940 Form 2015

What is the 940 Form

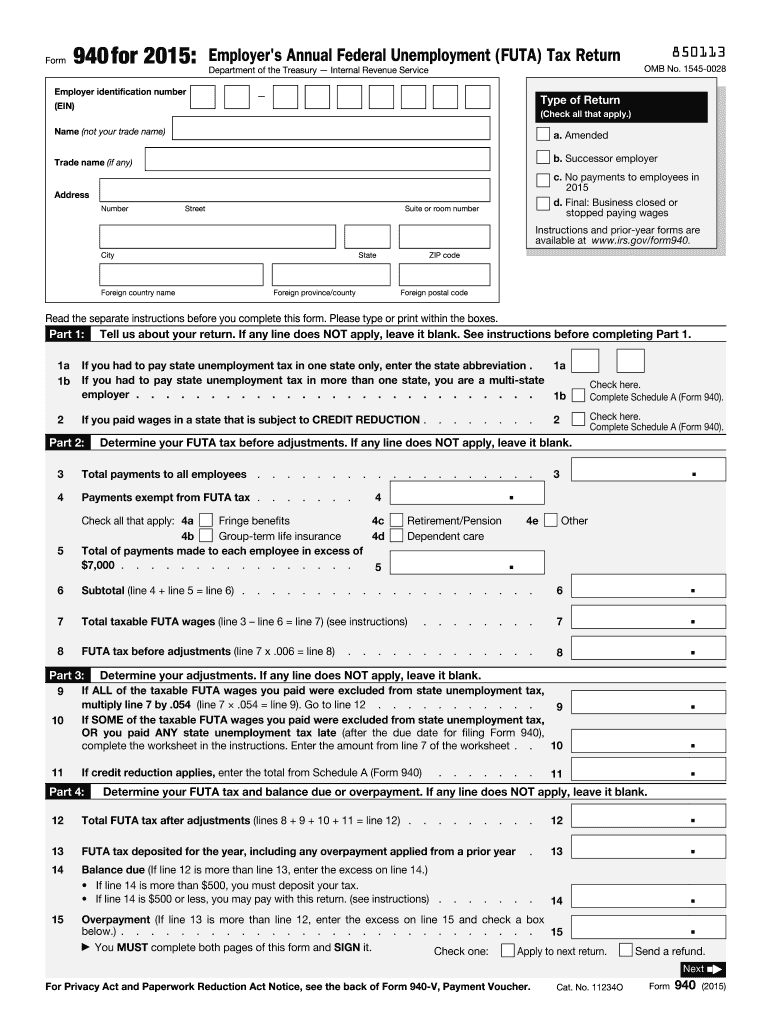

The 940 Form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a tax form used by employers in the United States to report and pay unemployment taxes to the federal government. This form is essential for businesses that are subject to the Federal Unemployment Tax Act (FUTA), which provides funds for unemployment benefits. The 940 Form must be filed annually, detailing the amount of unemployment tax owed based on employee wages.

How to use the 940 Form

Using the 940 Form involves several steps to ensure accurate reporting of unemployment taxes. Employers must first determine their FUTA tax liability based on total wages paid to employees. The form requires information such as the employer's identification number, total taxable wages, and the amount of tax due. Once completed, the form can be submitted electronically or via mail to the IRS. It is crucial to maintain accurate records of employee wages and tax payments for compliance and future reference.

Steps to complete the 940 Form

Completing the 940 Form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and total taxable wages for the year.

- Calculate the FUTA tax based on the applicable rate, which is typically six percent of the first $7,000 of each employee's wages.

- Fill out the form, ensuring all sections are completed accurately, including any adjustments for state unemployment taxes.

- Review the form for errors before submission to avoid penalties.

- Submit the completed form to the IRS by the deadline, which is usually January 31 of the following year.

Legal use of the 940 Form

The legal use of the 940 Form is governed by federal tax laws. Employers must file this form to comply with the Federal Unemployment Tax Act, which mandates that businesses contribute to the unemployment insurance system. Failure to file the form or pay the required taxes can result in penalties and interest charges. It is essential for employers to understand their obligations under the law to avoid legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines related to the 940 Form to ensure compliance. The form is typically due by January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, employers should keep track of any state-specific deadlines that may apply to their unemployment tax filings.

Form Submission Methods

The 940 Form can be submitted to the IRS through various methods. Employers have the option to file electronically using the IRS e-file system, which is often quicker and allows for immediate confirmation of receipt. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is important to choose a submission method that aligns with your record-keeping and compliance needs.

Quick guide on how to complete 2015 940 form

Effortlessly prepare 940 Form on any device

Digital document management has gained immense popularity among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without complications. Manage 940 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 940 Form with ease

- Find 940 Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Select your preferred method to submit your form, whether it be by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign 940 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 940 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 940 form

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is a 940 Form and why is it important?

The 940 Form is used by employers to report annual Federal Unemployment Tax Act (FUTA) liability. It is crucial for businesses to complete this form accurately to comply with federal regulations and avoid penalties. Using tools like airSlate SignNow can help streamline the eSignature process for completing your 940 Form quickly and efficiently.

-

How can airSlate SignNow assist with the 940 Form?

airSlate SignNow provides businesses with a seamless platform to send and obtain signatures on the 940 Form. This ensures that all necessary parties can easily sign the document, providing a faster and more reliable way to finalize your tax filings. With our user-friendly interface, managing your 940 Form becomes a hassle-free experience.

-

Is airSlate SignNow cost-effective for handling 940 Forms?

Yes, airSlate SignNow offers competitive pricing plans designed to fit businesses of all sizes, making it a cost-effective solution for handling your 940 Form requirements. Our subscription plans provide access to various features that simplify document management, ensuring you maximize your investment while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for 940 Form management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and HR software, allowing for efficient management of your 940 Form. This integration helps centralize your documents and align your workflows, enabling you to capture eSignatures without disrupting your existing processes.

-

What features of airSlate SignNow benefit the 940 Form process?

Key features of airSlate SignNow that enhance the 940 Form process include customizable templates, secure cloud storage, and real-time tracking for document completion. These tools allow users to create a streamlined workflow, ensuring that your 940 Form is completed and submitted on time with all necessary signatures in place.

-

Is it easy to use airSlate SignNow for first-time users working with the 940 Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for first-time users to manage the 940 Form. Our intuitive interface provides clear instructions, helping users navigate through the eSigning process without needing extensive training or technical expertise.

-

What security measures does airSlate SignNow offer for my 940 Form?

airSlate SignNow prioritizes the security of your documents, including the 940 Form, by implementing advanced encryption and secure access protocols. This ensures that sensitive information is protected during the signing process. You can have peace of mind knowing that your 940 Form is secure and accessible only to authorized users.

Get more for 940 Form

- Download allotment form us family health plan christus

- Honor flight guardian application honor flight network form

- Child nutrition special diet form 2020 2021

- For texas private applicators form

- Physicians diet modification form revised final

- Cfbisd prek half day admission agreement 17 18 english form

- Plumbing permit number form

- Fng complaint form northwest isd

Find out other 940 Form

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself