Form it 257 Claim of Right Credit Tax Year 2020

What is the Form IT 257 Claim of Right Credit Tax Year

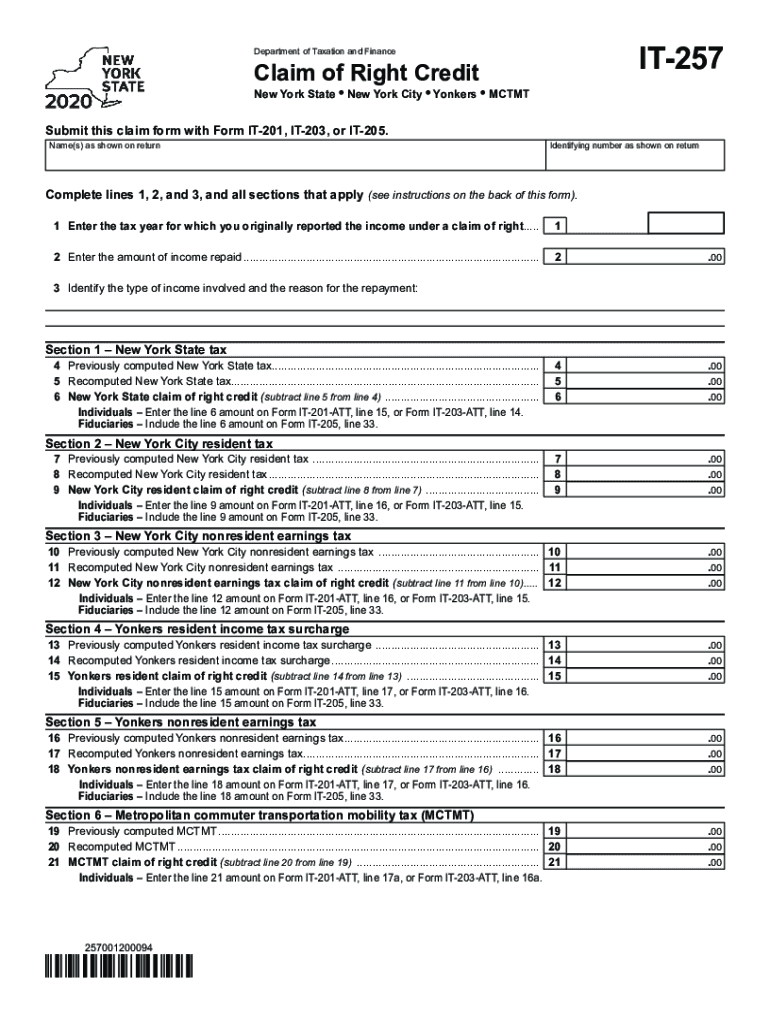

The Form IT 257 is used to claim the right credit for tax years in New York. This credit is available to taxpayers who have included income in their federal adjusted gross income in a prior year, which they later had to return. The form allows taxpayers to recover some of the taxes they paid on that income. It is essential to understand that this form is specifically designed for situations where income was reported and subsequently returned, ensuring that taxpayers are not unfairly taxed on money they ultimately did not keep.

How to use the Form IT 257 Claim of Right Credit Tax Year

To effectively use the Form IT 257, taxpayers must first determine their eligibility. This involves reviewing their previous tax returns to identify any income that was reported and later returned. Once eligibility is confirmed, the taxpayer should fill out the form accurately, providing all necessary details regarding the income in question and the tax paid on it. After completing the form, it should be submitted alongside the New York State tax return for the applicable year to ensure that the credit is applied correctly.

Steps to complete the Form IT 257 Claim of Right Credit Tax Year

Completing the Form IT 257 involves several key steps:

- Gather necessary documentation, including prior tax returns and any records related to the income that was returned.

- Fill out the taxpayer information section, ensuring all details are accurate.

- Detail the income that was included in previous tax years and subsequently returned, specifying the amounts and relevant tax years.

- Calculate the credit amount based on the taxes paid on the returned income.

- Review the completed form for accuracy before submission.

- Submit the form with the New York State tax return for the applicable year.

Key elements of the Form IT 257 Claim of Right Credit Tax Year

Several key elements must be included when filling out the Form IT 257. These include:

- Taxpayer Information: Name, address, and Social Security number of the taxpayer.

- Income Details: Specific amounts of income that were reported and later returned, along with the tax years involved.

- Credit Calculation: A clear calculation of the credit being claimed based on the taxes previously paid.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the claim.

Eligibility Criteria

To be eligible for the Form IT 257, taxpayers must meet specific criteria. They should have reported income in a previous tax year that was later returned. Additionally, the income must have been included in the federal adjusted gross income. Taxpayers must also ensure that they are filing for the correct tax year and that they have the necessary documentation to support their claim.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 257 can be submitted through various methods. Taxpayers have the option to file it online through the New York State Department of Taxation and Finance's e-filing system. Alternatively, the completed form can be printed and mailed to the appropriate tax office. In-person submission is also possible at designated tax offices, providing another avenue for taxpayers to ensure their claims are processed efficiently.

Quick guide on how to complete form it 257 claim of right credit tax year 2020

Complete Form IT 257 Claim Of Right Credit Tax Year effortlessly on any device

Online document management has become popular among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Form IT 257 Claim Of Right Credit Tax Year on any device using airSlate SignNow's Android or iOS applications and simplify document-related tasks today.

The easiest way to edit and eSign Form IT 257 Claim Of Right Credit Tax Year with ease

- Locate Form IT 257 Claim Of Right Credit Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your liking. Modify and eSign Form IT 257 Claim Of Right Credit Tax Year and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 257 claim of right credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 257 claim of right credit tax year 2020

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the form number to claim the 529 credit in NY?

The form number to claim the 529 credit in NY is Form IT-272. This form is essential for claiming the New York State tax credit for contributions made to a qualified 529 college savings plan. Ensure you fill it out accurately to maximize your tax benefits.

-

How can airSlate SignNow simplify the process of filing Form IT-272?

AirSlate SignNow offers a streamlined platform that allows users to eSign and send documents securely. By using our service, you can easily prepare and submit your Form IT-272 electronically, saving time and reducing errors associated with traditional paperwork.

-

Are there any fees associated with using airSlate SignNow for document signing?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You'll find our pricing is competitive and reflects the ease of use and efficiency in managing documents, such as the Form IT-272 for the 529 credit.

-

What features does airSlate SignNow provide to enhance document management?

AirSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features can be particularly beneficial when preparing important forms like the one needed to claim the 529 credit in NY, making the process simpler and more organized.

-

Can I integrate airSlate SignNow with other software for my workflow?

Absolutely! AirSlate SignNow integrates seamlessly with many popular applications, enhancing your workflow. This includes accounting and project management tools, which can be used when managing documents related to your 529 credit claims.

-

What benefits do I gain by using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, like Form IT-272, ensures that your documents are signed quickly and stored securely. The benefit of efficiency and increased organization means that you can focus on maximizing your savings, including your 529 credit.

-

Is airSlate SignNow suitable for individual users filing personal taxes?

Yes, airSlate SignNow is designed for both individual and business use. If you're filing personal taxes and need to submit the Form IF-272 to claim the 529 credit in NY, our user-friendly platform is perfect for managing your documents efficiently.

Get more for Form IT 257 Claim Of Right Credit Tax Year

- Biggest loser application 2023 form

- Refusal of care against medical advice university health services form

- Art contest rubric form

- Sample of filled attachment logbook for civil engineering form

- Veterinary icu treatment sheet form

- Certificate of arrival erasmus form

- Design exam cover page form

- Local forms packetssuperior court of california

Find out other Form IT 257 Claim Of Right Credit Tax Year

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure