Form 940 2020

What is the Form 940

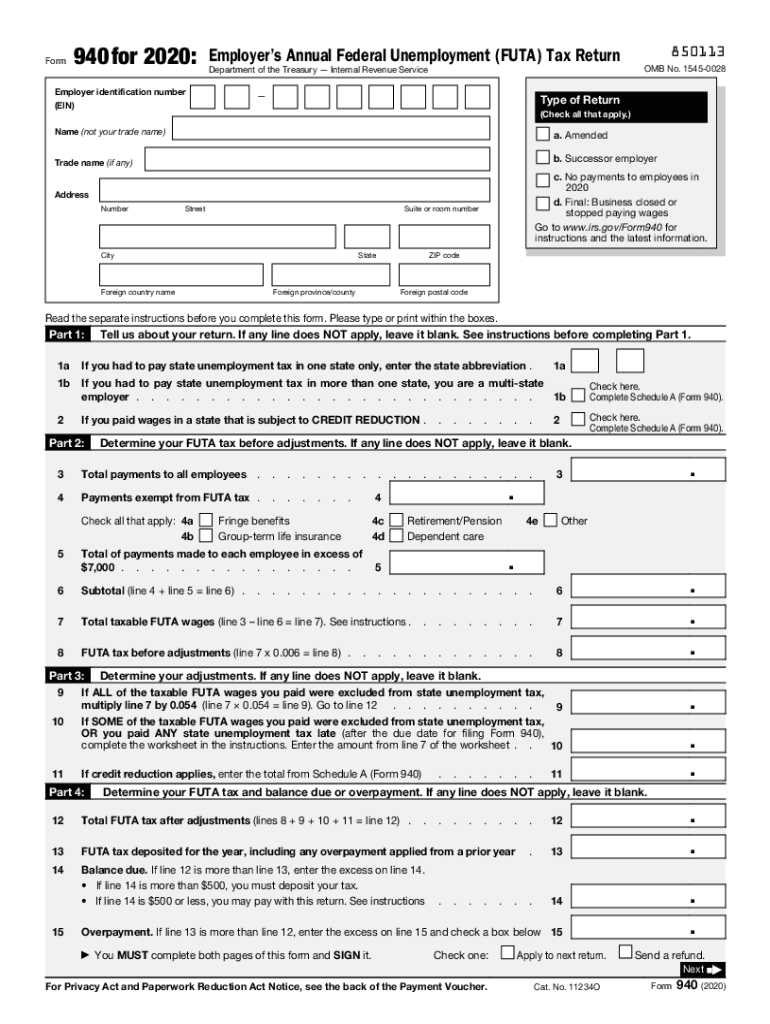

The IRS Form 940 is a federal tax form used by employers to report and pay unemployment taxes to the federal government. This form is essential for businesses that are subject to the Federal Unemployment Tax Act (FUTA). Employers use Form 940 to calculate their annual unemployment tax liability, which is based on the wages paid to employees. The form includes information about the total taxable wages, any adjustments for state unemployment taxes, and the total amount due.

How to obtain the Form 940

Employers can obtain the IRS Form 940 through several methods. The form is available for download on the official IRS website, where it can be printed and filled out manually. Additionally, businesses can access the form through various tax preparation software programs. Many accounting firms also provide the form as part of their services. It is important to ensure that the correct version of the form is used, particularly for the tax year in question, such as the 2019 version.

Steps to complete the Form 940

Completing the IRS Form 940 involves several key steps:

- Gather necessary information, including total wages paid and any state unemployment tax credits.

- Fill out the form with accurate figures, ensuring that all calculations are correct.

- Review the form for completeness and accuracy before submission.

- Sign and date the form to certify that the information provided is true and correct.

Employers should keep a copy of the completed form for their records, as it may be needed for future reference or audits.

Legal use of the Form 940

The IRS Form 940 has specific legal implications for employers. It serves as a formal declaration of the employer's unemployment tax liability and is required by law for compliance with federal tax regulations. Failure to file the form or to pay the associated taxes can result in penalties and interest charges. Therefore, it is crucial for employers to understand their obligations under the Federal Unemployment Tax Act and to ensure timely and accurate filing of the form.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 940 is typically January 31 of the year following the tax year being reported. For example, the deadline for the 2019 form is January 31, 2020. Employers should be aware of this deadline to avoid late fees and penalties. Additionally, if the employer has made timely payments of all FUTA taxes due, they may be eligible for an extension to file the form by February 10.

Penalties for Non-Compliance

Employers who fail to file the IRS Form 940 on time or who do not pay the required taxes may face significant penalties. The IRS may impose a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest may accrue on any unpaid taxes. It is essential for employers to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete form 940

Complete Form 940 effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 940 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and electronically sign Form 940 without hassle

- Find Form 940 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 940 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 940

Create this form in 5 minutes!

How to create an eSignature for the form 940

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the IRS Form 940 for 2019, and why do I need it?

The IRS Form 940 for 2019 is used to report annual Federal Unemployment Tax Act (FUTA) tax. Employers need this form to calculate their tax obligations and ensure compliance with federal tax regulations. By understanding the requirements of the IRS Form 940 2019, businesses can avoid penalties and streamline their payroll tax processes.

-

How can airSlate SignNow help with completing the IRS Form 940 for 2019?

airSlate SignNow provides an efficient platform to eSign and send your IRS Form 940 for 2019. The easy-to-use interface allows users to upload their completed form, add necessary signatures, and securely share it with relevant parties. This streamlines the filing process and ensures that your tax documents are submitted accurately and on time.

-

Are there any costs associated with using airSlate SignNow for IRS Form 940 2019?

While airSlate SignNow offers a free trial, users will need to choose a subscription plan for ongoing use, which provides full access to features. Pricing varies based on the selected plan, and companies can benefit from cost-effective solutions that enhance document management for forms like IRS Form 940 2019. Review our pricing page to find the best option for your needs.

-

What are the benefits of using airSlate SignNow for eSigning IRS Form 940 2019?

Using airSlate SignNow for your IRS Form 940 2019 offers numerous benefits, including enhanced security, ease of use, and time savings. The platform ensures that all signatures are legally binding and documents are stored securely in the cloud. This streamlined process allows you to focus on your business while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for IRS Form 940 2019?

Yes, airSlate SignNow offers integrations with various business applications that enhance productivity and workflow. By integrating with your existing software solutions, you can easily manage your IRS Form 940 2019 and other important documents all in one place. This powerful combination streamlines operations and strengthens your team's efficiency.

-

Is airSlate SignNow compliant with IRS regulations for eSigning IRS Form 940 2019?

Absolutely, airSlate SignNow is compliant with IRS guidelines and ensures that all eSignatures for IRS Form 940 2019 are legally recognized. The platform employs advanced security measures to protect your sensitive data and maintain the integrity of your documents. Feel confident using airSlate SignNow for your tax documentation needs.

-

What features does airSlate SignNow offer for managing IRS Form 940 2019?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time tracking for your IRS Form 940 2019. These tools simplify the process of document management, allowing users to create, send, and sign forms with ease. The comprehensive feature set enhances user experience and efficiency.

Get more for Form 940

Find out other Form 940

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT