Ifta 105 1 Form 2013

What is the IFTA 105 1 Form

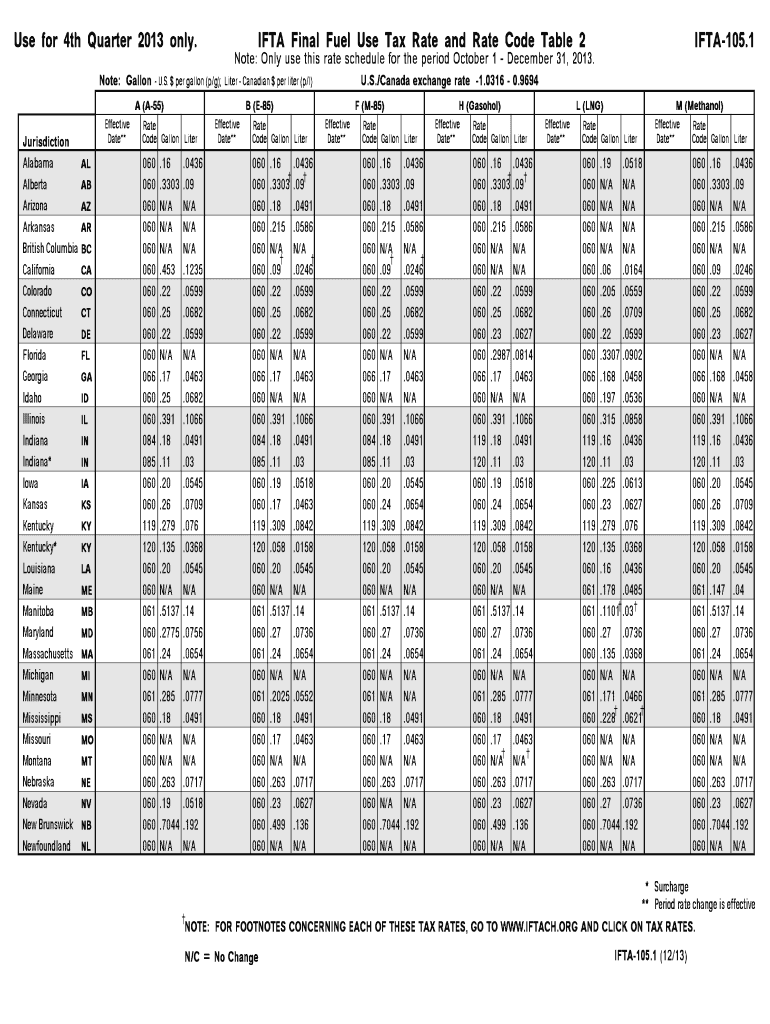

The IFTA 105 1 Form is a crucial document used by commercial motor carriers to report and pay fuel taxes to the International Fuel Tax Agreement (IFTA) jurisdictions. This form simplifies the process of reporting fuel use across multiple states and provinces, allowing carriers to file a single quarterly report instead of separate reports for each jurisdiction. The form collects information on miles traveled and fuel purchased in each jurisdiction, ensuring compliance with tax obligations.

How to use the IFTA 105 1 Form

Using the IFTA 105 1 Form involves several steps. First, gather all necessary data, including total miles traveled and fuel purchased in each jurisdiction. Next, accurately fill out the form, ensuring that all information is correct and complete. After completing the form, review it for any errors before submitting it to the appropriate state authority. It is essential to keep copies of submitted forms and supporting documents for your records.

Steps to complete the IFTA 105 1 Form

Completing the IFTA 105 1 Form involves the following steps:

- Collect mileage and fuel purchase records for each jurisdiction.

- Fill in the carrier's information, including name, address, and account number.

- Report total miles traveled and fuel purchased in each jurisdiction.

- Calculate the total tax due based on the reported figures.

- Sign and date the form to certify its accuracy.

Legal use of the IFTA 105 1 Form

The IFTA 105 1 Form is legally binding when completed and submitted correctly. It must be filed quarterly by registered carriers operating in IFTA jurisdictions. Failure to file the form or inaccuracies can result in penalties, including fines and interest on unpaid taxes. Therefore, it is crucial to adhere to the filing deadlines and ensure all information is accurate to maintain compliance with state and federal regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 105 1 Form typically occur quarterly. Carriers must submit the form by the last day of the month following the end of each quarter. For example, the deadlines are usually April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. It is essential to be aware of these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The IFTA 105 1 Form can be submitted through various methods, depending on the jurisdiction. Many states offer online submission options, allowing carriers to file electronically for convenience. Alternatively, the form can be mailed to the appropriate state authority or submitted in person at designated offices. Always check with your state’s IFTA office for specific submission guidelines and options available.

Quick guide on how to complete ifta 105 1 2013 form

Your assistance manual on how to prepare your Ifta 105 1 Form

If you’re curious about how to produce and send your Ifta 105 1 Form, here are a few brief guidelines on how to simplify tax filing.

To start, you only need to sign up for your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents with ease. Using its editor, you can toggle between text, check boxes, and eSignatures, and return to alter responses when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Complete the following actions to finalize your Ifta 105 1 Form in just a few minutes:

- Establish your account and start editing PDFs right away.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Press Get form to access your Ifta 105 1 Form in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to input your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Conserve modifications, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this guide to submit your taxes digitally with airSlate SignNow. Be aware that submitting paper forms may lead to increased return errors and postponed refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ifta 105 1 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I e fill Income tax ITR-1 form in excel and generate xml in excel 2013?

First download the excel file.Then after all the relevant information is filled click on validate.After you click on validate XML file will be generated which is required to be uploaded.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the ifta 105 1 2013 form

How to make an electronic signature for the Ifta 105 1 2013 Form in the online mode

How to create an electronic signature for your Ifta 105 1 2013 Form in Google Chrome

How to make an electronic signature for signing the Ifta 105 1 2013 Form in Gmail

How to make an electronic signature for the Ifta 105 1 2013 Form straight from your smartphone

How to create an electronic signature for the Ifta 105 1 2013 Form on iOS

How to make an eSignature for the Ifta 105 1 2013 Form on Android

People also ask

-

What is the Ifta 105 1 Form and why is it important?

The Ifta 105 1 Form is a crucial document used by truckers and transportation companies to report fuel taxes to multiple jurisdictions. It simplifies the process of tracking fuel consumption and tax liabilities across states, ensuring compliance with the International Fuel Tax Agreement (IFTA). Proper use of the Ifta 105 1 Form can save businesses from potential penalties and streamline their tax reporting.

-

How can airSlate SignNow help with the Ifta 105 1 Form?

airSlate SignNow provides a user-friendly platform to electronically sign and send the Ifta 105 1 Form, making the submission process seamless and efficient. With integrated templates and customizable features, you can easily fill out the form, ensuring accuracy and compliance. Our solution saves time and reduces the risk of errors by allowing you to manage all your documentation in one place.

-

What are the pricing options for using airSlate SignNow to manage the Ifta 105 1 Form?

airSlate SignNow offers a variety of pricing plans to fit different business needs, including options for individuals and larger organizations. Each plan provides access to features such as eSigning and document management tools. We offer competitive pricing that ensures you get the most value when using the airSlate SignNow for your Ifta 105 1 Form processing.

-

Can I integrate airSlate SignNow with other software for processing the Ifta 105 1 Form?

Yes, airSlate SignNow easily integrates with various software solutions, enhancing your workflow when processing the Ifta 105 1 Form. Whether you need to connect with accounting software or transportation management systems, our platform is designed for seamless integration. This helps streamline your processes and keep all data synchronized across platforms.

-

What are the key features of airSlate SignNow for managing the Ifta 105 1 Form?

airSlate SignNow is equipped with several key features that simplify managing the Ifta 105 1 Form. These include eSigning, document templates, secure data storage, and collaborative tools for team members to work together. These features ensure that your document management process is efficient, organized, and compliant with regulations.

-

How does airSlate SignNow ensure the security of my Ifta 105 1 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure servers to protect your Ifta 105 1 Form and other sensitive documents. Additionally, our compliance with industry standards ensures that your data remains private and secure throughout the signing and submission process.

-

Is it easy to track the status of my Ifta 105 1 Form submissions with airSlate SignNow?

Yes! With airSlate SignNow, you can easily track the status of your Ifta 105 1 Form submissions in real-time. The platform provides notifications and status updates, allowing you to stay informed at every stage of the signing process. This transparency ensures you can manage your documents effectively and within deadlines.

Get more for Ifta 105 1 Form

- Ccps scholarship application form

- Residential burn permit provo ut form

- Chelsea gerbitz form

- Metlife insurance company of connecticut annuity service request form

- Statutory declaration of common law union single signature sc isp 3104e servicecanada gc form

- Www uslegalforms comform library464727 transittransit plus application fill and sign printable template

- Unable to open few pdf forms showing ampquotif this message is not

- Bernalillo county ac license form pdf

Find out other Ifta 105 1 Form

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy