Ifta 1051 Form 1st Quarter Only 2012

What is the Ifta 1051 Form 1st Quarter Only

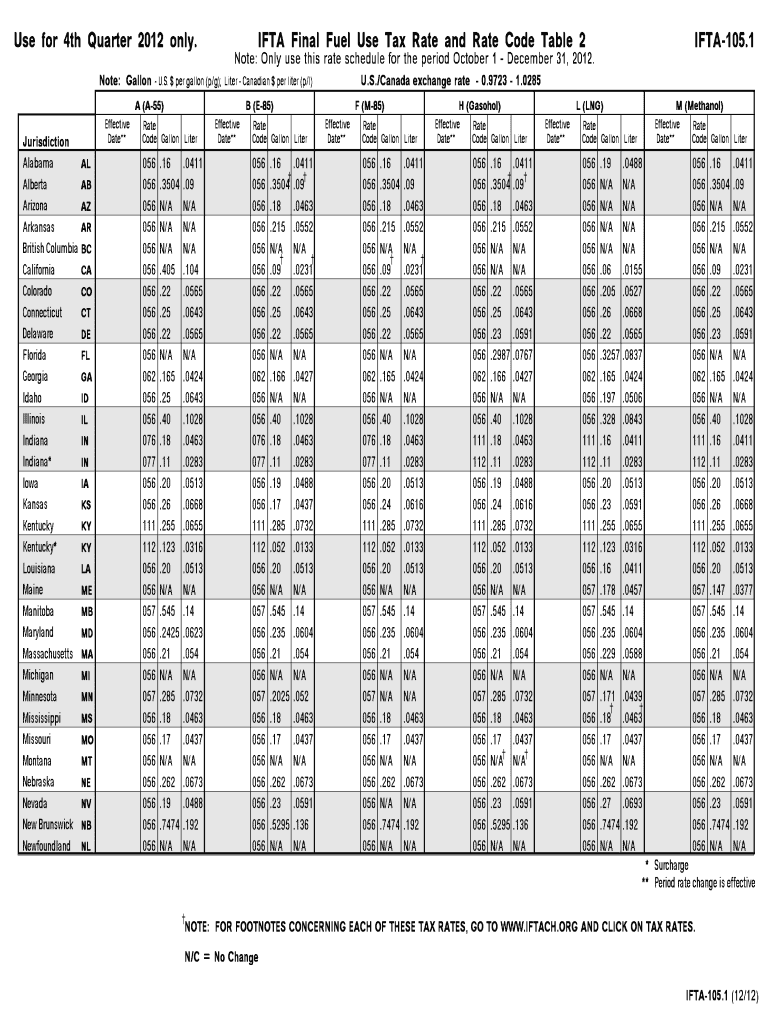

The Ifta 1051 Form 1st Quarter Only is a tax document used by motor carriers operating in multiple jurisdictions to report their fuel use and mileage. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting process for fuel taxes across participating states and provinces. The form specifically covers the first quarter of the year, typically from January to March, and is crucial for ensuring compliance with state fuel tax regulations.

Steps to complete the Ifta 1051 Form 1st Quarter Only

Completing the Ifta 1051 Form 1st Quarter Only involves several key steps:

- Gather necessary data, including total miles traveled and fuel purchased in each jurisdiction.

- Fill in the required sections of the form, ensuring accuracy in reporting mileage and fuel amounts.

- Calculate the total fuel tax owed based on the rates applicable in each jurisdiction.

- Review the completed form for any errors or omissions.

- Sign and date the form, confirming that the information provided is accurate.

How to use the Ifta 1051 Form 1st Quarter Only

The Ifta 1051 Form 1st Quarter Only is utilized by motor carriers to report their fuel consumption and mileage across different states. To use the form effectively, follow these guidelines:

- Ensure you have accurate records of your fuel purchases and mileage for the reporting period.

- Input the data into the appropriate fields on the form, categorized by jurisdiction.

- Submit the completed form to your base jurisdiction by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

Timely filing of the Ifta 1051 Form 1st Quarter Only is essential to avoid late fees and penalties. The deadline for submitting this form is typically April 30 following the first quarter. It is important to mark your calendar and ensure that all relevant data is collected and reported before this date.

Legal use of the Ifta 1051 Form 1st Quarter Only

The Ifta 1051 Form 1st Quarter Only must be used in accordance with federal and state regulations governing fuel tax reporting. It is legally binding, and any inaccuracies or omissions can lead to penalties. Users should familiarize themselves with the laws applicable in their base jurisdiction to ensure compliance and avoid legal issues.

Key elements of the Ifta 1051 Form 1st Quarter Only

Key elements of the Ifta 1051 Form 1st Quarter Only include:

- Identification information for the motor carrier, including name and address.

- Total miles traveled in each jurisdiction during the first quarter.

- Total gallons of fuel purchased in each jurisdiction.

- Calculations for fuel tax owed based on jurisdictional rates.

- Signature and date fields to validate the submission.

Who Issues the Form

The Ifta 1051 Form 1st Quarter Only is issued by the base jurisdiction of the motor carrier. This jurisdiction is typically where the carrier is registered and where they maintain their primary business operations. Each state participating in IFTA provides the necessary forms and guidelines for completion and submission.

Quick guide on how to complete ifta 1051 form 1st quarter only 2012

Your assistance manual on how to prepare your Ifta 1051 Form 1st Quarter Only

If you’re wondering how to complete and submit your Ifta 1051 Form 1st Quarter Only, below are some straightforward guidelines to make tax filing easier.

To get started, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to update details as needed. Streamline your tax administration with advanced PDF editing, eSigning, and simple sharing.

Follow the instructions below to complete your Ifta 1051 Form 1st Quarter Only in just a few minutes:

- Set up your account and begin working on PDFs in no time.

- Utilize our library to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Ifta 1051 Form 1st Quarter Only in our editor.

- Populate the required fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and save it to your device.

Make use of this guide to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper may lead to increased return errors and delay refunds. Additionally, before e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ifta 1051 form 1st quarter only 2012

FAQs

-

Can I fill out a BA private form while I’m in BSc, 1st year, and want to go with a BA private only for the next three years?

Then fall out of bsc , you might know you can do only one full time course at a time other one will be considered invalid.

-

How do very mixed race people fill out official documents and forms that ask for race if one is only allowed to choose one race?

None of the above?

-

I haven't filled the tax forms for 2011, 2012, and 2013 and Glacier Tax Preparation only allows me to do so for 2014. I entered the USA in 2011. How can I file those now?

I don't think you can file taxes for 2011 and 2012 this year.But as you did not have any income in those two years. It is fine even if you dont file taxes.Study how to file taxes, how to determine residency status and which forms you should submit when you are in F1 VisaF1(CPT, OPT), J1, M1 Visa tax returns filing : All information IRS wants you to know - Grad Schools BlogThough I am not expert in tax laws, I figured this from my case and few other friends.

-

If a student fails in the 1st compartment exam, then what should he do? If he fills out a private candidate form, is it compulsory to give all 5 subject exams or only the one in which he failed? What should he do?

If you have filled the improvement exam for which actually is the private form then all your problems is solved.It is not compulsory to give exams for all of the 5 subjects you can only choose the subject in which you failed but the exams will be held in March 2018.Compartment generally is conducted in the month of July and it was in july 2017.One subject costs around ₹200.Note:-Study very hard for your next exam because if you fail the next year also then you have to wait for one other year.Example:March 2017 was for the board exam but you failed,Then gave compartment in the month of July 2017, then gave improvement or became the private student then exam will be conducted for the compartment again will be in March 2018.But if you fail in the private exam also then you have to wait for the entire year, i.e. March 2019.So try not to score less or fail.Note 2:No compartment for improvement exam or private exam.Entire year is wasted again.https://www.cbse.nic.inKeep a daily check on this auspacious website.SNOOZE YOU LOOSEIf this was helpful please UPVOTE.FOLLOW ME FOR RESOLVING YOUR QUERIES ABOUT ALL THESE STUFFS

-

How do I create forms for MySQL database? I have created a small database in Access and I’m planning to move to MySQL, but I am able to create only tables so far. How do I create forms for users to fill out the tables?

You can't directly. MySQL is the data engine, and has no user interface capabilities.To do this, you must write an application of some kind.You might write a desktop windows app using C# and its UI framework. Or maybe a Java desktop app using JavaFX for the UI and JDBC to connect to MySQLYou might write a web application, and then have a browser based interface.Whatever you do, what gets sent to MySQL will be SQL commands.It's more difficult than access for sure. And you have to consider the effects of multiple users editing the same data at the same time.

Create this form in 5 minutes!

How to create an eSignature for the ifta 1051 form 1st quarter only 2012

How to generate an eSignature for the Ifta 1051 Form 1st Quarter Only 2012 in the online mode

How to create an electronic signature for your Ifta 1051 Form 1st Quarter Only 2012 in Chrome

How to create an eSignature for putting it on the Ifta 1051 Form 1st Quarter Only 2012 in Gmail

How to create an eSignature for the Ifta 1051 Form 1st Quarter Only 2012 right from your smartphone

How to create an eSignature for the Ifta 1051 Form 1st Quarter Only 2012 on iOS

How to create an eSignature for the Ifta 1051 Form 1st Quarter Only 2012 on Android OS

People also ask

-

What is the Ifta 1051 Form 1st Quarter Only?

The Ifta 1051 Form 1st Quarter Only is a specific tax form required for reporting fuel usage and related taxes for the first quarter of the year. It is essential for interstate commercial vehicle operators who participate in the International Fuel Tax Agreement (IFTA). Completing this form accurately ensures compliance with state and federal regulations.

-

How can airSlate SignNow help me complete the Ifta 1051 Form 1st Quarter Only?

airSlate SignNow provides an intuitive platform to easily fill out and eSign the Ifta 1051 Form 1st Quarter Only. Our user-friendly interface ensures that you can quickly enter all required information and securely submit your form, saving you time and reducing errors in the process.

-

Is there a cost associated with using airSlate SignNow for the Ifta 1051 Form 1st Quarter Only?

Yes, while airSlate SignNow offers competitive pricing, the cost varies based on the subscription plan you choose. We provide different pricing tiers that cater to businesses of all sizes, ensuring you have access to the tools you need for completing the Ifta 1051 Form 1st Quarter Only at an affordable rate.

-

What features does airSlate SignNow offer for managing the Ifta 1051 Form 1st Quarter Only?

With airSlate SignNow, you gain access to features such as seamless document editing, eSigning, and secure sharing. Additionally, our platform offers templates specifically designed for the Ifta 1051 Form 1st Quarter Only, streamlining your filing process and keeping everything organized in one place.

-

Are there any integrations available with airSlate SignNow that assist with the Ifta 1051 Form 1st Quarter Only?

Absolutely! airSlate SignNow integrates with various tools like Google Drive, Dropbox, and QuickBooks, allowing you to import your data directly into the Ifta 1051 Form 1st Quarter Only. These integrations enhance productivity and make it easier to manage your documents seamlessly.

-

Can I store copies of my submitted Ifta 1051 Form 1st Quarter Only in airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your documents, including the submitted Ifta 1051 Form 1st Quarter Only. You can easily access and manage these documents anytime, ensuring that you have them on hand whenever needed for future reference or audits.

-

What are the benefits of using airSlate SignNow for the Ifta 1051 Form 1st Quarter Only?

Using airSlate SignNow for the Ifta 1051 Form 1st Quarter Only offers several advantages, including time efficiency and enhanced accuracy. Our platform reduces the likelihood of errors, and its electronic signature feature speeds up the approval process, allowing you to focus on running your business rather than paperwork.

Get more for Ifta 1051 Form 1st Quarter Only

- Mike ferry daily tracking form 59358707

- Fillable std results form

- Church employment application form

- Pedi ikdc pdf form

- Sample expression of interest proposal pdf form

- Healthy food lesson plan for grade 1 form

- Cgfns international sweepstakes form

- Ds 5511 affidavit for the surviving spouse or next of kin form

Find out other Ifta 1051 Form 1st Quarter Only

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple