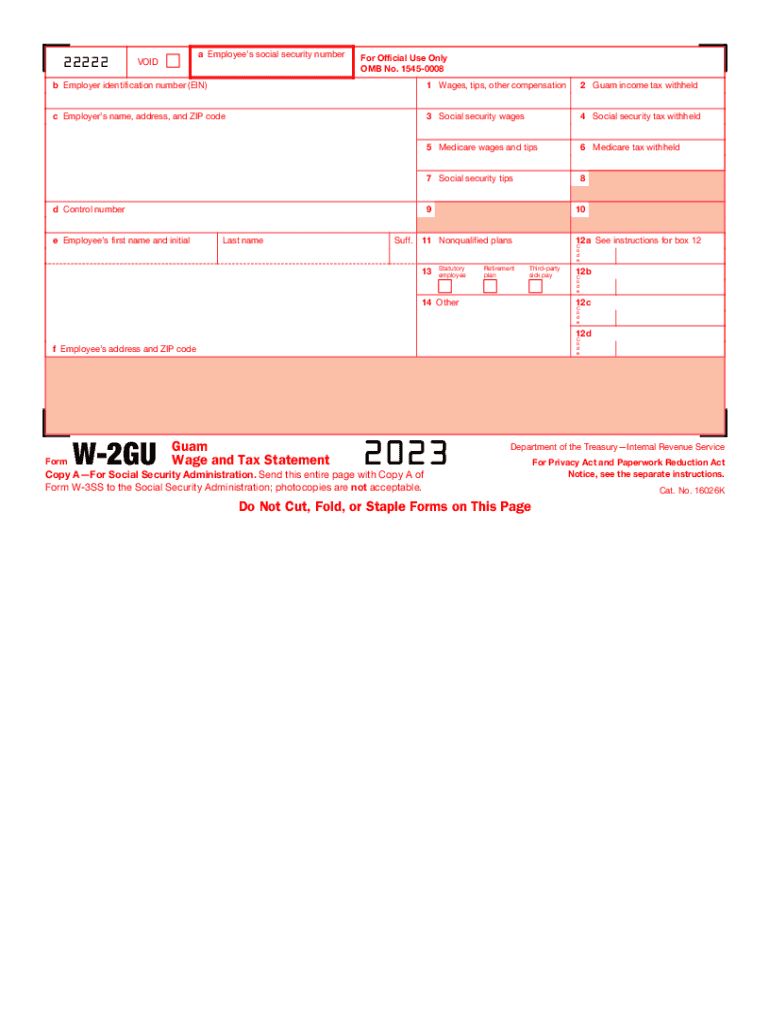

Form W 2GU Guam Wage and Tax Statement 2023

What is the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU is a specific wage and tax statement used in Guam, similar to the standard W-2 form used on the mainland United States. It reports the wages paid to employees and the taxes withheld during the year. This form is essential for employees to accurately file their income tax returns in Guam. It includes information such as the employee's total earnings, Social Security wages, Medicare wages, and any applicable Guam tax withheld. Understanding this form is crucial for compliance with local tax regulations.

How to Use the Form W-2GU Guam Wage and Tax Statement

To effectively use the Form W-2GU, employees should first ensure that they receive this document from their employer by the end of January each year. The form provides critical information needed to complete individual tax returns. Employees should carefully review the details for accuracy, including their name, Social Security number, and reported wages. If discrepancies are found, it is important to contact the employer for corrections. The completed form is then used to report income on the Guam tax return, ensuring proper tax calculation and compliance.

Steps to Complete the Form W-2GU Guam Wage and Tax Statement

Completing the Form W-2GU involves several key steps:

- Gather necessary information, including personal identification and earnings records.

- Fill out the employee's details, including name, address, and Social Security number.

- Report total earnings in the appropriate boxes, including wages, tips, and other compensation.

- Indicate the total amount of Guam income tax withheld.

- Review the form for accuracy before submission.

Once completed, the form should be provided to the employee and filed with the appropriate tax authorities.

Key Elements of the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU contains several key elements that are vital for both employees and employers. These include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Wage Information: Total wages, tips, and compensation for the year.

- Tax Withholding: Amount of Guam income tax withheld, Social Security tax, and Medicare tax.

- State-Specific Information: Any additional local tax information pertinent to Guam.

These elements ensure that both the employer and employee have a clear understanding of earnings and tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-2GU are crucial for compliance. Employers must provide this form to employees by January 31 of each year. Additionally, employers are required to submit copies of the W-2GU to the Guam Department of Revenue and Taxation by the same date. Employees should be aware of the tax filing deadline for their Guam income tax return, which typically falls on April 15. Keeping track of these dates helps avoid penalties and ensures timely tax filing.

Who Issues the Form W-2GU Guam Wage and Tax Statement

The Form W-2GU is issued by employers in Guam to their employees. Any business or organization that pays wages to employees is responsible for providing this form. This includes government agencies, private companies, and non-profit organizations. Employers must ensure that the information reported on the W-2GU is accurate and reflects the total earnings and taxes withheld for each employee. Failure to issue this form correctly can lead to compliance issues and potential penalties.

Quick guide on how to complete form w 2gu guam wage and tax statement

Complete Form W 2GU Guam Wage And Tax Statement effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the required form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form W 2GU Guam Wage And Tax Statement on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form W 2GU Guam Wage And Tax Statement with ease

- Locate Form W 2GU Guam Wage And Tax Statement and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, exhaustive form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 2GU Guam Wage And Tax Statement and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 2gu guam wage and tax statement

Create this form in 5 minutes!

How to create an eSignature for the form w 2gu guam wage and tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing a Guam return using airSlate SignNow?

To complete a Guam return with airSlate SignNow, simply upload your tax document, eSign it, and send it securely to the appropriate authorities. Our platform simplifies the entire process, ensuring that you meet deadlines effortlessly. The user-friendly interface helps you navigate through your Guam return without any hassle.

-

Are there any specific features of airSlate SignNow that assist with Guam returns?

Yes, airSlate SignNow includes features designed to streamline Guam returns, such as customizable templates and real-time tracking. These tools allow you to manage your documents efficiently and ensure that they are completed and submitted accurately. Additionally, integration options enable smooth workflows for your Guam return process.

-

What pricing plans are available for handling Guam returns on airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different needs, including options specifically for managing Guam returns. With flexible monthly and annual subscription models, you can choose a plan that fits your budget while still accessing essential features for efficient document handling. Review our pricing page to find the best plan for your Guam return needs.

-

How can airSlate SignNow improve the efficiency of my Guam return?

Using airSlate SignNow signNowly enhances the efficiency of your Guam return by minimizing the time spent on document preparation and submission. Our platform allows you to quickly create, sign, and send documents electronically, reducing delays and improving compliance. This streamlined approach ensures a faster turnaround for your Guam return filings.

-

Can I integrate airSlate SignNow with other applications for managing Guam returns?

Absolutely! airSlate SignNow supports numerous integrations with popular applications, making it easier to manage all aspects of your Guam return. Whether you need to connect with accounting software or customer management tools, these integrations enable a seamless workflow. Explore our integration options to enhance your Guam return process.

-

What are the security measures in place for my Guam return using airSlate SignNow?

airSlate SignNow prioritizes security, utilizing encryption and secure storage to protect your Guam return documents. With features like two-factor authentication and compliance with industry standards, you can trust that your sensitive information remains safe. This commitment to security ensures peace of mind when managing your Guam return.

-

Is there a mobile app available for managing Guam returns on airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage your Guam returns on the go. With the app, you can easily upload documents, eSign them, and track their progress from your smartphone or tablet. This flexibility enhances convenience and allows you to handle your Guam return anytime, anywhere.

Get more for Form W 2GU Guam Wage And Tax Statement

Find out other Form W 2GU Guam Wage And Tax Statement

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now