Form it 257 "Claim of Right Credit" New York 2021

What is the Form IT-257 "Claim of Right Credit" New York

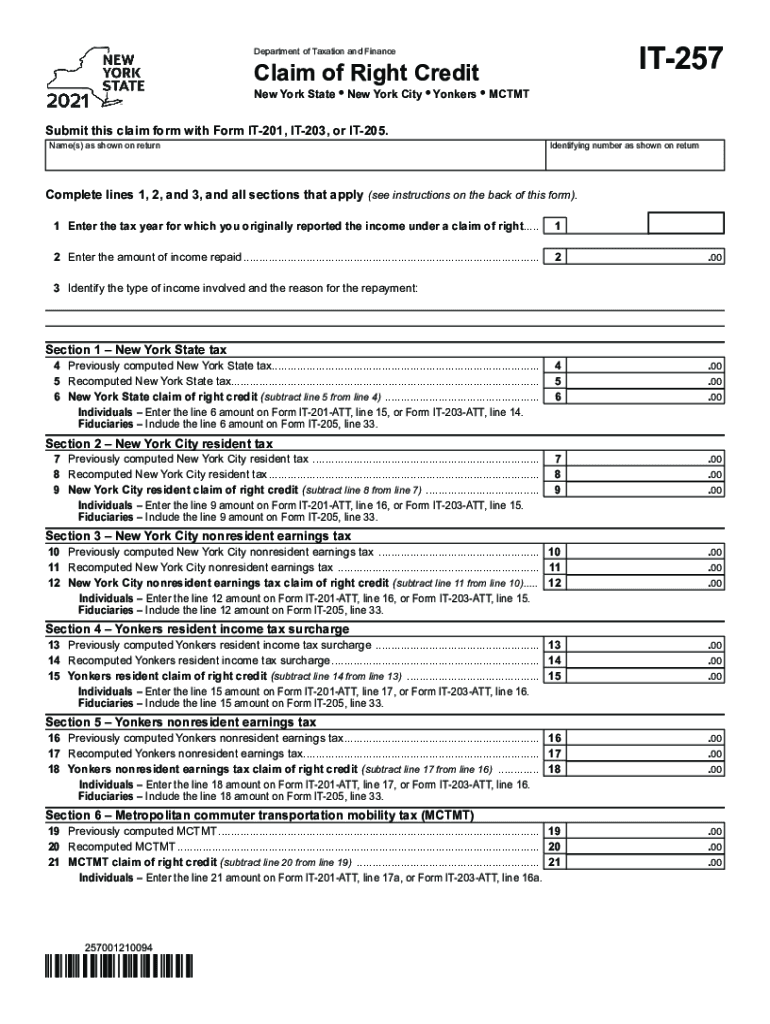

The Form IT-257 is a specific tax form used in New York State that allows taxpayers to claim a credit for income that was previously reported but later returned. This form is particularly relevant for individuals who have received income that they must repay, thus affecting their tax liability. The Claim of Right Credit helps to alleviate the tax burden associated with this income, ensuring that taxpayers are not penalized for amounts they no longer possess.

How to Use the Form IT-257 "Claim of Right Credit" New York

Using the Form IT-257 involves several steps to ensure proper completion and submission. Taxpayers must first gather all necessary documentation related to the income being claimed. After filling out the form accurately, it should be submitted along with the taxpayer's annual return. It is essential to follow the instructions carefully to avoid errors that could delay processing or lead to penalties.

Steps to Complete the Form IT-257 "Claim of Right Credit" New York

Completing the Form IT-257 requires attention to detail. Here are the key steps:

- Gather all relevant documentation related to the income that was returned.

- Provide personal information, including your name, address, and Social Security number.

- Detail the amount of income that was previously reported and the amount being claimed as a credit.

- Sign and date the form to certify that the information provided is accurate.

Eligibility Criteria for the Form IT-257 "Claim of Right Credit" New York

To be eligible for the Claim of Right Credit using Form IT-257, taxpayers must have reported income that they later had to repay. This typically applies to situations such as bonuses, commissions, or other forms of income that were mistakenly received. Additionally, the repayment must occur in the same tax year or the following year to qualify for the credit.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Form IT-257. Generally, the form must be submitted by the same deadline as the annual tax return, which is typically April fifteenth. However, extensions may apply, so it is advisable to check the specific due dates for the current tax year to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form IT-257 can be submitted through various methods, providing flexibility for taxpayers. It can be filed online through the New York State Department of Taxation and Finance website, mailed to the appropriate tax office, or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form it 257 ampquotclaim of right creditampquot new york

Effortlessly Prepare Form IT 257 "Claim Of Right Credit" New York on Any Device

Digital document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Form IT 257 "Claim Of Right Credit" New York on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Form IT 257 "Claim Of Right Credit" New York with Minimal Effort

- Obtain Form IT 257 "Claim Of Right Credit" New York and select Get Form to begin.

- Utilize the tools we offer to finish your document.

- Select important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Decide how you wish to send your form, whether via email, SMS, or invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from a device of your choice. Edit and eSign Form IT 257 "Claim Of Right Credit" New York and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 257 ampquotclaim of right creditampquot new york

Create this form in 5 minutes!

How to create an eSignature for the form it 257 ampquotclaim of right creditampquot new york

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What is NY 257 in relation to airSlate SignNow?

NY 257 refers to the regulatory guidelines for electronic signatures in New York. airSlate SignNow adheres to NY 257, ensuring that your eSigned documents are legally compliant and recognized in New York State.

-

How can airSlate SignNow help with compliance regarding NY 257?

With airSlate SignNow, you can ensure your electronic signatures are in compliance with NY 257 by utilizing advanced security features. Our platform includes audit trails, encryption, and authentication options that protect your documents and maintain legal integrity.

-

What features does airSlate SignNow offer for NY 257 compliance?

airSlate SignNow offers a variety of features designed to support NY 257 compliance, including secure document storage, eSignature automation, and multi-factor authentication. These features provide businesses with a comprehensive solution for legally binding electronic signatures.

-

Is airSlate SignNow a cost-effective solution for NY 257 requirements?

Yes, airSlate SignNow is a cost-effective solution that meets the requirements of NY 257. Our pricing plans are tailored to fit all business sizes, providing robust eSigning features without breaking the bank.

-

How does airSlate SignNow integrate with other tools while meeting NY 257 standards?

airSlate SignNow seamlessly integrates with popular business applications while ensuring compliance with NY 257 standards. This means you can manage your eSigning processes efficiently alongside your preferred tools, enhancing productivity and compliance.

-

Can I use airSlate SignNow for various document types under NY 257?

Absolutely! airSlate SignNow supports a wide range of document types, making it ideal for various business needs while adhering to NY 257. Whether it's contracts, agreements, or forms, you can eSign securely on our platform.

-

What are the benefits of using airSlate SignNow for businesses in New York?

By using airSlate SignNow, businesses in New York benefit from streamlined document workflows, reduced turnaround times, and compliance with NY 257. This leads to improved efficiency and enhances customer satisfaction through faster processing.

Get more for Form IT 257 "Claim Of Right Credit" New York

Find out other Form IT 257 "Claim Of Right Credit" New York

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP