Form W 3 PDF Attention You May File Forms W 2 and W 3 Electronically 2022

Understanding Guam Tax Forms

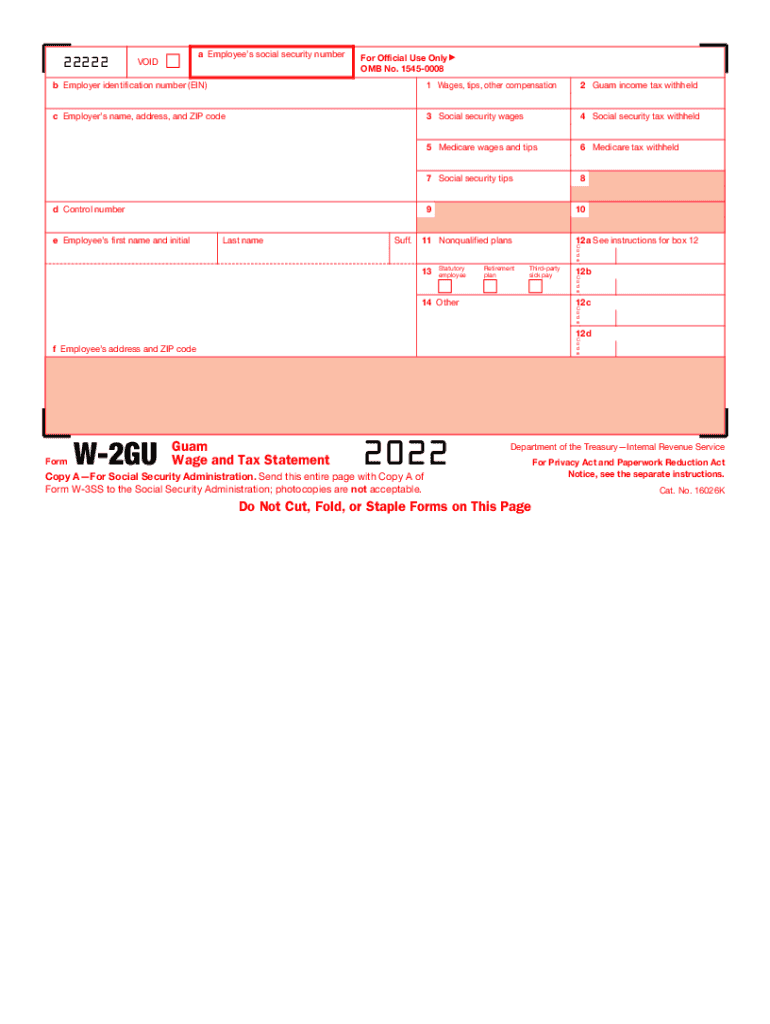

Guam tax forms are essential for residents and businesses to report income and calculate taxes owed. The primary form used for individual income tax is the Guam Individual Income Tax Return, while businesses may need to file various forms depending on their structure and activities. It is crucial to understand the specific forms required, such as the Form 5074 for individuals, which is used to claim a credit for taxes paid to another jurisdiction.

Steps to Complete Guam Tax Forms

Completing Guam tax forms involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms for employees, 1099s for independent contractors, and any relevant financial statements. Next, accurately fill out the tax forms, ensuring all income, deductions, and credits are reported. Review the completed forms for any errors before submitting them to the Guam Department of Revenue and Taxation.

Filing Methods for Guam Tax Forms

Guam tax forms can be submitted in various ways, providing flexibility for taxpayers. Individuals can file their forms electronically through the Guam Department of Revenue and Taxation's online portal, which streamlines the process and reduces processing times. Alternatively, forms can be mailed to the appropriate department or submitted in person at designated offices. It is important to choose the method that best suits your needs and to keep copies of submitted forms for your records.

Important Deadlines for Guam Tax Filing

Timely filing of Guam tax forms is essential to avoid penalties. The typical deadline for individual income tax returns is April 15, aligning with federal deadlines. However, extensions may be available if requested. Businesses should be aware of specific deadlines related to their tax obligations, including estimated tax payments and annual filings. Staying informed about these dates helps ensure compliance and avoids unnecessary fines.

Legal Use of Guam Tax Forms

Guam tax forms must be completed accurately and submitted according to the law to be considered legally binding. This includes adhering to Guam's tax regulations and ensuring that all information provided is truthful and complete. Failure to comply can result in penalties, interest, and potential legal action. Using a reliable platform for electronic filing can enhance the security and legality of your submissions.

Common Exemptions and Deductions in Guam Tax

Understanding available exemptions and deductions can significantly affect your tax liability in Guam. For instance, residents may qualify for Guam Gross Receipts Tax (GRT) exemptions based on specific criteria, such as the type of business or certain activities. Additionally, taxpayers can deduct eligible expenses that directly relate to their income-generating activities. Familiarizing yourself with these options can lead to substantial savings.

Quick guide on how to complete form w 3pdf attention you may file forms w 2 and w 3 electronically

Complete Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically seamlessly on any device

Digital document management has gained increased traction among enterprises and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without complications. Manage Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically effortlessly

- Locate Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically and click Get Form to begin.

- Make use of the tools at your disposal to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to preserve your updates.

- Select your preferred way to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically to guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 3pdf attention you may file forms w 2 and w 3 electronically

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to guam tax?

airSlate SignNow is an electronic signature platform that simplifies document management. For businesses operating under guam tax regulations, using SignNow can streamline the process of signing and storing important tax-related documents efficiently and securely.

-

How can airSlate SignNow help businesses with guam tax compliance?

By using airSlate SignNow, businesses can ensure that all necessary documents are properly signed and documented for guam tax compliance. This service helps maintain clear records of transactions, making it easier to file taxes accurately and on time.

-

What pricing plans does airSlate SignNow offer for managing guam tax documents?

airSlate SignNow offers a variety of pricing plans that cater to the needs of different businesses. The cost-effective solutions provided can signNowly reduce the overhead associated with managing guam tax documentation while enhancing productivity.

-

Can airSlate SignNow integrate with accounting software for guam tax purposes?

Yes, airSlate SignNow provides seamless integrations with various accounting software, making it easier to manage guam tax documentation. These integrations help keep your financial records synchronized and organized, facilitating a smoother tax filing process.

-

What features does airSlate SignNow offer that are beneficial for guam tax filing?

airSlate SignNow includes features like customizable templates, advanced security protocols, and automated workflows, all of which are beneficial for guam tax filing. These features simplify document preparation and enhance security measures for sensitive tax information.

-

How does airSlate SignNow ensure security for documents related to guam tax?

airSlate SignNow prioritizes document security through encryption and secure storage options. This ensures that all documents pertaining to guam tax are protected from unauthorized access, giving businesses peace of mind while managing sensitive information.

-

Is airSlate SignNow user-friendly for those dealing with guam tax regulations?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with technology. Users can easily navigate the platform to manage their guam tax documents without extensive training.

Get more for Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically

- Bill of sale in connection with sale of business by individual or corporate seller nevada form

- Civil cover sheet 497320755 form

- Office lease agreement nevada form

- Nevada petition divorce form

- Nv witness form

- Commercial sublease nevada form

- Residential lease renewal agreement nevada form

- Nv case file form

Find out other Form W 3 pdf Attention You May File Forms W 2 And W 3 Electronically

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors