Form 8027 2014

What is the Form 8027

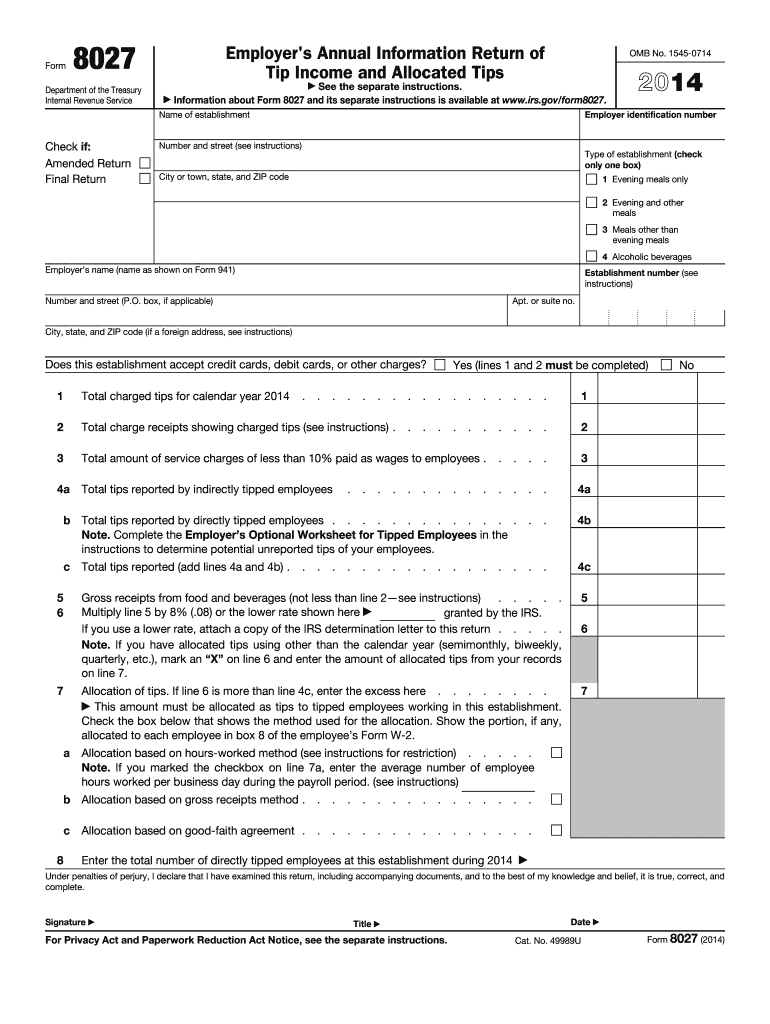

The Form 8027, also known as the Employer's Annual Information Return of Tip Income and Allocated Tips, is a tax form used by employers in the United States to report tip income received by employees. This form is essential for ensuring that employees accurately report their tip income, which is subject to federal income tax. Employers must submit this form to the Internal Revenue Service (IRS) annually, detailing the total tips received by employees and any tips allocated to them. The information on Form 8027 helps the IRS track tip income and ensure compliance with tax regulations.

How to use the Form 8027

Using Form 8027 involves several steps to ensure accurate reporting of tip income. Employers must first gather the necessary data, including the total amount of tips received by employees. Once the data is compiled, employers can fill out the form, indicating the total tips received and any allocated tips. It is crucial to ensure that all information is accurate and complete before submission. After completing the form, employers must file it with the IRS by the specified deadline. This process helps maintain compliance with tax laws and ensures that employees' income is reported correctly.

Steps to complete the Form 8027

Completing Form 8027 requires careful attention to detail. Here are the key steps involved:

- Gather all relevant information regarding employee tip income.

- Fill out the form, ensuring to include the total tips received and allocated tips.

- Review the form for accuracy, checking all calculations and entries.

- Submit the completed form to the IRS by the specified deadline.

Following these steps will help ensure that the form is completed correctly and submitted on time, reducing the risk of penalties.

Legal use of the Form 8027

The legal use of Form 8027 is governed by IRS regulations. Employers are required to file this form to report tip income accurately. Failure to do so can lead to penalties, including fines and increased scrutiny from the IRS. The form must be submitted annually, and it is essential for employers to maintain accurate records of tip income throughout the year. Compliance with these regulations not only helps avoid legal issues but also ensures that employees are properly credited for their tip income.

Filing Deadlines / Important Dates

Filing deadlines for Form 8027 are critical for compliance. Generally, employers must submit the form by the last day of February following the end of the tax year. If filing electronically, the deadline may extend to March 31. It is important for employers to mark these dates on their calendars to avoid late submissions, which can result in penalties. Keeping track of these deadlines ensures that both the employer and employees remain compliant with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting Form 8027. The form can be filed electronically, which is often the most efficient method. Alternatively, employers may choose to mail the completed form to the appropriate IRS address. In-person submission is generally not available for this form. When filing electronically, employers should ensure they use IRS-approved software to facilitate the submission process. Each method has its advantages, and employers should select the one that best fits their needs.

Quick guide on how to complete 2014 form 8027

Complete Form 8027 effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the proper forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Form 8027 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form 8027 effortlessly

- Obtain Form 8027 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important parts of the documents or black out sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tiresome form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 8027 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8027

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8027

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 8027 and why is it important for businesses?

Form 8027 is a crucial document used by businesses to report the number of employees and their wages to the IRS. It ensures compliance with tax regulations and helps avoid potential penalties. Understanding how to effectively manage Form 8027 can streamline your payroll processes.

-

How can airSlate SignNow assist with the completion of Form 8027?

airSlate SignNow offers an intuitive interface that simplifies the eSigning process for Form 8027. With features like templates and automation, you can quickly fill out and send this form without the hassle of paper-based methods. This boosts efficiency and reduces errors.

-

What are the costs associated with using airSlate SignNow for Form 8027?

airSlate SignNow provides flexible pricing plans tailored to your business needs, making it a cost-effective solution for managing Form 8027. You can choose from various subscription options, which provide access to features that streamline document handling and eSigning. Check our website for detailed pricing information.

-

Are there any integrations that can help with Form 8027 submission?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software that can simplify the submission process for Form 8027. By connecting these tools, you can automatically sync data and track submissions, helping you maintain compliance effortlessly.

-

How secure is the eSigning process for Form 8027 with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 8027. We use advanced encryption protocols to protect your data and ensure that all signatures are legally binding and verifiable. You can trust that your information is safe.

-

Can I customize Form 8027 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for Form 8027 to fit your specific business requirements. This flexibility ensures you have all necessary fields addressed, making it simpler to gather information from employees and maintain accuracy in reporting.

-

What features does airSlate SignNow provide to enhance the eSigning experience of Form 8027?

airSlate SignNow offers features such as automatic reminders, mobile access, and tracking capabilities to enhance the eSigning process for Form 8027. These features ensure that your documents are completed on time and reduce the chances of delays in your payroll processes.

Get more for Form 8027

Find out other Form 8027

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement