Form it 370 Application for Automatic Six Month Extension of 2020

What is the Form IT 370 Application For Automatic Six Month Extension Of

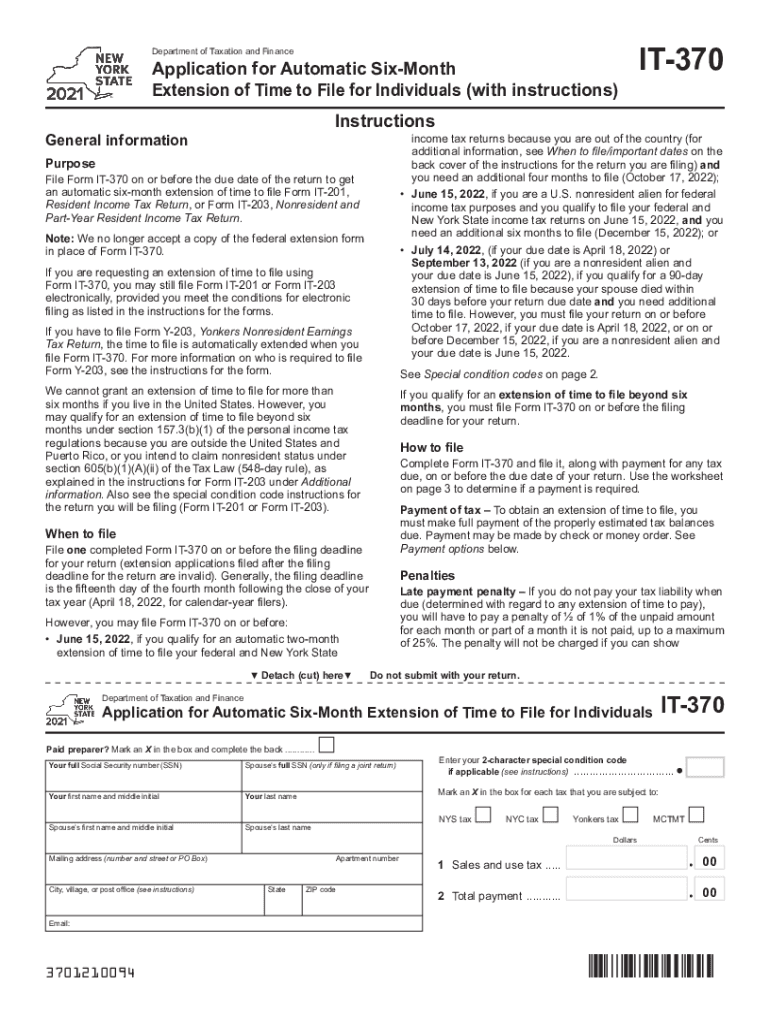

The Form IT 370 Application For Automatic Six Month Extension Of is a tax form used by individuals and businesses in the United States to request an automatic six-month extension for filing their New York State personal income tax returns. This form is particularly useful for taxpayers who may need additional time to gather necessary documentation or complete their tax returns accurately. By submitting this application, taxpayers can avoid late filing penalties while ensuring compliance with state tax regulations.

Steps to Complete the Form IT 370 Application For Automatic Six Month Extension Of

Completing the Form IT 370 involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect your personal details, including your name, address, and Social Security number, as well as any relevant financial information from your tax documents.

- Fill out the form: Enter the required information into the form, ensuring that all fields are completed accurately.

- Review the form: Double-check all entries for accuracy, as mistakes can lead to processing delays or penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the tax deadline.

Legal Use of the Form IT 370 Application For Automatic Six Month Extension Of

The Form IT 370 is legally recognized under New York State tax law, allowing taxpayers to extend their filing deadline without incurring penalties for late submission. To ensure the form's legal validity, it must be completed accurately and submitted on time. Compliance with all state tax regulations is essential, as failure to do so can result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form IT 370 is crucial for taxpayers. Typically, the application must be submitted by the original due date of the tax return, which is usually April fifteenth for most individuals. Failure to submit the form by this date may result in penalties or a denial of the extension request. It is advisable to stay informed about any changes to tax deadlines that may occur annually.

Required Documents

When completing the Form IT 370, taxpayers should have certain documents on hand to facilitate the process. These may include:

- Your most recent tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

Having these documents ready will help ensure that the information entered on the form is accurate and complete.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 370 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers prefer to submit the form electronically through the New York State Department of Taxation and Finance website.

- By Mail: You can print the completed form and send it to the appropriate address as specified by the state tax authority.

- In-Person: Some may choose to deliver the form directly to their local tax office for immediate processing.

Each submission method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete form it 370 application for automatic six month extension of

Complete Form IT 370 Application For Automatic Six Month Extension Of effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without hold-ups. Manage Form IT 370 Application For Automatic Six Month Extension Of on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Form IT 370 Application For Automatic Six Month Extension Of without any hassle

- Locate Form IT 370 Application For Automatic Six Month Extension Of and click Get Form to initiate.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to keep your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 370 Application For Automatic Six Month Extension Of and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 370 application for automatic six month extension of

Create this form in 5 minutes!

People also ask

-

What is the Form IT 370 Application For Automatic Six Month Extension Of?

The Form IT 370 Application For Automatic Six Month Extension Of is a form used by individuals and businesses to request an extension on their New York state income tax filing. With our platform, you can easily prepare and submit this form online, ensuring compliance and reducing potential penalties.

-

How can airSlate SignNow help me with the Form IT 370 Application For Automatic Six Month Extension Of?

airSlate SignNow offers a streamlined solution for completing the Form IT 370 Application For Automatic Six Month Extension Of. Our user-friendly interface allows you to fill out, sign, and send the form quickly, eliminating tedious paperwork and enhancing your filing experience.

-

What are the costs associated with using airSlate SignNow for filing the Form IT 370 Application For Automatic Six Month Extension Of?

The pricing for airSlate SignNow is competitive and cost-effective, offering various plans tailored to meet your needs. You can choose from monthly or annual subscriptions, ensuring you pay only for what you need when filing the Form IT 370 Application For Automatic Six Month Extension Of.

-

What features does airSlate SignNow offer that can assist with the Form IT 370 Application For Automatic Six Month Extension Of?

Our platform includes a variety of features such as customizable templates, secure eSignature capabilities, and real-time document tracking. These tools make the process of completing the Form IT 370 Application For Automatic Six Month Extension Of straightforward and efficient.

-

Are there any integrations available with airSlate SignNow for the Form IT 370 Application For Automatic Six Month Extension Of?

Yes, airSlate SignNow integrates seamlessly with popular software solutions such as Google Drive, Dropbox, and Slack. This functionality allows you to retrieve documents easily and efficiently while preparing the Form IT 370 Application For Automatic Six Month Extension Of.

-

How secure is my information when using airSlate SignNow for the Form IT 370 Application For Automatic Six Month Extension Of?

Security is a top priority at airSlate SignNow. Our platform utilizes encryption and secured storage to protect your sensitive data when filling out the Form IT 370 Application For Automatic Six Month Extension Of.

-

Can I access airSlate SignNow from any device when filing the Form IT 370 Application For Automatic Six Month Extension Of?

Absolutely! airSlate SignNow is designed to be accessible from various devices including desktops, tablets, and smartphones. This flexibility allows you to complete the Form IT 370 Application For Automatic Six Month Extension Of anytime and anywhere.

Get more for Form IT 370 Application For Automatic Six Month Extension Of

- Warranty deed from limited partnership or llc is the grantor or grantee idaho form

- Special warranty deed idaho form

- Idaho ucc3 financing statement amendment addendum idaho form

- Legal last will and testament form for single person with no children idaho

- Legal last will and testament form for a single person with minor children idaho

- Legal last will and testament form for single person with adult and minor children idaho

- Legal last will and testament form for single person with adult children idaho

- Legal last will and testament for married person with minor children from prior marriage idaho form

Find out other Form IT 370 Application For Automatic Six Month Extension Of

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast