Form W 2GU Guam Wage and Tax Statement 2021

What is the Form W-2GU Guam Wage and Tax Statement

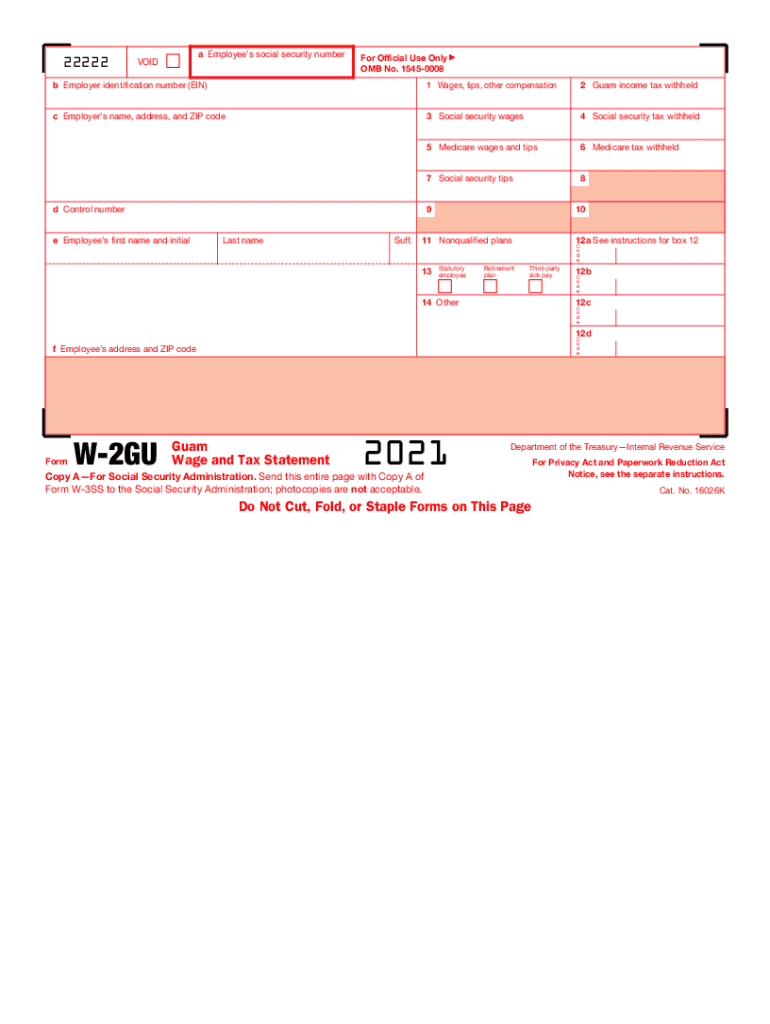

The Form W-2GU is a crucial document used in Guam for reporting wages and taxes withheld from employees. This form serves a similar purpose to the standard W-2 used in the mainland United States but is specifically tailored to comply with Guam's tax regulations. Employers are required to issue this form to their employees by January thirty-first of each year, summarizing the total earnings and tax withholdings for the previous calendar year. Understanding this form is essential for both employers and employees to ensure accurate tax filings.

Steps to Complete the Form W-2GU Guam Wage and Tax Statement

Completing the Form W-2GU involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the employee's Social Security number, total wages, and applicable tax withholdings. Next, accurately fill out each section of the form, ensuring that all figures are correct. Pay particular attention to the boxes designated for local and federal tax withholdings, as these differ from standard reporting. Once completed, the form should be distributed to employees and submitted to the appropriate tax authorities.

Legal Use of the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU holds legal significance in Guam as it provides a formal record of an employee's earnings and the taxes withheld. This document is essential for tax compliance and serves as proof of income when filing tax returns. Both employers and employees must ensure that the information provided is accurate to avoid potential legal issues, such as penalties for incorrect reporting. Compliance with local tax laws is crucial for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Timely filing of the Form W-2GU is critical to avoid penalties. Employers must provide the completed forms to employees by January thirty-first each year. Additionally, the forms must be submitted to the Guam Department of Revenue and Taxation by the same date. It is important to be aware of these deadlines to ensure compliance and avoid any late filing penalties that may arise from missed deadlines.

Who Issues the Form W-2GU

The Form W-2GU is issued by employers in Guam who are required to report wages paid to employees. This includes various types of employers, such as private businesses, government agencies, and non-profit organizations. Each employer must ensure that they accurately complete and distribute this form to all eligible employees to meet their tax reporting obligations.

Required Documents

To complete the Form W-2GU, certain documents and information are necessary. Employers should gather the following: employee Social Security numbers, total wages paid, and amounts withheld for local and federal taxes. Additionally, any relevant payroll records should be reviewed to ensure accurate reporting. Having these documents on hand will streamline the completion process and help maintain compliance with tax regulations.

Penalties for Non-Compliance

Failure to properly complete and file the Form W-2GU can result in significant penalties for employers. These may include fines for late submissions, inaccuracies, or failure to provide forms to employees. It is essential for employers to understand these penalties and take the necessary steps to ensure compliance with Guam's tax laws to avoid financial repercussions.

Quick guide on how to complete 2021 form w 2gu guam wage and tax statement

Easily Prepare Form W 2GU Guam Wage And Tax Statement on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents quickly without delays. Manage Form W 2GU Guam Wage And Tax Statement on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Form W 2GU Guam Wage And Tax Statement effortlessly

- Obtain Form W 2GU Guam Wage And Tax Statement and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal standing as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form W 2GU Guam Wage And Tax Statement to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form w 2gu guam wage and tax statement

Create this form in 5 minutes!

How to create an eSignature for the 2021 form w 2gu guam wage and tax statement

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an e-signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is my guam tax, and how can airSlate SignNow help?

My guam tax refers to the taxes applicable to residents and businesses in Guam. AirSlate SignNow can assist by streamlining the document management process involved in tax preparation, making eSigning forms easier and faster.

-

How does airSlate SignNow ensure the security of my guam tax documents?

AirSlate SignNow prioritizes the security of your documents, including those related to my guam tax. We implement advanced encryption protocols and ensure compliance with industry standards to keep your sensitive information protected.

-

What are the pricing options for using airSlate SignNow for my guam tax needs?

AirSlate SignNow provides various pricing plans tailored to suit your business size and requirements. Each plan is designed to deliver excellent value, ensuring you can efficiently handle your my guam tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with my existing systems for managing my guam tax?

Yes, airSlate SignNow offers seamless integration with various platforms, making it easy to incorporate into your current systems. This allows you to manage your my guam tax processes without any disruptions in your workflow.

-

What features does airSlate SignNow offer for handling my guam tax documents?

AirSlate SignNow includes features such as customizable templates, automated reminders, and audit trails that are particularly useful for managing my guam tax documents. These tools simplify the process and ensure that you stay compliant and organized.

-

How quickly can I get started with airSlate SignNow for my guam tax documentation?

Getting started with airSlate SignNow is quick and user-friendly. You can sign up and start eSigning your my guam tax documents within minutes, allowing you to focus on your business rather than paperwork.

-

What benefits does airSlate SignNow provide for small businesses dealing with my guam tax?

Small businesses can greatly benefit from airSlate SignNow when dealing with my guam tax by reducing the time spent on paperwork and increasing efficiency. Our platform helps in minimizing errors and ensuring that documentation is completed accurately and promptly.

Get more for Form W 2GU Guam Wage And Tax Statement

- Form notice tenant

- Transfer uniform minors act florida

- Discovery interrogatories from defendant to plaintiff with production requests florida form

- Florida interrogatories divorce form

- Quitclaim deed three individuals to one individual florida form

- Special warranty deed individual to trust florida form

- Quitclaim deed five individuals to husband and wife florida form

- Fl deed form

Find out other Form W 2GU Guam Wage And Tax Statement

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself