Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips 2022

What is the Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips

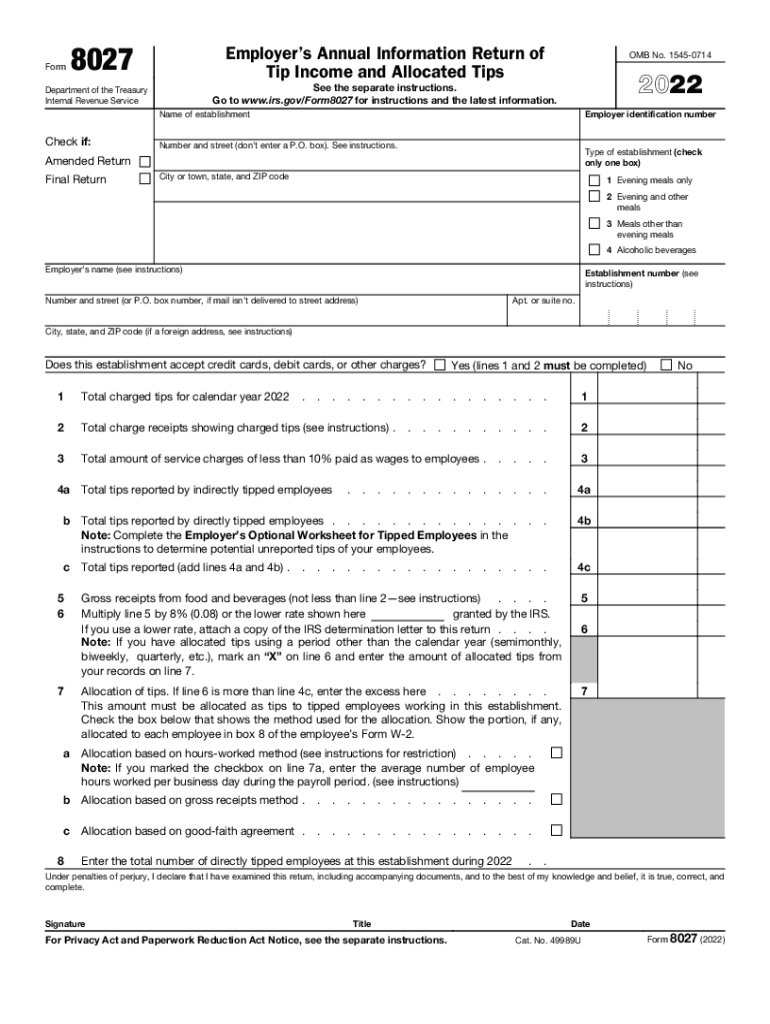

The Form 8027 is an essential document for employers in the United States who operate establishments where tipping is customary. This form serves as the Employer's Annual Information Return of Tip Income and Allocated Tips. It is primarily used to report tip income received by employees and any allocated tips that the employer distributes. Accurate completion of this form helps ensure compliance with IRS regulations regarding tip reporting and taxation.

Employers must file this form if they are required to report tips for employees who work in food and beverage establishments, as well as other service-oriented businesses. The information reported on Form 8027 is crucial for determining the tax obligations of both the employer and the employees.

Steps to Complete the Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips

Completing Form 8027 involves several key steps to ensure accuracy and compliance with IRS requirements. Here is a straightforward guide to help employers fill out the form:

- Gather necessary information: Collect data on total sales, total tips reported by employees, and allocated tips.

- Complete the identification section: Fill in the employer's name, address, and employer identification number (EIN).

- Report total sales: Enter the total sales amount for the year, including both cash and credit transactions.

- Enter reported tips: Input the total tips reported by employees during the year.

- Allocate tips: If applicable, calculate and enter the allocated tips based on the IRS guidelines.

- Review and verify: Double-check all entries for accuracy before submission.

Following these steps will help ensure that the Form 8027 is completed correctly, minimizing the risk of errors that could lead to penalties.

Legal Use of the Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips

The legal use of Form 8027 is governed by IRS regulations that mandate its submission under specific circumstances. Employers are required to file this form if they meet the criteria outlined by the IRS, which includes operating a business where tipping is common and having a certain volume of sales. Failure to file the form or inaccuracies in reporting can lead to penalties, making it crucial for employers to understand their obligations.

Additionally, the information provided on Form 8027 helps the IRS ensure that employees are accurately reporting their tip income, which is essential for tax compliance. Employers should familiarize themselves with the legal requirements surrounding this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Timely filing of Form 8027 is critical to avoid penalties. The IRS sets specific deadlines for submitting this form each year. Generally, employers must file Form 8027 by the last day of February following the end of the tax year. If filing electronically, the deadline may extend to March 31. It is important for employers to mark these dates on their calendars to ensure compliance.

Employers should also be aware of any changes to filing deadlines that may occur due to IRS updates or changes in tax law, as staying informed can help avoid last-minute complications.

Key Elements of the Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips

Understanding the key elements of Form 8027 is vital for accurate completion. The form includes several sections that require specific information:

- Employer Information: Name, address, and EIN.

- Total Sales: The total sales amount for the reporting period.

- Reported Tips: Total tips reported by employees.

- Allocated Tips: Any tips allocated by the employer based on IRS guidelines.

- Signature: The form must be signed by an authorized representative of the business.

Each section plays a crucial role in ensuring that the form is complete and compliant with IRS regulations. Employers should pay careful attention to these elements when preparing their submissions.

Examples of Using the Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips

Employers in various industries utilize Form 8027 to report tip income accurately. For instance, a restaurant owner would use this form to report tips received by waitstaff and bartenders. Similarly, a hotel manager would report tips for bellhops and concierge staff. Each example highlights the importance of accurately reporting tip income to comply with IRS regulations.

Employers should also consider scenarios where allocated tips may apply, such as when tips are distributed among employees based on hours worked or sales generated. Understanding these examples can help employers navigate the complexities of tip reporting effectively.

Quick guide on how to complete 2022 form 8027 employers annual information return of tip income and allocated tips

Effortlessly Prepare Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips Effortlessly

- Obtain Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize key portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8027 employers annual information return of tip income and allocated tips

Create this form in 5 minutes!

People also ask

-

What is the worksheet IRS in the context of airSlate SignNow?

The worksheet IRS is a critical document used for organizing and submitting important tax-related information. By utilizing airSlate SignNow, you can easily create, send, and eSign your worksheet IRS efficiently, ensuring that all necessary details are properly documented and submitted on time.

-

How does airSlate SignNow help with completing a worksheet IRS?

airSlate SignNow provides an intuitive platform that allows users to fill out their worksheet IRS digitally. You can upload templates, add fields for input, and eSign the document, making it easily accessible and editable from anywhere, which is particularly beneficial during tax season.

-

Is there a cost associated with using airSlate SignNow for a worksheet IRS?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, including the ability to manage your worksheet IRS. By choosing a suitable plan, you can take advantage of features designed to streamline document workflows and enhance productivity.

-

What are the key features of airSlate SignNow for managing the worksheet IRS?

Key features of airSlate SignNow include easy document creation, secure electronic signatures, and automatic storage of all completed worksheets IRS. These functionalities simplify the entire signing process, ensuring that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other tools when using the worksheet IRS?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, allowing you to sync your worksheet IRS with your existing software tools for an enhanced workflow. Whether it’s CRM systems, accounting software, or cloud storage, the integrations cater to your business requirements.

-

How secure is the completed worksheet IRS in airSlate SignNow?

AirSlate SignNow takes security seriously, utilizing advanced encryption and compliance standards to protect your completed worksheet IRS. You can rest assured that your sensitive tax documents are stored securely and can only be accessed by authorized users.

-

Is it easy to track changes made to the worksheet IRS in airSlate SignNow?

Yes, airSlate SignNow includes robust tracking features that allow you to monitor changes made to your worksheet IRS in real-time. You can easily see who accessed the document, what edits were made, and when, ensuring full transparency and control over your tax-related documents.

Get more for Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

- New york order protection form

- Ny order protection 497321703 form

- New york compensation 497321709 form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house new 497321710 form

- Ny annual file form

- Notices resolutions simple stock ledger and certificate new york form

- Organizational meeting 497321713 form

- Ny state department form

Find out other Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast