About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return 2022

Understanding the fillable 940 Form

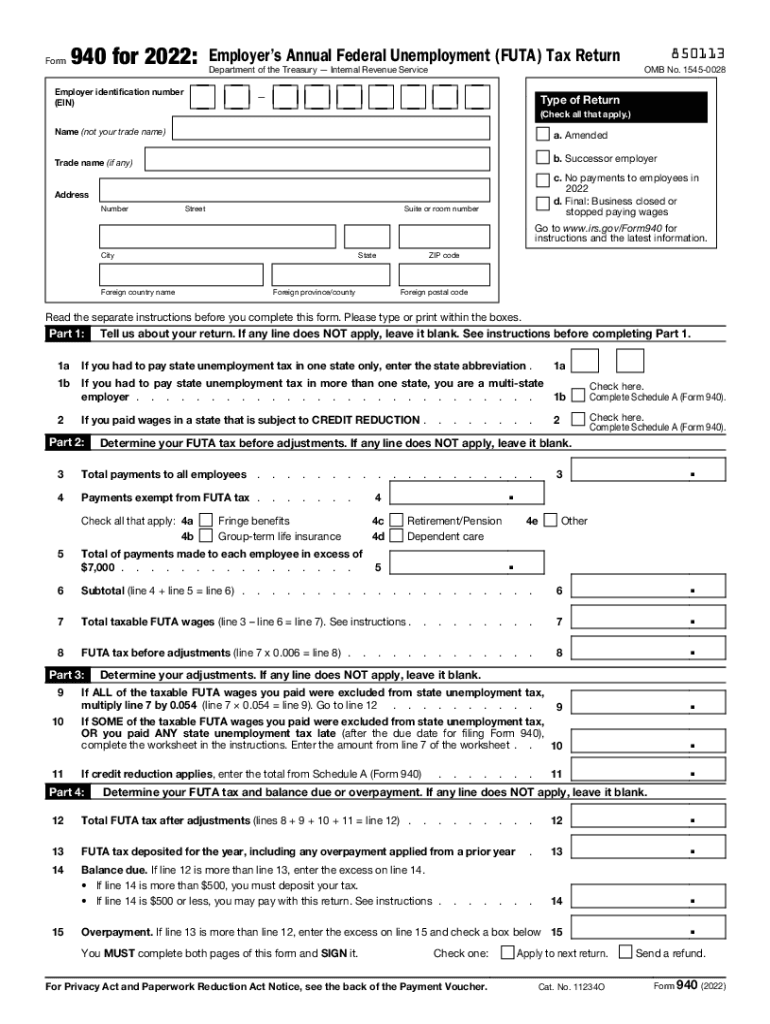

The fillable 940 form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is essential for businesses in the United States. This form is used to report and pay unemployment taxes to the federal government. Employers are required to file this form annually if they meet certain criteria, such as having paid wages of $1,500 or more in any calendar quarter or having one or more employees for at least some part of a day in any 20 or more weeks during the current or preceding calendar year. Understanding the purpose and requirements of this form is crucial for compliance with federal tax regulations.

Steps to Complete the fillable 940 Form

Completing the fillable 940 form involves several steps to ensure accuracy and compliance. Begin by gathering necessary information, including your business's Employer Identification Number (EIN), total wages paid, and any adjustments for state unemployment taxes. Next, follow these steps:

- Enter your business details, including the name and address.

- Report the total wages subject to FUTA tax.

- Calculate the FUTA tax owed based on the applicable rate.

- Account for any adjustments or credits for state unemployment taxes.

- Sign and date the form to certify its accuracy.

After completing the form, review it thoroughly before submission to avoid errors that could lead to penalties.

Filing Deadlines for the fillable 940 Form

Timely filing of the fillable 940 form is critical to avoid penalties. The form is typically due by January 31 of the following year for the previous calendar year's wages. If you make timely deposits of your FUTA tax, you may have until February 10 to file the form. It is important to keep track of these deadlines to ensure compliance with IRS regulations and avoid unnecessary fees.

Legal Use of the fillable 940 Form

The fillable 940 form is legally binding when completed and submitted correctly. To ensure its legal standing, employers must adhere to the guidelines set forth by the IRS, including accurate reporting of wages and taxes. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. Additionally, using a reliable electronic signature solution can enhance the legal validity of the submitted form.

Obtaining the fillable 940 Form

The fillable 940 form can be obtained directly from the IRS website or through authorized tax preparation software. The form is available in a fillable PDF format, allowing users to complete it electronically. Employers should ensure they are using the most current version of the form to comply with any updates or changes in tax law.

Penalties for Non-Compliance with the fillable 940 Form

Non-compliance with the requirements of the fillable 940 form can lead to significant penalties. Employers may face fines for late filing, inaccurate reporting, or failure to pay the required FUTA taxes. The IRS may impose penalties based on the amount of tax owed and the duration of the delay. Understanding these potential consequences is essential for maintaining compliance and avoiding financial repercussions.

Quick guide on how to complete about form 940 employers annual federal unemployment futa tax return

Easily Prepare About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Handle About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return on any device with the airSlate SignNow apps for Android or iOS and simplify any document-focused process today.

How to Edit and Electronically Sign About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return Effortlessly

- Find About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 940 employers annual federal unemployment futa tax return

Create this form in 5 minutes!

People also ask

-

What is a fillable 940 form?

A fillable 940 form is a digital version of the Employer's Annual Federal Unemployment (FUTA) Tax Return, designed to streamline the tax filing process. With airSlate SignNow, users can easily fill out and eSign the form electronically, ensuring accuracy and compliance. This feature helps businesses save time and reduce errors associated with traditional paper forms.

-

How does airSlate SignNow handle fillable 940 forms?

airSlate SignNow allows users to create, fill out, and eSign fillable 940 forms seamlessly. The platform supports easy customization and integration of the form into your workflow. This ensures that all relevant information is captured accurately, making the filing process more efficient.

-

Can I integrate fillable 940 forms with other software?

Yes, airSlate SignNow offers robust integration options with various applications such as CRM systems, accounting software, and more. This enables users to incorporate fillable 940 forms into their existing workflows without hassle. Streamlining your business processes has never been easier with these integrations.

-

Is airSlate SignNow cost-effective for businesses needing fillable 940 forms?

Absolutely! AirSlate SignNow provides a cost-effective solution for businesses that require fillable 940 forms. With its affordable pricing plans, companies can efficiently manage their document signing and filling processes without breaking the bank.

-

What features does airSlate SignNow offer for fillable 940 forms?

AirSlate SignNow offers a range of features for fillable 940 forms, including customizable templates, easy eSigning, and secure cloud storage. These features help simplify the process of filling out and submitting forms. Additionally, users have access to tracking and reminder functionalities to stay organized.

-

How secure is the information on fillable 940 forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. When using fillable 940 forms, all data is encrypted, ensuring that sensitive information remains protected. The platform also complies with industry-standard security protocols, giving users peace of mind while handling important tax documents.

-

Can I track the status of my fillable 940 forms?

Yes, airSlate SignNow allows you to track the status of your fillable 940 forms in real-time. Users receive notifications once forms are eSigned or if further action is needed. This transparency helps businesses keep track of important deadlines and ensures timely submissions.

Get more for About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return

Find out other About Form 940, Employer's Annual Federal Unemployment FUTA Tax Return

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract