Form it 257 Claim of Right Credit Tax Year 2023

What is the Form IT 257 Claim of Right Credit?

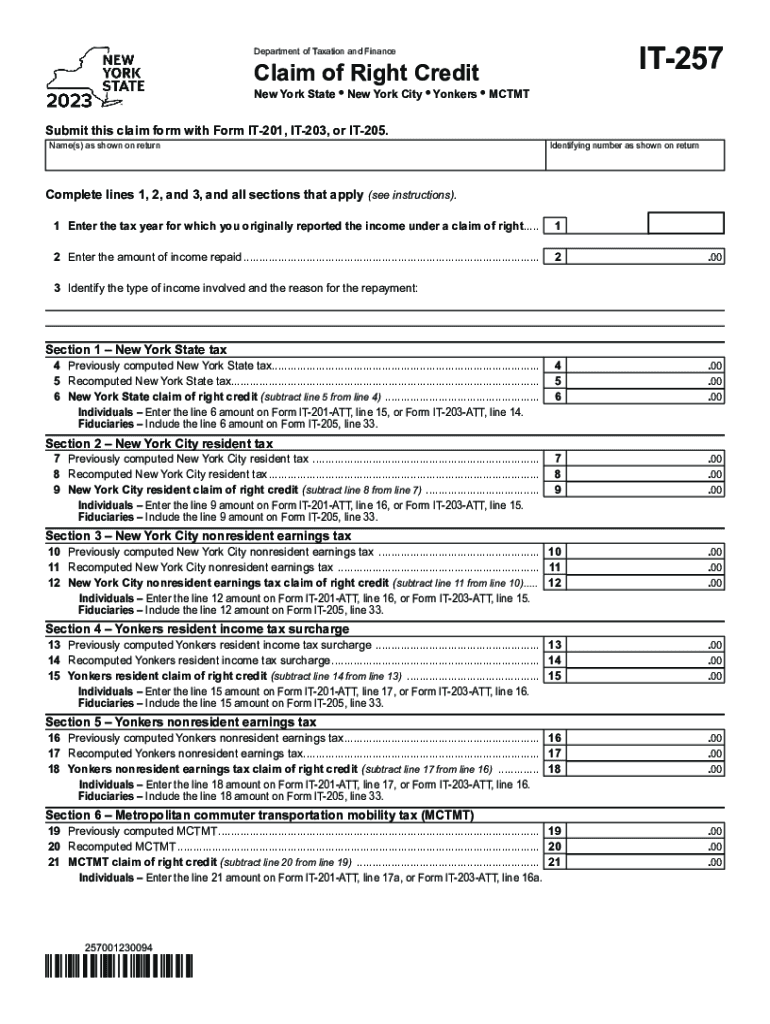

The Form IT 257 is a tax form used in New York State for claiming the Claim of Right Credit. This credit is available to individuals who have included income in a prior year that they later had to repay. The purpose of the form is to allow taxpayers to recoup some of the taxes paid on that income, effectively providing relief for those who have experienced a financial setback. The form is specifically designed for the tax year in which the repayment occurred, making it essential for accurate tax reporting.

Steps to Complete the Form IT 257 Claim of Right Credit

Completing the Form IT 257 involves several key steps:

- Gather Documentation: Collect all relevant documents, including prior year tax returns and records of the income that was repaid.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Repayment Amount: Indicate the amount of income that was repaid in the appropriate section of the form.

- Calculate the Credit: Follow the instructions to determine the amount of credit you are eligible to claim based on the repayment.

- Review and Sign: Ensure all information is accurate, sign the form, and date it before submission.

How to Obtain the Form IT 257 Claim of Right Credit

The Form IT 257 can be obtained through several methods. It is available for download directly from the New York State Department of Taxation and Finance website. Additionally, taxpayers can request a physical copy by contacting the department’s customer service. Local tax offices may also have copies available. It is advisable to ensure you are using the most current version of the form for the applicable tax year.

Eligibility Criteria for the Form IT 257 Claim of Right Credit

To qualify for the Claim of Right Credit using Form IT 257, taxpayers must meet specific eligibility criteria:

- The taxpayer must have included income in a previous tax year that was subsequently repaid.

- The repayment must have occurred in the tax year for which the credit is being claimed.

- Taxpayers must have filed a New York State income tax return for the year in which the income was originally reported.

Form Submission Methods for IT 257 Claim of Right Credit

Taxpayers can submit the Form IT 257 through various methods. The form can be filed online using the New York State Department of Taxation and Finance's e-file system, which offers a convenient and secure way to submit tax documents. Alternatively, taxpayers may choose to mail the completed form to the appropriate address specified in the form instructions. In-person submissions at local tax offices are also an option for those who prefer direct interaction.

Key Elements of the Form IT 257 Claim of Right Credit

Understanding the key elements of the Form IT 257 is crucial for accurate completion. Important sections include:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Repayment Details: Taxpayers must provide information about the income that was repaid, including the amount and the year it was originally reported.

- Credit Calculation: This section guides taxpayers through the process of calculating the credit based on the repayment amount.

Examples of Using the Form IT 257 Claim of Right Credit

Examples can help clarify how the Form IT 257 is utilized. For instance, if a taxpayer received a bonus in 2022 but had to repay it in 2023 due to a company policy change, they can claim the credit for the taxes paid on that bonus in their 2023 tax return. Another example includes situations where a taxpayer received unemployment benefits that they later had to repay. In both cases, the form allows for the recovery of some tax liability related to that income.

Quick guide on how to complete form it 257 claim of right credit tax year

Access Form IT 257 Claim Of Right Credit Tax Year effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to craft, modify, and electronically sign your documents promptly without delays. Manage Form IT 257 Claim Of Right Credit Tax Year on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

How to modify and eSign Form IT 257 Claim Of Right Credit Tax Year with ease

- Locate Form IT 257 Claim Of Right Credit Tax Year and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Form IT 257 Claim Of Right Credit Tax Year and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 257 claim of right credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 257 claim of right credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 257 claim form and why do I need it?

The 257 claim form is a vital document used in specific insurance and claims processes. It allows businesses and individuals to submit their claims efficiently. By utilizing the 257 claim form, users can ensure accurate processing of their claims, leading to timely reimbursements.

-

How does airSlate SignNow facilitate the completion of the 257 claim form?

airSlate SignNow offers an easy-to-use platform that simplifies the completion of the 257 claim form. With features like eSigning and document sharing, users can fill out the form efficiently and send it securely to relevant parties. This streamlines the claims process and reduces paperwork.

-

Is there a cost associated with using the 257 claim form on airSlate SignNow?

Yes, there is a pricing model for using airSlate SignNow, which includes the ability to handle the 257 claim form. However, the cost is competitive and varies based on the features your organization may need. To get the most value, consider the features that suit your claim processing requirements.

-

What are the benefits of using airSlate SignNow for the 257 claim form?

Using airSlate SignNow for the 257 claim form enhances efficiency and reduces errors in claim submissions. The platform allows for quick eSigning and document tracking, ensuring greater accountability. This leads to faster processing times and improved satisfaction for both submitters and recipients.

-

Can I integrate the 257 claim form with other tools using airSlate SignNow?

Yes, airSlate SignNow supports integration with various business tools, making it easy to connect the 257 claim form with your existing systems. These integrations can help automate workflows and improve overall productivity. You can easily link it with CRM systems, project management tools, and more.

-

How secure is the 257 claim form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The 257 claim form and all documents processed through the platform are secured with encryption and comply with industry standards. This ensures that sensitive information remains protected throughout the claims process.

-

Is training provided for using the 257 claim form on airSlate SignNow?

Absolutely! airSlate SignNow offers various resources and training sessions to help users become proficient in completing the 257 claim form. Whether through tutorials, webinars, or direct support, users can quickly learn how to maximize the platform's features.

Get more for Form IT 257 Claim Of Right Credit Tax Year

- Department of homeland security omb approval no 1651 department of homeland security us customs and borderdepartment of form

- Dorscgovforms siteformsstate of south carolina sc8857 department of revenue request

- Application for vehicle dealer registration plates for dealers licensed form

- Mvc forms njgov

- Transcript release new 1doc form

- Pd542 061 form

- Mpl application form

- Wwwpdffillercom505753766 member benefitfillable online member benefit claim form fax email print

Find out other Form IT 257 Claim Of Right Credit Tax Year

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT