for both small and large businesses.

-

Can airSlate SignNow integrate with other software for IFTA quarters?

Absolutely! airSlate SignNow offers integrations with various accounting and fleet management software, making it easier to manage IFTA quarters alongside other business processes. These integrations help streamline data transfer and reduce manual entry, ensuring that your IFTA reporting is accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for IFTA quarters?

Using airSlate SignNow for IFTA quarters provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's electronic signature capabilities allow for faster approvals, while its document management features help keep everything organized. This ultimately leads to a smoother reporting process and peace of mind for businesses.

-

How secure is airSlate SignNow when handling IFTA quarters?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to IFTA quarters. Users can trust that their documents are safe and secure, ensuring that all data remains confidential. This commitment to security helps businesses feel confident in their document management processes.

Get more for IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1

- Warranty deed joint form

- Partial payment certificate mortgage or contract by individual ucbc form 61 m minnesota

- Partial payment certificate mortgage or contract by corporation ucbc form 62 m minnesota

- Affidavit by attorney in fact nontermination or nonrevocation in support of real property transaction ucbc form 10021 minnesota

- Notice foreclose 497312134 form

- Pendency form

- Notice foreclosure mn form

- Minnesota mortgage foreclosure form

Find out other IFTA 105 IFTA Final Fuel Use Tax Rate And Rate Code Table 1

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document