Irs Form 940 for 2014

What is the IRS Form 940 For

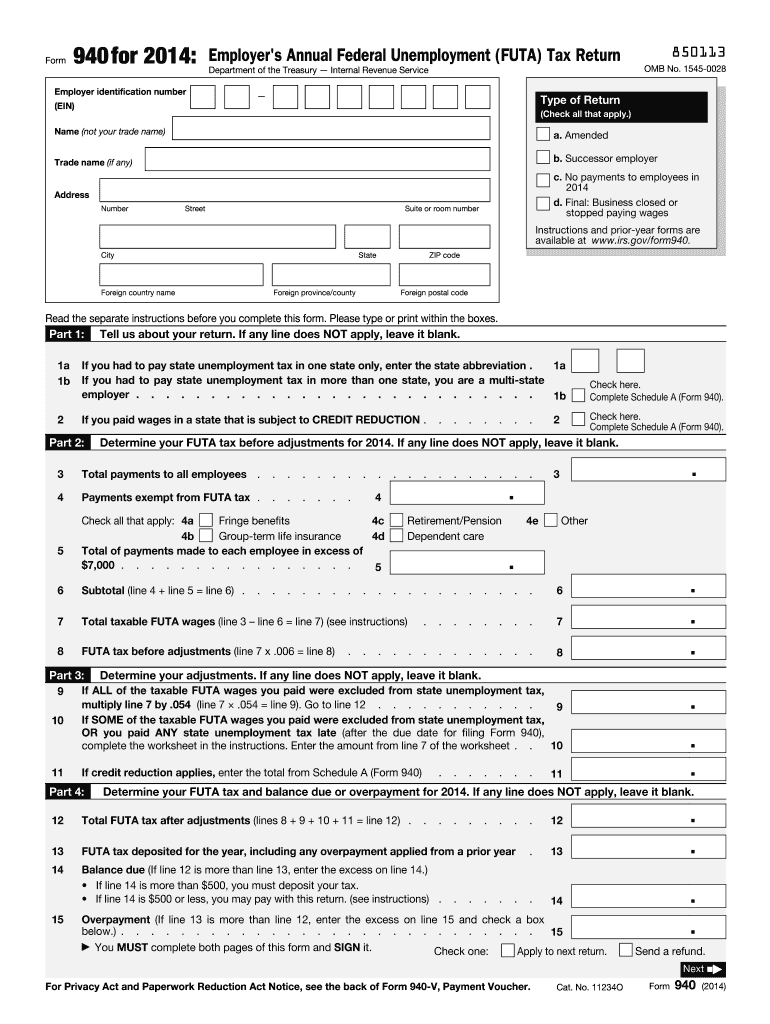

The IRS Form 940 is an annual tax form used by employers to report their Federal Unemployment Tax Act (FUTA) liability. This form is essential for businesses as it helps determine the amount of unemployment tax owed to the federal government. Employers must file this form if they paid wages of $1,500 or more in any calendar quarter or if they had at least one employee for at least part of a day in any 20 or more weeks during the current or previous year. Understanding the purpose of this form is crucial for compliance with federal tax regulations.

Steps to Complete the IRS Form 940

Completing the IRS Form 940 involves several key steps. First, gather all necessary information, including total wages paid to employees and any state unemployment taxes paid. Next, calculate the FUTA tax based on the applicable rate, which is typically six percent on the first $7,000 of each employee's wages. After calculating the tax, fill out the form by entering the required information in the appropriate sections, including your business details and tax calculations. Finally, review the form for accuracy before submitting it to the IRS by the deadline.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the IRS Form 940 to avoid penalties. The form is due annually on January 31 for the previous calendar year. However, if you deposited all FUTA tax owed in a timely manner, you have until February 10 to file. It is essential to mark these dates on your calendar to ensure timely submission and compliance with IRS regulations.

Legal Use of the IRS Form 940

The legal use of the IRS Form 940 is governed by federal tax laws. Employers must accurately report their unemployment tax liability to ensure compliance with the Federal Unemployment Tax Act. Failure to file the form or inaccuracies in reporting can lead to penalties and interest on unpaid taxes. It is important for employers to understand their obligations under the law and to maintain accurate records to support their filings.

How to Obtain the IRS Form 940

The IRS Form 940 can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, businesses can access the form through various tax software programs that facilitate electronic filing. It is advisable to ensure that you are using the most current version of the form to comply with any updates or changes in tax regulations.

Penalties for Non-Compliance

Employers who fail to file the IRS Form 940 on time or do not pay the required taxes may face significant penalties. The IRS imposes a failure-to-file penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes from the due date until the tax is paid in full. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete irs form 940 for 2014

Complete Irs Form 940 For effortlessly on any gadget

Online document administration has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Irs Form 940 For on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Irs Form 940 For without breaking a sweat

- Locate Irs Form 940 For and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Irs Form 940 For and ensure excellent communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 940 for 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form 940 for 2014

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is IRS Form 940 used for?

IRS Form 940 is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This form is crucial for businesses to calculate their unemployment tax liability and ensure compliance with federal regulations. By using airSlate SignNow, you can easily manage and eSign your IRS Form 940 for a streamlined filing process.

-

How can airSlate SignNow help with IRS Form 940?

airSlate SignNow provides a user-friendly platform that allows you to create, manage, and eSign IRS Form 940 conveniently. With our secure eSigning features, you can ensure that your documents are legally binding and compliant with IRS requirements. This eliminates the hassle of paper forms and enhances your efficiency when dealing with IRS Form 940.

-

What features does airSlate SignNow offer for IRS Form 940?

airSlate SignNow offers a range of features tailored for IRS Form 940, including customizable templates, secure cloud storage, and multi-signature capabilities. These tools make it easier for businesses to fill out and sign their IRS Form 940 accurately and quickly. Additionally, our platform ensures that your documents are accessible anytime and anywhere.

-

Is airSlate SignNow affordable for small businesses filing IRS Form 940?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing to file IRS Form 940. Our pricing plans are flexible and cater to various business sizes, ensuring that you can manage your documentation needs without breaking the bank. Investing in airSlate SignNow can save you time and money in the long run.

-

Can I integrate airSlate SignNow with other software for IRS Form 940 management?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and accounting software, making it easier to manage your IRS Form 940. This integration capability allows you to sync data and streamline your workflow, ensuring that your tax forms are always up-to-date and accurately completed.

-

What are the benefits of using airSlate SignNow for IRS Form 940?

Using airSlate SignNow for IRS Form 940 offers several benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform simplifies the eSigning process, allowing you to focus on running your business rather than getting bogged down in administrative tasks. Additionally, our secure system protects your sensitive information.

-

How does airSlate SignNow ensure the security of IRS Form 940 documents?

airSlate SignNow prioritizes the security of your IRS Form 940 documents with industry-leading encryption and compliance with data protection regulations. We use secure servers to store your documents and provide features like audit trails and authentication to ensure that only authorized users can access and sign your forms. This commitment to security gives you peace of mind.

Get more for Irs Form 940 For

Find out other Irs Form 940 For

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile