Form W 2GU Guam Wage and Tax Statement 2024-2026

Understanding the Form W-2GU Guam Wage and Tax Statement

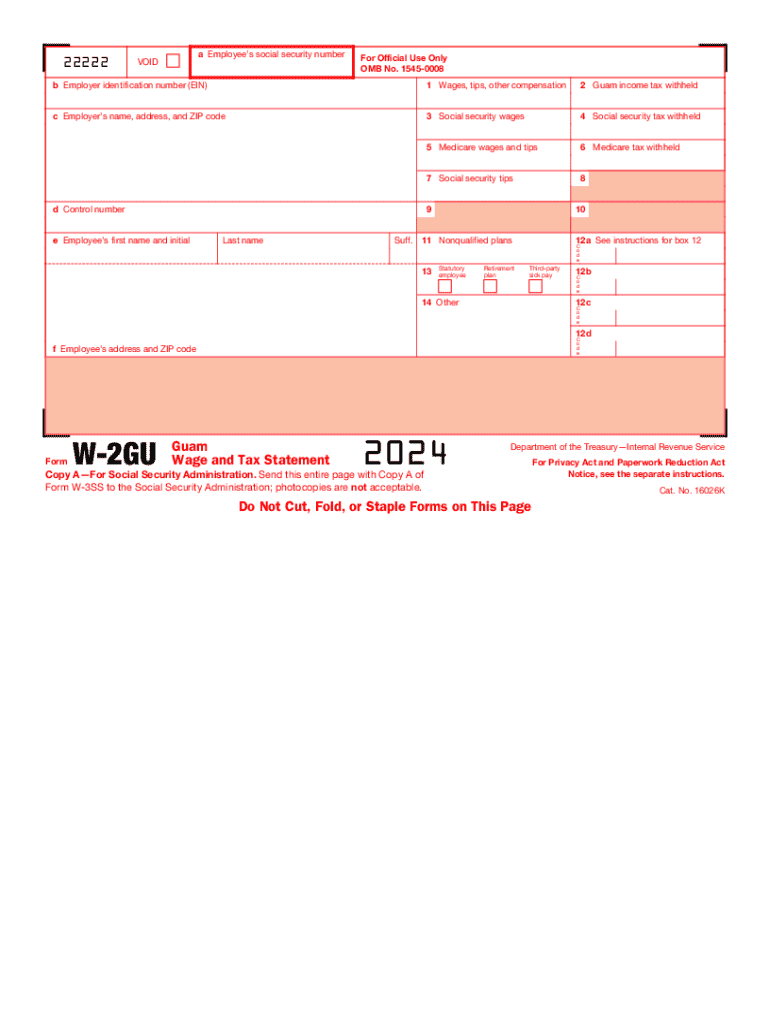

The Form W-2GU is a crucial document for employees in Guam, serving as the Guam Wage and Tax Statement. This form provides essential information regarding wages earned and taxes withheld during the tax year. It is similar to the standard W-2 form used in the mainland United States but is specifically tailored to comply with Guam's tax regulations. Employers are required to issue this form to their employees by the end of January each year, ensuring that individuals have the necessary documentation to file their income tax returns accurately.

Steps to Complete the Form W-2GU Guam Wage and Tax Statement

Completing the Form W-2GU involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including employee details, wages, and tax withholdings. Next, fill out the employee's name, address, and Social Security number in the designated fields. Report the total wages paid in box one and the total federal income tax withheld in box two. Additionally, include any Guam income tax withheld in the appropriate box. Finally, review the completed form for accuracy before submitting it to the employee and the Guam Department of Revenue and Taxation.

How to Obtain the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU can be obtained from the Guam Department of Revenue and Taxation’s website or directly from employers who are required to provide it. Employers can also access the form through various tax software programs that support Guam tax forms. It is important for employees to ensure they receive this form by the end of January each year, as it is essential for filing their income tax returns accurately.

Key Elements of the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU contains several key elements that are essential for accurate tax reporting. These include the employee's personal information, total wages earned, federal and Guam income tax withheld, and contributions to Social Security and Medicare. Each box on the form is clearly labeled, providing a straightforward way to report earnings and tax withholdings. Understanding these elements is crucial for both employers and employees to ensure compliance with Guam tax laws.

Filing Deadlines and Important Dates for the Form W-2GU

Filing deadlines for the Form W-2GU are critical for compliance. Employers must provide the completed form to employees by January thirty-first of each year. Additionally, employers are required to submit copies of the form to the Guam Department of Revenue and Taxation by the same date. Failure to meet these deadlines can result in penalties, making it essential for employers to stay organized and adhere to the timeline.

Legal Use of the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU is legally required for all employers in Guam who pay wages to employees. This form must be used to report wages and tax withholdings accurately, ensuring compliance with local tax laws. Employers are responsible for issuing this form to their employees and must retain copies for their records. Legal use of the form is crucial for both employers and employees to avoid potential penalties and ensure proper tax reporting.

Form Submission Methods for the W-2GU

The Form W-2GU can be submitted through various methods to meet compliance requirements. Employers can provide the form to employees in paper format or electronically, depending on the employee's preference. For submission to the Guam Department of Revenue and Taxation, employers may need to file electronically or via mail, depending on the number of forms being submitted. Understanding these submission methods is vital for ensuring that all forms are filed accurately and on time.

Quick guide on how to complete form w 2gu guam wage and tax statement 706109088

Complete Form W 2GU Guam Wage And Tax Statement smoothly on any device

Managing documents online has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Form W 2GU Guam Wage And Tax Statement on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign Form W 2GU Guam Wage And Tax Statement effortlessly

- Locate Form W 2GU Guam Wage And Tax Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs within a few clicks from a device of your choice. Modify and eSign Form W 2GU Guam Wage And Tax Statement and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 2gu guam wage and tax statement 706109088

Create this form in 5 minutes!

How to create an eSignature for the form w 2gu guam wage and tax statement 706109088

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Guam tax and how does it affect my business?

Guam tax refers to the local taxation rules that businesses must adhere to when operating in Guam. Understanding Guam tax regulations is crucial as they can impact your overall financial operations and compliance. Using airSlate SignNow can help streamline document eSigning and ensure that your tax documentation is in order according to Guam tax laws.

-

How can airSlate SignNow assist me with Guam tax documentation?

AirSlate SignNow provides a seamless platform for creating, sending, and eSigning documents crucial for Guam tax compliance. It helps businesses manage tax forms and submissions securely and efficiently. By utilizing airSlate SignNow, you can maintain an organized workflow and ensure timely filing related to Guam tax obligations.

-

What pricing options are available for airSlate SignNow?

AirSlate SignNow offers various pricing plans to cater to businesses of all sizes, tailored to your specific needs related to document signing and management. Each plan includes features that can simplify the process of handling Guam tax documents and integrations with other software. You can choose a plan that aligns with your budget and operational requirements.

-

Are there any integrations available for managing Guam tax documents?

Yes, airSlate SignNow supports integrations with a range of applications that facilitate the management of Guam tax documents. These integrations allow for a smoother workflow and data transfer between platforms essential for tax purposes. By leveraging these tools, users can enhance their productivity and ensure proper compliance with Guam tax regulations.

-

What features does airSlate SignNow offer that help with Guam tax compliance?

AirSlate SignNow provides features such as custom templates, audit trails, and secure cloud storage that are critical for managing Guam tax compliance. These tools enable users to tailor their documentation process, track changes, and access documents anytime, ensuring adherence to Guam tax laws. The platform simplifies the complexities associated with tax documentation.

-

Can airSlate SignNow help reduce the time spent on Guam tax submissions?

Absolutely! AirSlate SignNow's efficient eSigning and document management capabilities signNowly reduce the time allocated to Guam tax submissions. With automated workflows, templates, and a user-friendly interface, businesses can streamline their processes and focus more on growth rather than paperwork. This ultimately enhances operational efficiency related to Guam tax management.

-

What benefits does eSigning with airSlate SignNow offer for Guam tax documents?

eSigning with airSlate SignNow is beneficial for handling Guam tax documents as it ensures speed, security, and compliance. It allows for instant execution of tax forms, reducing delays typically encountered with manual signatures. Furthermore, the secure storage of signed documents helps maintain compliance with Guam tax regulations.

Get more for Form W 2GU Guam Wage And Tax Statement

- Control number sc p013 pkg form

- Control number sc p017 pkg form

- Control number sc p019 pkg form

- Control number sc p022 pkg form

- North carolina declaration of a desire for a natural death form

- Fillable online west virginia revocation of anatomical gift form

- Control number sc p027 pkg form

- Keep the interview legal hiring with monster form

Find out other Form W 2GU Guam Wage And Tax Statement

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT