Irs Form 940 2012

What is the Irs Form 940

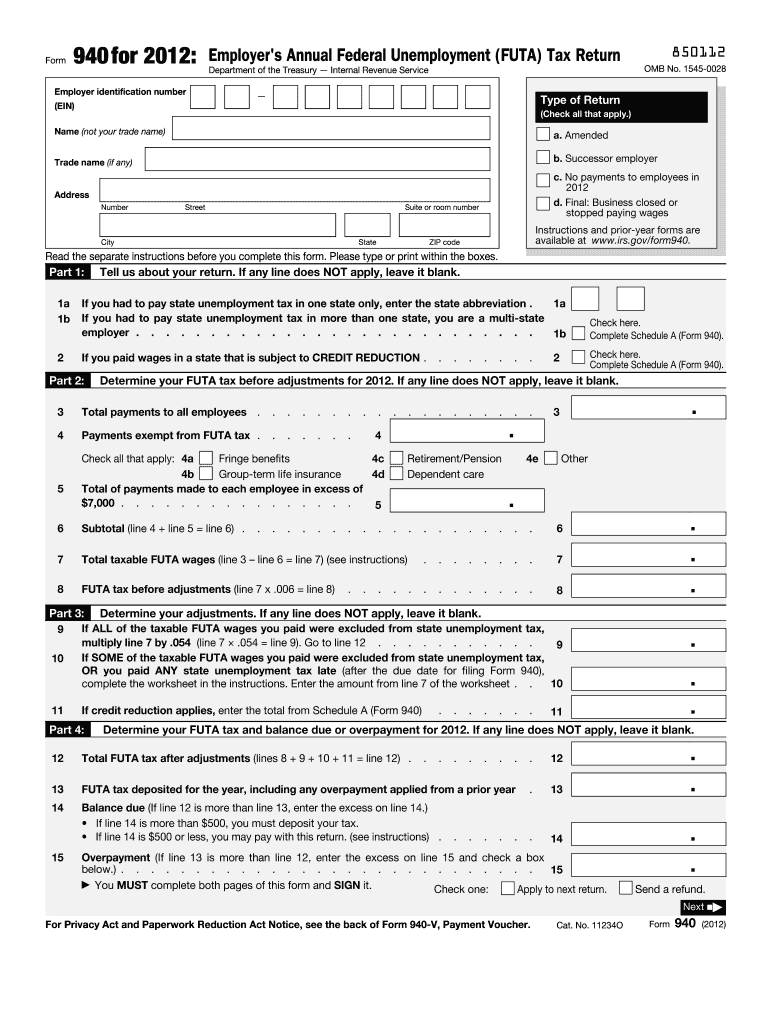

The Irs Form 940 is an annual tax form used by employers in the United States to report their Federal Unemployment Tax Act (FUTA) liability. This form is essential for businesses that pay wages to employees and is used to calculate the amount of unemployment tax owed to the federal government. The FUTA tax funds unemployment benefits for workers who have lost their jobs. Employers must file this form even if they do not owe any tax, as it provides a record of their compliance with federal unemployment tax regulations.

How to use the Irs Form 940

Using the Irs Form 940 involves several key steps. First, employers must gather all necessary payroll information for the year, including total wages paid and any adjustments for previous quarters. Next, they will complete the form by filling out sections that detail their total taxable wages and calculating the tax owed. After completing the form, employers must file it with the IRS by the specified deadline, which is typically January 31 of the following year. It is crucial to ensure accuracy to avoid penalties.

Steps to complete the Irs Form 940

Completing the Irs Form 940 requires careful attention to detail. Here are the steps to follow:

- Gather payroll records for the entire year, including total wages and any adjustments.

- Fill out Part 1 of the form, which includes basic information about your business.

- Complete Part 2, where you report total taxable wages and calculate your FUTA tax.

- In Part 3, report any adjustments that may affect your tax liability.

- Sign and date the form, certifying that the information provided is accurate.

Legal use of the Irs Form 940

The legal use of the Irs Form 940 is crucial for compliance with federal tax laws. Employers are required to file this form annually to report their unemployment tax obligations. Failure to file or inaccuracies can result in penalties and interest charges. The form must be signed by an authorized representative of the business, ensuring that the information is legally binding. Additionally, electronic filing options are available, which can streamline the submission process while maintaining compliance with eSignature laws.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Irs Form 940. The form is due annually by January 31 of the following year. If you are required to make a payment, it must also be submitted by this date. If January 31 falls on a weekend or holiday, the due date may be extended to the next business day. Employers should keep track of these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Irs Form 940. The form can be filed electronically through the IRS e-file system, which is often the quickest method. Alternatively, employers may choose to mail a paper copy of the form to the appropriate IRS address. In-person submission is generally not available for this form. When filing by mail, it is advisable to use certified mail to ensure delivery and maintain a record of submission.

Quick guide on how to complete 2012 irs form 940

Generate Irs Form 940 effortlessly on any device

Digital document management has become trendy among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 940 on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Irs Form 940 with ease

- Find Irs Form 940 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Identify pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Adjust and eSign Irs Form 940 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs form 940

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs form 940

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is IRS Form 940 and who needs to use it?

IRS Form 940 is an annual federal tax form used to report how much an employer owes in federal unemployment taxes. Businesses that have wages exceeding $1,500 or have at least one employee for a day or more in any 20 weeks of the year need to file IRS Form 940. Using airSlate SignNow can simplify the signing process for this essential document.

-

How can airSlate SignNow assist with the completion of IRS Form 940?

airSlate SignNow allows users to easily create, edit, and eSign IRS Form 940 online. Our platform provides templates and user-friendly features to ensure that your IRS Form 940 is completed accurately and efficiently. This streamlines the process, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for IRS Form 940?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage documents like IRS Form 940 without overspending. Each plan includes essential features to facilitate eSigning and document management.

-

What are the key features of airSlate SignNow for handling IRS Form 940?

Key features of airSlate SignNow include eSignature capabilities, document templates, and cloud storage, making it simple to manage IRS Form 940. Additionally, our audit trail feature ensures compliance by providing a detailed history of who signed and when. This enhances transparency and accountability in your filing process.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 940?

Yes, airSlate SignNow integrates seamlessly with various third-party applications like CRM tools, accounting software, and cloud storage services, which allows you to manage IRS Form 940 efficiently. These integrations enhance your workflow and streamline the documentation process. You can track and access your IRS Form 940 alongside your other essential business documents.

-

What benefits do I get from using airSlate SignNow for IRS Form 940?

Using airSlate SignNow for IRS Form 940 comes with numerous benefits, including faster turnaround times and reduced paperwork. Our platform provides a secure and legally binding way to eSign documents, ensuring that your IRS Form 940 is processed quickly. Moreover, the ease of use increases productivity by allowing you to focus on your core business activities.

-

How secure is the information I provide for IRS Form 940 on airSlate SignNow?

airSlate SignNow prioritizes security with features like data encryption, secure user authentication, and compliance with industry standards. This keeps your sensitive information for IRS Form 940 safe and secure. You can trust that your data is protected throughout the entire signing process.

Get more for Irs Form 940

Find out other Irs Form 940

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online