Instructions for Form 8027 Internal Revenue Service 2012

What is the Instructions For Form 8027 Internal Revenue Service

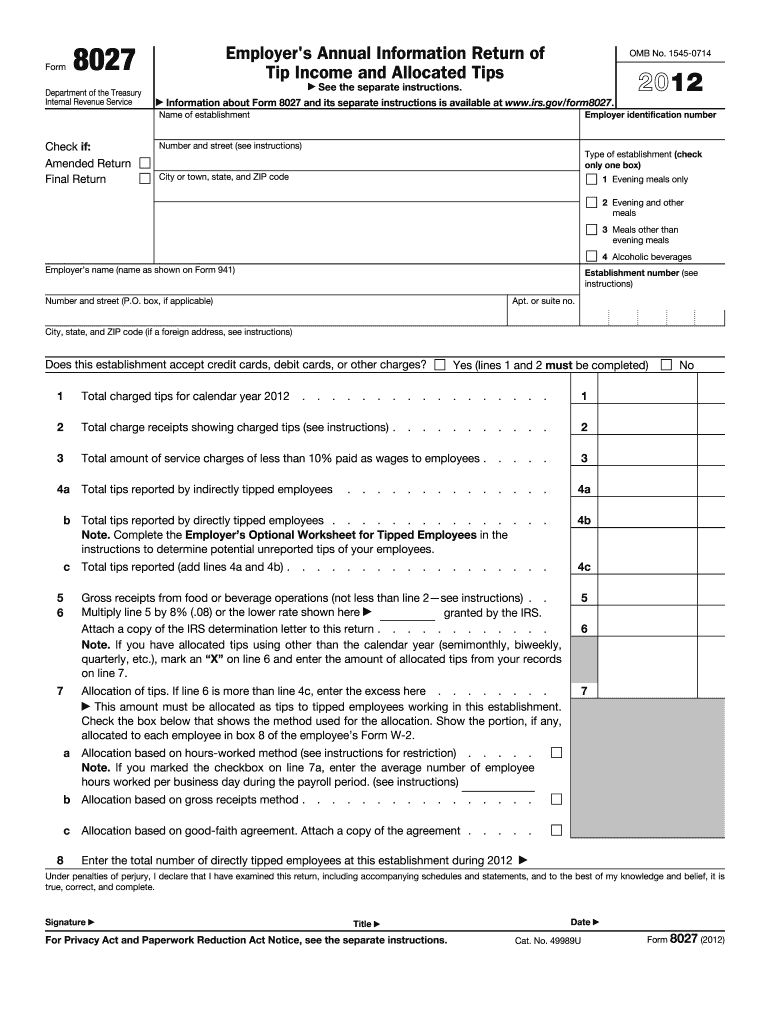

The Instructions for Form 8027, issued by the Internal Revenue Service (IRS), provide guidance for employers who are required to report tips received by employees in food and beverage establishments. This form is specifically designed for establishments that have a significant number of employees receiving tips, such as restaurants and bars. The instructions detail the necessary steps to accurately report tip income, ensuring compliance with federal tax regulations.

Steps to complete the Instructions For Form 8027 Internal Revenue Service

Completing the Instructions for Form 8027 involves several key steps:

- Gather necessary information, including the total number of employees, the total tips reported by employees, and the establishment's gross receipts.

- Fill out the form accurately, ensuring all required fields are completed, such as the employer's name, address, and Employer Identification Number (EIN).

- Calculate the total tips and compare them to the expected amount based on the establishment's gross receipts.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the required deadline, either electronically or via mail.

Legal use of the Instructions For Form 8027 Internal Revenue Service

The legal use of the Instructions for Form 8027 is crucial for compliance with IRS regulations. Employers must ensure that all reported tip income is accurate and reflects the actual earnings of their employees. Failure to comply with these instructions can result in penalties, including fines and increased scrutiny from the IRS. It is essential for employers to maintain accurate records and adhere to the guidelines provided in the instructions to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for Form 8027 are critical for compliance. Employers must submit the form annually, typically by the last day of February if filing by paper, or by March 31 if filing electronically. It is important to keep track of these deadlines to avoid late filing penalties. Additionally, employers should be aware of any changes in deadlines that may occur due to IRS updates or extensions.

Required Documents

To complete the Instructions for Form 8027, employers will need several documents, including:

- Employee tip records, which detail the tips received by each employee.

- Gross receipts records for the establishment, which provide context for tip reporting.

- Employer Identification Number (EIN) and other identification details.

Having these documents readily available will facilitate the accurate completion of the form.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting Form 8027. The form can be filed electronically through the IRS e-file system, which is often the preferred method due to its efficiency and speed. Alternatively, employers may choose to mail the completed form to the designated IRS address. In-person submissions are generally not accepted for this form. It is advisable to check the IRS website for the most current submission guidelines and addresses.

Quick guide on how to complete instructions for form 8027 2018internal revenue service

Effortlessly Prepare Instructions For Form 8027 Internal Revenue Service on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without unnecessary delays. Handle Instructions For Form 8027 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Adjust and eSign Instructions For Form 8027 Internal Revenue Service with Ease

- Obtain Instructions For Form 8027 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact confidential information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Decide how you want to send your form—via email, SMS, or invitation link—or download it to your computer.

Don’t worry about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Instructions For Form 8027 Internal Revenue Service, ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8027 2018internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8027 2018internal revenue service

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What are the Instructions For Form 8027 Internal Revenue Service?

The Instructions For Form 8027 Internal Revenue Service provide guidance on how to report tips received by employees of certain establishments. This form is essential for employers in the food and beverage industry to communicate accurate tip income to the IRS. Following these instructions ensures compliance and helps avoid penalties.

-

How can airSlate SignNow assist with the Instructions For Form 8027 Internal Revenue Service?

airSlate SignNow can simplify the process of completing and signing the Instructions For Form 8027 Internal Revenue Service digitally. Our platform allows for easy eSigning and document management, so users can efficiently submit their forms without the hassle of printing and mailing. This streamlines your workflow and minimizes errors.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Form 8027 Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost is budget-friendly and provides excellent value given the efficiency and convenience we offer for managing documents like the Instructions For Form 8027 Internal Revenue Service. Check out our pricing page for detailed information.

-

What features does airSlate SignNow offer for completing the Instructions For Form 8027 Internal Revenue Service?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and team collaboration tools specifically for documents like the Instructions For Form 8027 Internal Revenue Service. These features enhance the accuracy and speed at which users can complete and manage important IRS forms.

-

Are there any benefits to using airSlate SignNow for tax-related forms like the Instructions For Form 8027 Internal Revenue Service?

Using airSlate SignNow for tax-related forms, including the Instructions For Form 8027 Internal Revenue Service, offers benefits like improved accuracy, faster processing times, and reduced paperwork headaches. Our eSigning solution ensures that documents are secure and legally binding, thus instilling confidence in the completion of tax obligations.

-

Can airSlate SignNow integrate with other tools to assist with the Instructions For Form 8027 Internal Revenue Service?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management tools that can help manage the Instructions For Form 8027 Internal Revenue Service. This allows users to sync their data effectively, ensuring that all aspects of their tax documentation are streamlined and organized.

-

How do I get started with airSlate SignNow for the Instructions For Form 8027 Internal Revenue Service?

To get started with airSlate SignNow for the Instructions For Form 8027 Internal Revenue Service, simply sign up for an account on our website. You can choose a plan that fits your needs and start creating, signing, and managing your documents right away. Our user-friendly interface makes it easy for anyone to navigate.

Get more for Instructions For Form 8027 Internal Revenue Service

Find out other Instructions For Form 8027 Internal Revenue Service

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself