Ny Ifta Form 105 2018

What is the NY IFTA Form 105?

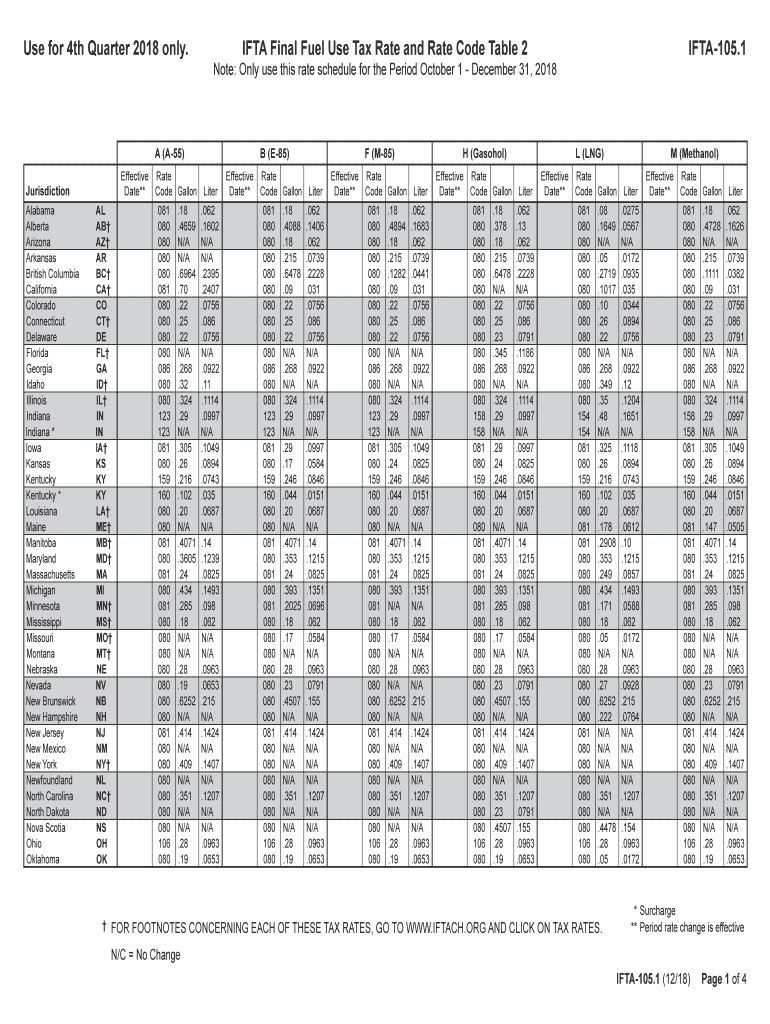

The NY IFTA Form 105 is a tax document used by motor carriers to report fuel use and calculate taxes owed to various jurisdictions under the International Fuel Tax Agreement (IFTA). This form is essential for businesses that operate commercial vehicles across state lines, ensuring compliance with fuel tax regulations. The form consolidates fuel consumption data and mileage traveled in each state, allowing for accurate tax reporting and payment. The IFTA Form 105 is typically filed quarterly, reflecting the fuel usage for that specific period.

Steps to Complete the NY IFTA Form 105

Completing the NY IFTA Form 105 involves several important steps to ensure accuracy and compliance. First, gather all necessary records of fuel purchases and mileage traveled during the reporting period. This includes receipts and logs that detail fuel consumption by state. Next, fill in the required sections of the form, including the total miles driven and total gallons of fuel purchased in each jurisdiction. It is crucial to ensure that the figures are accurate to avoid penalties. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the NY IFTA Form 105 are typically set on a quarterly basis. The due date for the 2nd quarter, which covers the months of April, May, and June, is usually July 31. It is important for businesses to mark these dates on their calendars to avoid late filing penalties. Additionally, keeping track of any changes in tax regulations or deadlines is essential for maintaining compliance with state and federal laws.

Legal Use of the NY IFTA Form 105

The NY IFTA Form 105 must be used in accordance with state and federal regulations governing fuel tax reporting. This form is legally binding and must be completed accurately to reflect the actual fuel usage and mileage. Failure to comply with the requirements can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of the form is crucial for businesses to avoid potential legal issues.

Key Elements of the NY IFTA Form 105

The NY IFTA Form 105 includes several key elements that are essential for accurate reporting. These elements typically include the following:

- Carrier Information: Details about the business, including name, address, and IFTA account number.

- Fuel Consumption: Total gallons of fuel purchased in each jurisdiction.

- Mileage Records: Total miles driven in each jurisdiction during the reporting period.

- Tax Calculations: Calculations for taxes owed based on fuel consumption and mileage.

- Signature: An authorized signature confirming the accuracy of the information provided.

Form Submission Methods

The NY IFTA Form 105 can be submitted through various methods, including online filing, mail, or in-person submission. Many businesses prefer online filing due to its convenience and faster processing times. However, those who choose to file by mail should ensure that the form is sent well before the deadline to allow for any potential delays. In-person submissions may be made at designated tax offices, where assistance may be available for completing the form.

Quick guide on how to complete ifta 105 1 2018 2019 form

Your assistance manual on how to prepare your Ny Ifta Form 105

If you’re interested in learning how to complete and submit your Ny Ifta Form 105, here are a few simple guidelines to make tax processing signNowly more manageable.

To begin, you only need to establish your airSlate SignNow profile to revolutionize how you handle paperwork online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, draft, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify information where necessary. Streamline your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to finalize your Ny Ifta Form 105 in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our catalog to access any IRS tax form; explore various versions and schedules.

- Click Get form to launch your Ny Ifta Form 105 in our editor.

- Complete the required fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase the likelihood of return errors and cause delays in refunds. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ifta 105 1 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the ifta 105 1 2018 2019 form

How to create an electronic signature for the Ifta 105 1 2018 2019 Form online

How to create an electronic signature for the Ifta 105 1 2018 2019 Form in Chrome

How to generate an electronic signature for signing the Ifta 105 1 2018 2019 Form in Gmail

How to make an electronic signature for the Ifta 105 1 2018 2019 Form from your mobile device

How to make an eSignature for the Ifta 105 1 2018 2019 Form on iOS devices

How to generate an electronic signature for the Ifta 105 1 2018 2019 Form on Android

People also ask

-

What is the Ny Ifta Form 105 and why is it important?

The Ny Ifta Form 105 is a crucial document required for reporting fuel use taxes for businesses operating in New York. It simplifies the process of tracking fuel usage and ensures compliance with state regulations. By using the Ny Ifta Form 105, businesses can avoid penalties and streamline their fuel tax reporting.

-

How can airSlate SignNow help with completing the Ny Ifta Form 105?

airSlate SignNow offers an intuitive platform that allows users to easily fill out and eSign the Ny Ifta Form 105. Our solution ensures that all necessary fields are completed accurately, reducing the risk of errors. Plus, you can save and store your forms securely for future reference.

-

Is there a cost associated with using airSlate SignNow for the Ny Ifta Form 105?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the completion of the Ny Ifta Form 105. Our plans are designed to be cost-effective, providing excellent value for the features and security we offer. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for the Ny Ifta Form 105?

airSlate SignNow includes a range of features specifically designed to streamline the completion of the Ny Ifta Form 105. Key features include customizable templates, electronic signatures, and automated workflows. These tools help businesses save time and ensure accuracy in their tax reporting.

-

Can I integrate airSlate SignNow with other software for the Ny Ifta Form 105?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage the Ny Ifta Form 105 and other documents. This integration allows for smoother data transfer and improved efficiency in your business processes.

-

What are the benefits of using airSlate SignNow for the Ny Ifta Form 105?

Using airSlate SignNow for the Ny Ifta Form 105 offers numerous benefits, such as improving document turnaround time and ensuring compliance with tax regulations. Our platform provides a user-friendly experience that saves time and reduces the likelihood of errors in your submissions. Additionally, you'll have access to secure storage for all your completed forms.

-

Is airSlate SignNow secure for handling the Ny Ifta Form 105?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe option for handling sensitive documents like the Ny Ifta Form 105. We utilize advanced encryption methods to protect your data and ensure that your forms are only accessible to authorized users. You can trust us to keep your information secure.

Get more for Ny Ifta Form 105

- Annual reconciliation of employer wage tax phila form

- Express scripts letterhead form

- Helix curved stair lift evaluationorder form

- 4900 alameda blvd ne suite a form

- Iyb spring aau tryout waiver iyb basketball form

- Opera limited opra stock price today quote ampamp news form

- Trrrc membership request form update

- 25 west end avenue somerville nj form

Find out other Ny Ifta Form 105

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors