Form W 2GU Guam Wage and Tax Statement 2014

What is the Form W-2GU Guam Wage And Tax Statement

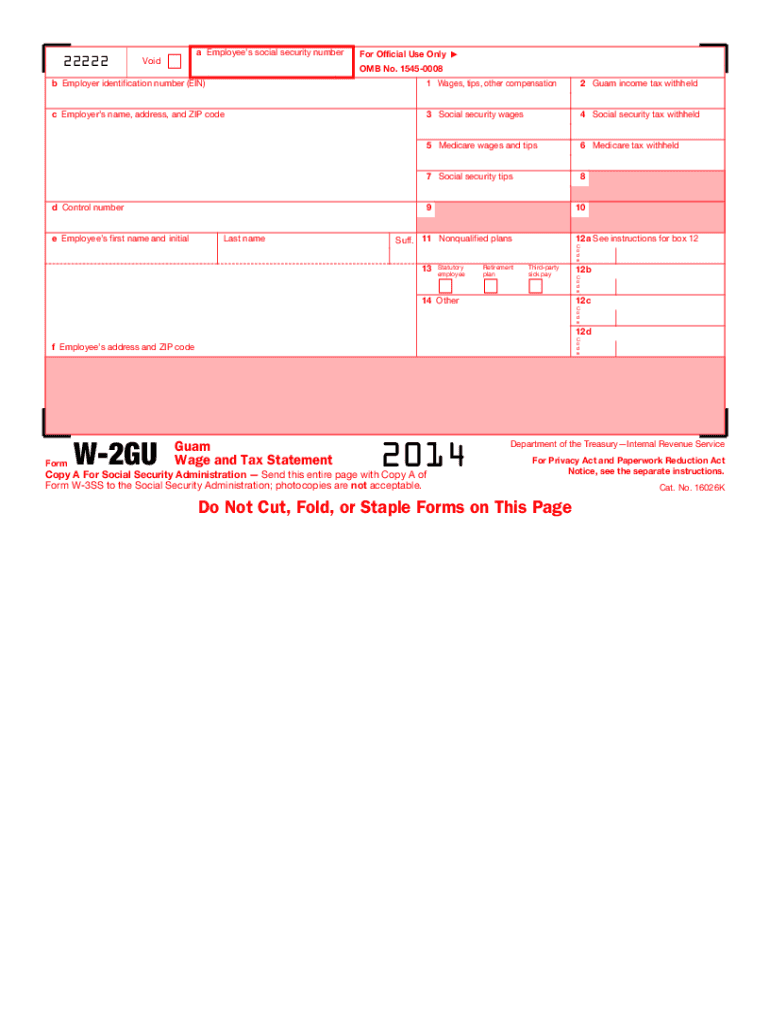

The Form W-2GU Guam Wage and Tax Statement is a tax document used by employers in Guam to report wages paid to employees and the taxes withheld from those wages. This form is essential for employees to accurately report their income when filing federal and Guam tax returns. It includes critical information such as the employee's total earnings, Social Security wages, and the amounts withheld for federal income tax, Social Security, and Medicare. Understanding this form is vital for compliance with tax regulations in Guam.

How to use the Form W-2GU Guam Wage And Tax Statement

To use the Form W-2GU effectively, employees should first ensure they receive this form from their employer at the end of the tax year. Once received, review the information for accuracy, including your personal details and wage amounts. This form should be used when preparing your tax returns, as it provides the necessary data for reporting income and calculating tax obligations. If any discrepancies are found, it is crucial to contact your employer for corrections before filing your taxes.

Steps to complete the Form W-2GU Guam Wage And Tax Statement

Completing the Form W-2GU involves several steps:

- Gather all necessary personal information, including your Social Security number and address.

- Review your employer's records to ensure all wages and tax withholdings are accurately reported.

- Fill in your total earnings, Social Security wages, and any other relevant financial data as indicated on the form.

- Double-check all entries for accuracy before submission.

- Submit the form to the appropriate tax authorities as part of your annual tax filing process.

Key elements of the Form W-2GU Guam Wage And Tax Statement

The Form W-2GU contains several key elements that are essential for both employers and employees:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and Employer Identification Number (EIN).

- Wage Information: Total wages paid, Social Security wages, and Medicare wages.

- Tax Withholdings: Amounts withheld for federal income tax, Social Security, and Medicare.

- State-Specific Information: Any relevant Guam tax information that may apply.

Filing Deadlines / Important Dates

When dealing with the Form W-2GU, it is important to be aware of key filing deadlines. Employers must provide this form to employees by January thirty-first of the following year. Employees should ensure they have received their form in a timely manner to prepare their tax returns accurately. The tax filing deadline for individuals typically falls on April fifteenth, unless extended due to weekends or holidays. Keeping track of these dates helps ensure compliance and avoids penalties.

Who Issues the Form

The Form W-2GU is issued by employers in Guam who are required to report wages and tax information for their employees. This includes both private sector employers and government agencies. Employers must ensure that the form is completed accurately and distributed to employees by the required deadlines. It is the responsibility of the employee to ensure they receive this form and verify its accuracy for tax filing purposes.

Quick guide on how to complete 2014 form w 2gu guam wage and tax statement

Complete Form W 2GU Guam Wage And Tax Statement effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with everything necessary to generate, modify, and eSign your documents quickly without delays. Manage Form W 2GU Guam Wage And Tax Statement across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form W 2GU Guam Wage And Tax Statement with ease

- Locate Form W 2GU Guam Wage And Tax Statement and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choice. Revise and eSign Form W 2GU Guam Wage And Tax Statement and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form w 2gu guam wage and tax statement

Create this form in 5 minutes!

How to create an eSignature for the 2014 form w 2gu guam wage and tax statement

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Form W 2GU Guam Wage And Tax Statement?

The Form W 2GU Guam Wage And Tax Statement is a document used to report wages paid and taxes withheld for employees working in Guam. It serves to provide necessary tax information to both employees and the Guam Department of Revenue and Taxation, ensuring compliance with local regulations.

-

How does airSlate SignNow simplify the eSigning process for the Form W 2GU Guam Wage And Tax Statement?

airSlate SignNow simplifies the eSigning process by allowing users to easily upload, send, and sign the Form W 2GU Guam Wage And Tax Statement from any device. Its user-friendly interface ensures that both employers and employees can efficiently complete their documents without any hassle.

-

Is there a cost associated with using airSlate SignNow for the Form W 2GU Guam Wage And Tax Statement?

Yes, airSlate SignNow offers competitive pricing plans designed to fit a range of business needs. Users can select a plan that accommodates their requirements, ensuring that they can manage the Form W 2GU Guam Wage And Tax Statement without breaking the bank.

-

What features does airSlate SignNow offer for managing the Form W 2GU Guam Wage And Tax Statement?

airSlate SignNow offers several features for managing the Form W 2GU Guam Wage And Tax Statement, including templates for quick access, automated workflows, and real-time tracking of document status. These features help users efficiently handle their tax documentation needs.

-

Can I integrate airSlate SignNow with other applications for handling the Form W 2GU Guam Wage And Tax Statement?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting and HR software, to streamline the process of managing the Form W 2GU Guam Wage And Tax Statement. This integration enhances workflow efficiency and reduces the risk of manual errors.

-

What are the benefits of using airSlate SignNow for the Form W 2GU Guam Wage And Tax Statement?

Using airSlate SignNow for the Form W 2GU Guam Wage And Tax Statement offers numerous benefits, including improved accuracy, faster processing times, and enhanced compliance. Businesses can ensure that their employees receive their tax documents accurately and promptly.

-

How can I ensure my Form W 2GU Guam Wage And Tax Statement is compliant?

airSlate SignNow helps ensure your Form W 2GU Guam Wage And Tax Statement is compliant by providing templates that are regularly updated according to Guam's tax regulations. Additionally, the platform's built-in eSigning features and audit trails add an extra layer of compliance.

Get more for Form W 2GU Guam Wage And Tax Statement

- Georgia unearned application form

- Ga tenant form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497303724 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497303725 form

- Georgia landlord in form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497303727 form

- Letter tenant form 497303728

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497303729 form

Find out other Form W 2GU Guam Wage And Tax Statement

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document