940 Form 2011

What is the 940 Form

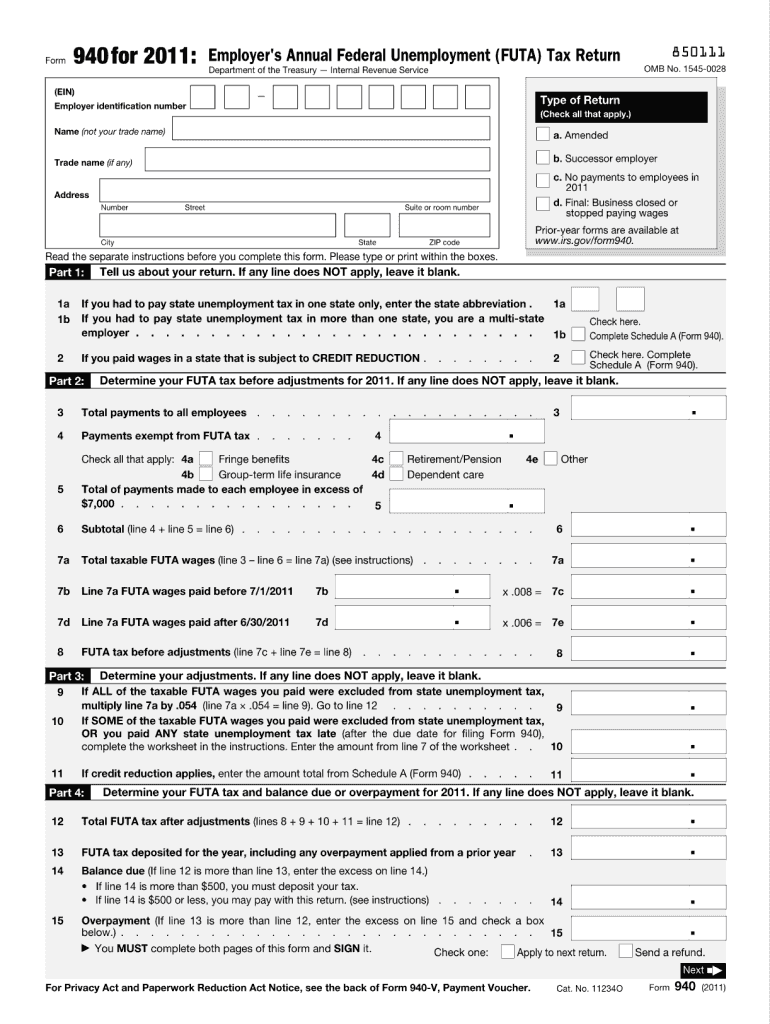

The 940 Form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document for employers in the United States. It is used to report and pay federal unemployment taxes on wages paid to employees. This form is essential for businesses to comply with federal regulations regarding unemployment insurance and helps ensure that funds are available for unemployed workers. The 940 Form must be filed annually, reflecting the employer's total FUTA tax liability for the year.

How to use the 940 Form

Using the 940 Form involves a few key steps. Employers must first gather all necessary payroll information for the tax year, including total wages paid and any applicable credits. Next, they will complete the form by accurately entering this information, ensuring that all calculations are correct. After completing the form, employers must submit it to the IRS, either electronically or via mail, by the specified deadline. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the 940 Form

Completing the 940 Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather payroll records for the tax year, including total wages and any adjustments.

- Calculate the total FUTA tax owed based on the wages paid to employees.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the 940 Form are critical for compliance. Employers must submit the form annually, typically by January 31 of the following year. If the employer has made timely payments throughout the year, they may have until February 10 to file. It is essential to mark these dates on your calendar to avoid penalties for late submission.

Legal use of the 940 Form

The legal use of the 940 Form is governed by federal tax laws. Employers are required to file this form to report their unemployment tax liabilities accurately. Failure to file or incorrect filings can lead to penalties, including fines and interest on unpaid taxes. It is vital for employers to understand their legal obligations regarding the 940 Form to maintain compliance with the IRS.

Penalties for Non-Compliance

Non-compliance with the 940 Form requirements can result in significant penalties. Employers who fail to file the form on time may incur a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, failure to pay the tax owed can result in further penalties and interest charges. Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete 2011 940 form

Complete 940 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage 940 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign 940 Form with ease

- Locate 940 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign 940 Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 940 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 940 form

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is a 940 Form and how does it relate to airSlate SignNow?

The 940 Form is an annual Federal Unemployment Tax Return that employers must file. With airSlate SignNow, businesses can easily prepare, send, and eSign the 940 Form, ensuring compliance while streamlining the filing process.

-

How can airSlate SignNow help me with my 940 Form?

airSlate SignNow simplifies the process of completing and eSigning your 940 Form. Our platform allows you to fill out the form digitally, gather signatures, and securely store your documents, making tax filing hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 940 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. By choosing a plan, you gain access to features that make handling the 940 Form and other documents efficient and cost-effective.

-

What features does airSlate SignNow offer for managing the 940 Form?

With airSlate SignNow, you can access templates for the 940 Form, collaborate with team members, and track the status of your document. Additionally, our eSignature feature ensures that your submissions are legally binding and quickly processed.

-

Can I integrate airSlate SignNow with my existing accounting software for the 940 Form?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions. This allows you to seamlessly manage your 940 Form and other financial documents, enhancing your workflow efficiency.

-

How secure is my information when using airSlate SignNow for the 940 Form?

Security is a top priority at airSlate SignNow. When you use our platform for the 940 Form, your data is protected with advanced encryption and compliance with industry standards, ensuring that your sensitive information remains safe.

-

What benefits can I expect from using airSlate SignNow for filing the 940 Form?

Using airSlate SignNow for your 940 Form provides numerous benefits, including time savings, reduced paperwork, and enhanced organization. Our user-friendly interface makes the eSigning process quick and efficient, allowing you to focus on your business.

Get more for 940 Form

- Hipaa compliance agreement this hipaa health bb form

- Record building work form

- Product reseller agreement this product reseller form

- Lottery contract form

- Nba contract template form

- Clearing trading permit holder organization form

- Pca flowsheet northeast kingdom homecare form

- Patient id sheetdoc form

Find out other 940 Form

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement