Instructions for Form 8027 Internal Revenue Service 2020

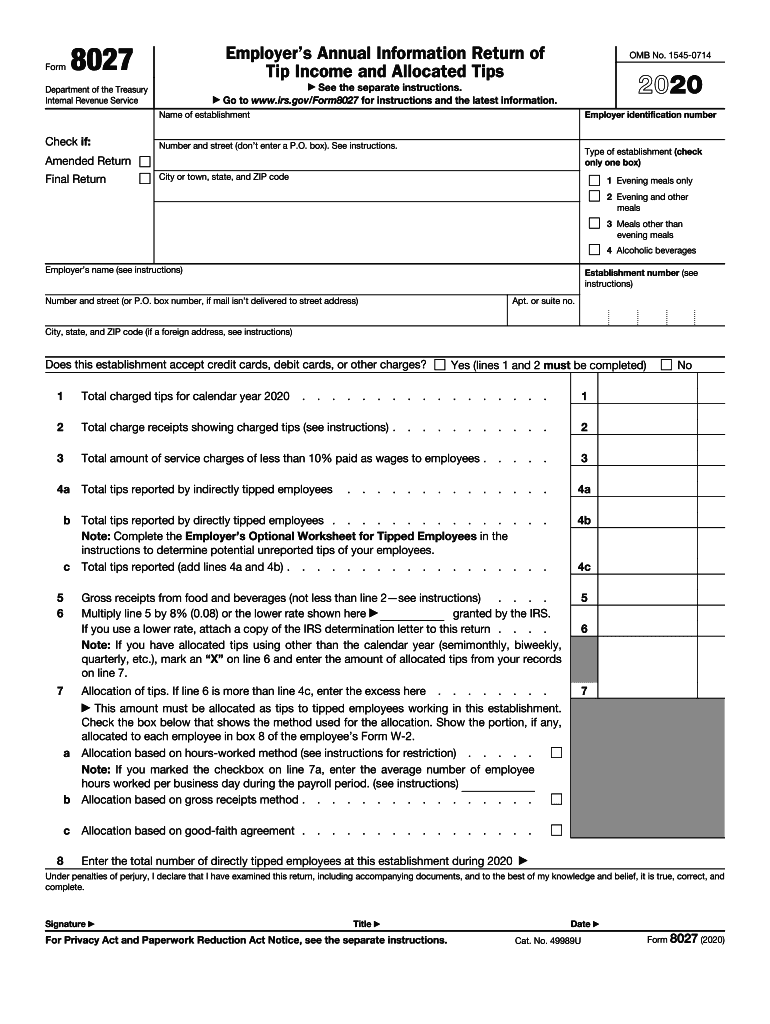

What is the 2015 IRS Form 8027?

The 2015 IRS Form 8027 is an information return used by certain employers to report annual tip income and allocated tips for employees. This form is specifically designed for establishments that have a large number of employees who receive tips, such as restaurants and bars. The information collected helps the IRS ensure that employees are accurately reporting their tip income for tax purposes.

Steps to Complete the 2015 IRS Form 8027

Completing the 2015 IRS Form 8027 involves several key steps:

- Gather necessary information about your establishment, including the employer identification number (EIN) and business name.

- Collect data on total sales, total tips, and the number of employees who received tips during the reporting period.

- Fill out the form by entering the required information in the designated fields, ensuring accuracy to avoid penalties.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines for the 2015 IRS Form 8027

The filing deadline for the 2015 IRS Form 8027 is typically the last day of February of the following year. If you are filing electronically, the deadline extends to March 31. It is important to meet these deadlines to avoid any penalties or interest charges.

Legal Use of the 2015 IRS Form 8027

The 2015 IRS Form 8027 must be used in compliance with IRS regulations. Employers are legally obligated to report tips accurately and timely. Failure to do so may result in penalties, including fines or additional scrutiny from the IRS. Understanding the legal implications of this form is crucial for maintaining compliance.

Required Documents for the 2015 IRS Form 8027

To complete the 2015 IRS Form 8027, you will need the following documents:

- Employer Identification Number (EIN)

- Records of total sales and tips received

- Employee records, including names and Social Security numbers

- Any relevant payroll documentation

Form Submission Methods for the 2015 IRS Form 8027

The 2015 IRS Form 8027 can be submitted in several ways:

- Electronically through the IRS e-file system, which is recommended for faster processing.

- By mail, sending the completed form to the appropriate IRS address based on your location.

- In-person at local IRS offices, although this method is less common.

Quick guide on how to complete 2020 instructions for form 8027 internal revenue service

Effortlessly Prepare Instructions For Form 8027 Internal Revenue Service on Any Device

Digital document management has gained traction with companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and seamlessly. Manage Instructions For Form 8027 Internal Revenue Service on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Instructions For Form 8027 Internal Revenue Service with Ease

- Obtain Instructions For Form 8027 Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form 8027 Internal Revenue Service and guarantee outstanding communication at every point of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 8027 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 8027 internal revenue service

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the purpose of the 2015 IRS Form 8027?

The 2015 IRS Form 8027 is used by large food and beverage establishments to report their tip income and to reconcile the tips reported by employees. Filing this form helps ensure compliance with IRS guidelines regarding tip reporting and payment of employment taxes.

-

How can airSlate SignNow assist with submitting the 2015 IRS Form 8027?

AirSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the 2015 IRS Form 8027. This streamlines the filing process, making it simpler to manage and submit your forms on time.

-

Is there a fee for using airSlate SignNow to file the 2015 IRS Form 8027?

AirSlate SignNow offers a variety of pricing plans that cater to different business needs. While the fees may vary based on the chosen plan, using airSlate SignNow can ultimately save businesses time and money when managing documents like the 2015 IRS Form 8027.

-

What are the key features of airSlate SignNow for handling forms like the 2015 IRS Form 8027?

AirSlate SignNow includes features such as customizable templates, automated workflows, and real-time status tracking. These functionalities simplify the process of preparing and submitting important forms like the 2015 IRS Form 8027.

-

Can I integrate airSlate SignNow with other software for managing the 2015 IRS Form 8027?

Yes, airSlate SignNow offers integrations with popular applications, allowing you to link your existing software with the eSigning process for the 2015 IRS Form 8027. This enhances efficiency and helps centralize your document management.

-

What are the benefits of using airSlate SignNow for the 2015 IRS Form 8027?

Using airSlate SignNow for your 2015 IRS Form 8027 not only speeds up the signing and submission process but also ensures enhanced security. Your sensitive financial information is protected, minimizing the risk of data bsignNowes or loss.

-

What if I need help with the 2015 IRS Form 8027 using airSlate SignNow?

AirSlate SignNow provides customer support for any questions related to the 2015 IRS Form 8027 and other document needs. Their support team is available to assist you in navigating the eSigning process and ensure a smooth experience.

Get more for Instructions For Form 8027 Internal Revenue Service

Find out other Instructions For Form 8027 Internal Revenue Service

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now