940 Form 2016

What is the 940 Form

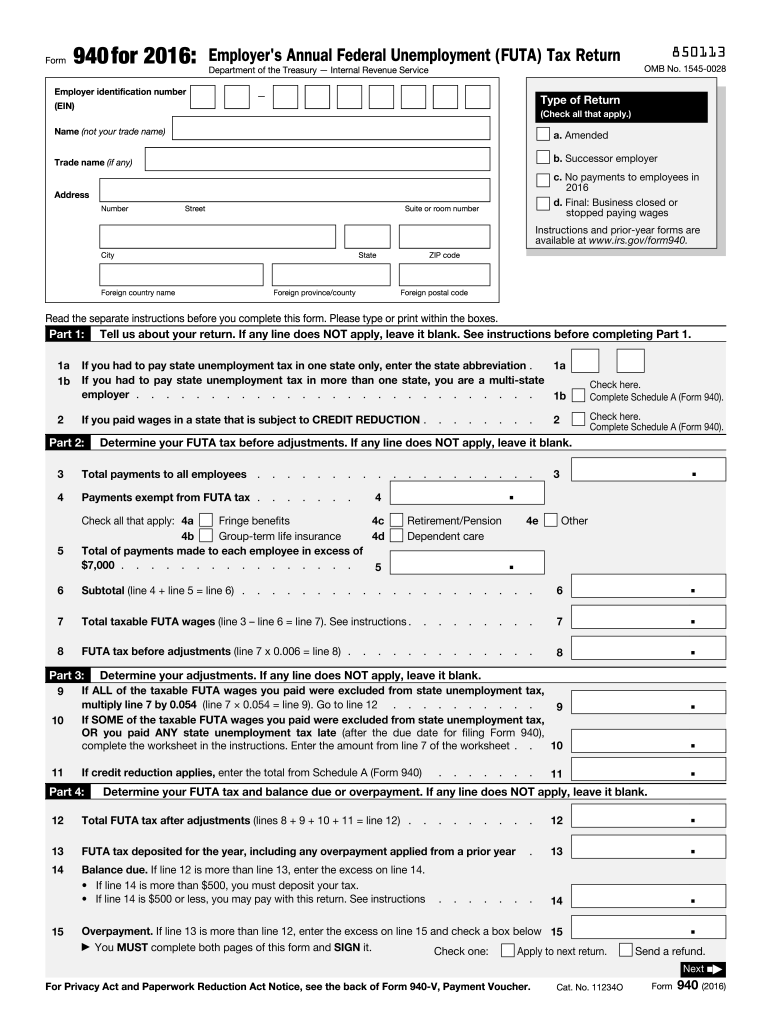

The 940 Form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a document used by employers in the United States to report and pay federal unemployment taxes. This form is essential for businesses that pay wages to employees and are subject to FUTA tax. The 940 Form summarizes the employer's unemployment tax liability for the year and is typically filed annually. Understanding this form is crucial for compliance with federal tax regulations and ensures that employers contribute to the unemployment compensation system.

How to use the 940 Form

Using the 940 Form involves several steps to ensure accurate reporting of unemployment taxes. Employers must first gather information regarding their total taxable wages, any adjustments made during the year, and the amount of FUTA tax owed. The form requires detailed entries, including the employer's identification number and the total number of employees. Once completed, the form must be submitted to the Internal Revenue Service (IRS) by the designated deadline. Proper usage of the 940 Form helps maintain compliance and avoid penalties.

Steps to complete the 940 Form

Completing the 940 Form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and total taxable wages.

- Calculate the total FUTA tax owed based on your taxable wages and any applicable credits.

- Fill out the form accurately, ensuring all sections are completed, including the employer's information and tax calculations.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline, either electronically or by mail.

Legal use of the 940 Form

The legal use of the 940 Form is governed by federal tax laws, specifically those related to unemployment insurance. Employers are required to file this form if they meet certain criteria, such as having paid wages of $1,500 or more in any quarter or having at least one employee for a part of a day in any twenty weeks during the current or previous calendar year. Filing the form accurately and on time is essential to avoid legal repercussions, including fines and penalties for non-compliance.

Filing Deadlines / Important Dates

Employers must be aware of the important deadlines associated with the 940 Form. The form is typically due by January 31 of the year following the tax year being reported. If the employer has deposited all FUTA tax owed on time, they may have an extension until February 10. It is crucial to adhere to these deadlines to avoid late fees and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the 940 Form on time or inaccuracies in the information provided can lead to significant penalties. The IRS imposes a penalty of five percent of the unpaid tax for each month the form is late, up to a maximum of twenty-five percent. Additionally, incorrect filings may result in further audits or inquiries from the IRS. Understanding these penalties emphasizes the importance of accurate and timely submissions.

Quick guide on how to complete 940 form 2016

Complete 940 Form effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage 940 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign 940 Form effortlessly

- Locate 940 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or via an invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 940 Form to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 940 form 2016

Create this form in 5 minutes!

How to create an eSignature for the 940 form 2016

How to make an electronic signature for the 940 Form 2016 in the online mode

How to make an electronic signature for the 940 Form 2016 in Google Chrome

How to make an electronic signature for putting it on the 940 Form 2016 in Gmail

How to create an electronic signature for the 940 Form 2016 right from your smartphone

How to generate an eSignature for the 940 Form 2016 on iOS

How to create an electronic signature for the 940 Form 2016 on Android

People also ask

-

What is a 940 Form and why is it important?

The 940 Form is an essential document used by employers to report annual Federal Unemployment Tax Act (FUTA) taxes. Understanding how to accurately complete the 940 Form is crucial for compliance and avoiding penalties. With airSlate SignNow, you can easily eSign your 940 Form, ensuring that it is submitted promptly and accurately.

-

How can airSlate SignNow help me with my 940 Form?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning the 940 Form. Our user-friendly solution allows you to manage your tax documents efficiently, ensuring they are completed and submitted on time. Plus, our templates make filling out the 940 Form straightforward and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 940 Form?

Yes, airSlate SignNow offers competitive pricing based on your needs. Our plans cater to different business sizes, allowing you to choose a package that suits your budget while providing access to features specifically designed for handling documents like the 940 Form. Explore our pricing options to find the best fit for your organization.

-

Can I track the status of my 940 Form once it's sent for signing?

Absolutely! With airSlate SignNow, you can track the status of your 940 Form in real-time. Our platform sends notifications when the document is opened, signed, or completed, giving you peace of mind and ensuring that you stay informed throughout the signing process.

-

What features does airSlate SignNow offer for managing the 940 Form?

airSlate SignNow offers a comprehensive suite of features for managing the 940 Form, including customizable templates, secure eSigning, and seamless integration with your existing workflow. You can also utilize our document storage capabilities to keep all your tax forms organized and easily accessible when needed.

-

Is it easy to integrate airSlate SignNow with other software for 940 Form processing?

Yes, airSlate SignNow integrates smoothly with various business applications, making it easier to process your 940 Form alongside other important documents. Whether you use accounting software or HR platforms, our integrations enhance your workflow, allowing for efficient document management and collaboration.

-

How does airSlate SignNow ensure the security of my 940 Form?

We take security seriously at airSlate SignNow. Your 940 Form and all other documents are protected with industry-standard encryption and secure access controls. This ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for 940 Form

Find out other 940 Form

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement