Ifta 105 2023

What is the Ifta 105

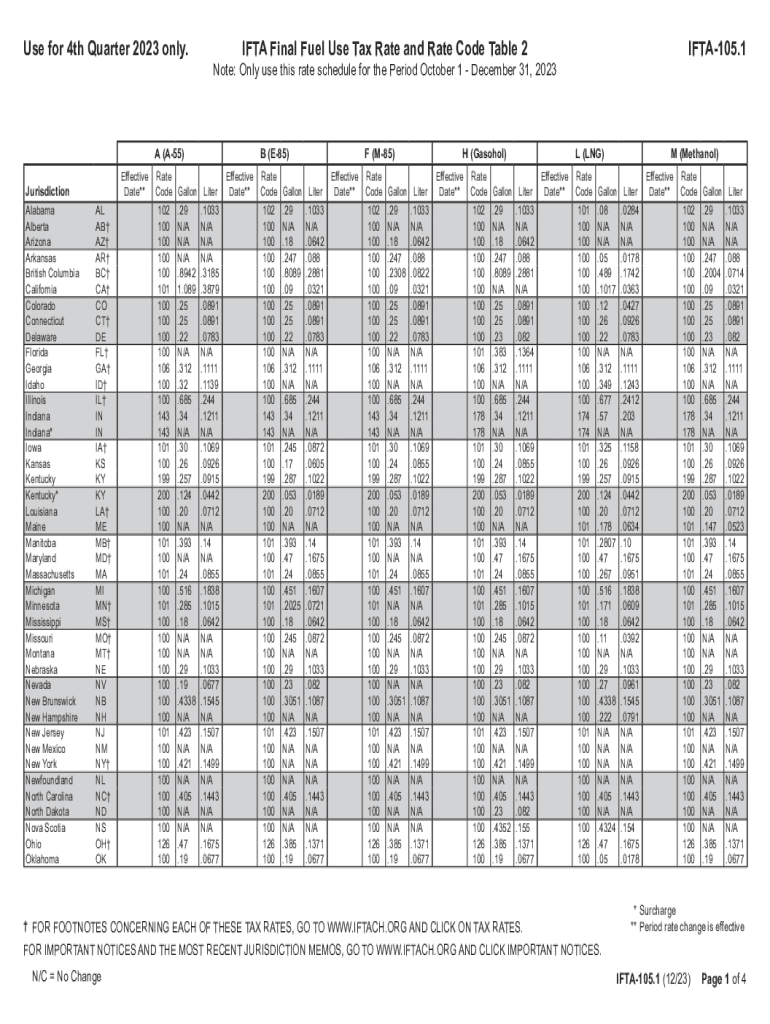

The IFTA 105 form, also known as the International Fuel Tax Agreement form, is a crucial document for commercial motor carriers operating in multiple jurisdictions. This form is used to report fuel use and calculate the tax owed to various states and provinces based on the miles traveled and fuel consumed. The IFTA 105 provides a standardized method for tracking fuel tax obligations, simplifying the process for carriers that operate across state lines. It is essential for maintaining compliance with fuel tax regulations and ensuring that all jurisdictions receive their fair share of fuel tax revenue.

How to use the Ifta 105

Using the IFTA 105 form involves several steps to ensure accurate reporting of fuel consumption and mileage. Carriers must gather data on the total miles traveled in each jurisdiction and the amount of fuel purchased. This information is then entered into the appropriate sections of the IFTA 105. Accurate record-keeping is vital, as discrepancies can lead to penalties. Once completed, the form can be submitted to the appropriate state tax authority, ensuring compliance with IFTA regulations.

Steps to complete the Ifta 105

Completing the IFTA 105 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary data, including total miles traveled and fuel purchases for each jurisdiction.

- Fill in the required fields on the IFTA 105, ensuring all information is accurate.

- Calculate the total tax owed based on the fuel consumption and mileage data.

- Review the form for any errors or omissions before submission.

- Submit the completed IFTA 105 to the appropriate state authority by the filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 105 are typically quarterly. Carriers must submit their forms by the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the form is due by April 30. It is crucial for carriers to be aware of these deadlines to avoid penalties and ensure compliance with tax obligations.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties. Common consequences include fines, interest on unpaid taxes, and potential audits by state tax authorities. Carriers may also face suspension of their IFTA license if they repeatedly fail to file or pay taxes owed. It is essential for carriers to stay informed about their obligations and file the IFTA 105 accurately and on time to avoid these repercussions.

Form Submission Methods (Online / Mail / In-Person)

The IFTA 105 form can be submitted through various methods, depending on the state regulations. Many jurisdictions offer online submission options, allowing for quick and efficient filing. Alternatively, carriers can mail the completed form to their state tax authority or submit it in person at designated offices. Each method has its own processing times, so it is advisable to choose the one that best fits the carrier's needs and ensures timely compliance.

Key elements of the Ifta 105

The IFTA 105 form includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Carrier information, including name and address.

- Details of the jurisdictions traveled and fuel purchased.

- Mileage records for each jurisdiction.

- Total fuel consumed and tax calculations.

Each section must be filled out accurately to ensure compliance and avoid penalties.

Quick guide on how to complete ifta 105

Complete Ifta 105 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the features you require to design, modify, and electronically sign your documents promptly without holdups. Handle Ifta 105 across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign Ifta 105 with ease

- Obtain Ifta 105 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Ifta 105 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta 105

Create this form in 5 minutes!

How to create an eSignature for the ifta 105

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IFTA 105 form and its purpose?

The IFTA 105 form is crucial for trucking and transportation companies as it is used for reporting fuel usage across state lines and ensuring compliance with the International Fuel Tax Agreement. Utilizing airSlate SignNow allows you to easily eSign and manage your IFTA 105 documents, streamlining the filing process and reducing errors.

-

How can airSlate SignNow help with IFTA 105 submissions?

AirSlate SignNow simplifies the IFTA 105 submission process by providing an easy-to-use platform for eSigning and managing your forms. You can collect signatures quickly, track document status, and ensure timely submissions, thus enhancing the efficiency of your tax compliance procedures.

-

Is there a cost associated with using airSlate SignNow for IFTA 105?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of different businesses. You can choose a plan that fits your budget and requirements, ensuring affordable access to features that support the completion and eSigning of your IFTA 105 forms.

-

Are there integrations available for IFTA 105 with airSlate SignNow?

AirSlate SignNow provides seamless integrations with various accounting and transportation management systems, which can help automate data entry for your IFTA 105 submissions. Integrating with tools like QuickBooks or TruckingOffice enhances your workflow efficiency and accuracy when managing fuel tax reporting.

-

What features does airSlate SignNow offer for handling IFTA 105 forms?

AirSlate SignNow includes features such as customizable templates, audit trails, and secure cloud storage, specifically designed to facilitate the management of IFTA 105 forms. These features ensure that you can easily access, track, and eSign your documents securely and efficiently.

-

Can I store IFTA 105 documents securely using airSlate SignNow?

Absolutely! AirSlate SignNow offers secure cloud storage for all your IFTA 105 documents, ensuring that they are protected and easily accessible. With built-in encryption and compliance with regulatory standards, you can rest assured that your sensitive information remains confidential.

-

How does using airSlate SignNow save time when dealing with IFTA 105 documents?

Using airSlate SignNow for IFTA 105 documents signNowly reduces the time spent on manual paperwork. The eSigning process is instant, and features like reminders and automated workflows keep you on track with submissions, allowing you to focus more on your core business operations.

Get more for Ifta 105

Find out other Ifta 105

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors