DIS Kansas Department of Revenue 2022-2026

What is the DIS Kansas Department of Revenue?

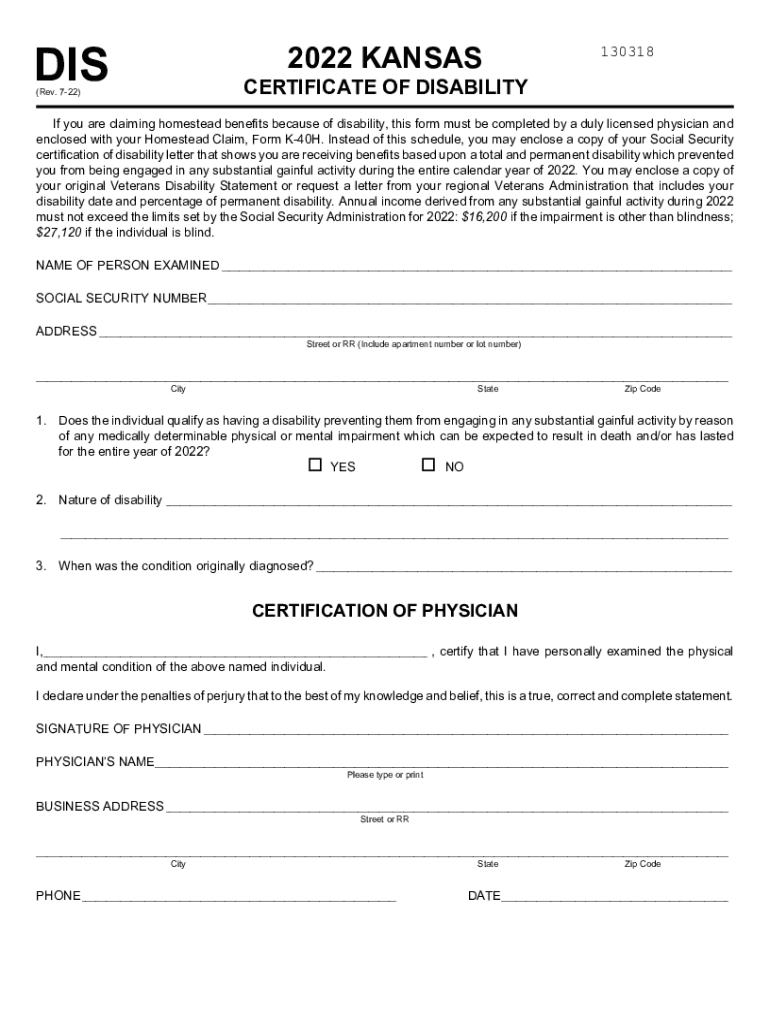

The DIS Kansas Department of Revenue form is a crucial document used for various tax-related purposes within the state of Kansas. This form is typically required for individuals and businesses to report specific financial activities or to apply for certain tax exemptions. Understanding its purpose is essential for compliance with state tax regulations.

How to Obtain the DIS Kansas Department of Revenue

Obtaining the DIS Kansas Department of Revenue form can be done through several methods. Individuals can access the form online via the official Kansas Department of Revenue website. Additionally, physical copies may be available at local government offices or through tax professionals. It is important to ensure that the correct version of the form is used to avoid any compliance issues.

Steps to Complete the DIS Kansas Department of Revenue

Completing the DIS Kansas Department of Revenue form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information related to the reporting period. Next, fill out the form carefully, ensuring all fields are completed accurately. After completing the form, review it for any errors before submission. Finally, submit the form according to the specified guidelines, whether online or via mail.

Legal Use of the DIS Kansas Department of Revenue

The DIS Kansas Department of Revenue form is legally binding when completed and submitted in accordance with state laws. To ensure its legal standing, it must be signed by the appropriate parties and submitted within the designated time frames. Compliance with all relevant regulations is crucial for the form to be considered valid in any legal or tax-related matters.

Required Documents for the DIS Kansas Department of Revenue

When completing the DIS Kansas Department of Revenue form, certain documents may be required to support the information provided. These may include previous tax returns, financial statements, and identification documents. Ensuring that all required documents are attached can facilitate a smoother processing experience and help avoid delays.

Form Submission Methods

The DIS Kansas Department of Revenue form can be submitted through various methods. Individuals may choose to file online through the Kansas Department of Revenue’s e-filing system, which offers convenience and faster processing times. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated offices. Each method has its own guidelines and deadlines, so it is important to follow the instructions carefully.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the DIS Kansas Department of Revenue form can result in penalties. These penalties may include fines, interest on unpaid taxes, or other legal repercussions. It is essential to understand the implications of non-compliance and to ensure timely and accurate submission of the form to avoid such consequences.

Quick guide on how to complete dis kansas department of revenue

Effortlessly Prepare DIS Kansas Department Of Revenue on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with everything needed to create, modify, and electronically sign your documents quickly and without delays. Manage DIS Kansas Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

The Simplest Way to Edit and Electronically Sign DIS Kansas Department Of Revenue with Ease

- Acquire DIS Kansas Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign DIS Kansas Department Of Revenue to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dis kansas department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dis kansas department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Kansas dis?

airSlate SignNow is an eSignature solution that allows businesses in Kansas dis to send and sign documents quickly and securely. It streamlines the signing process, making it easy for users to manage their paperwork efficiently. Whether you are in real estate, healthcare, or any industry in Kansas dis, our platform is designed to meet your needs.

-

What are the pricing options for airSlate SignNow in Kansas dis?

airSlate SignNow offers flexible pricing plans tailored to businesses in Kansas dis. You can choose from monthly or annual subscriptions, depending on your business needs. Each plan provides access to essential features, ensuring you get great value for your investment.

-

What features does airSlate SignNow provide for Kansas dis companies?

airSlate SignNow provides a comprehensive suite of features for Kansas dis organizations, including customizable templates, multi-party signing, and real-time tracking of documents. These features help streamline workflows and enhance overall productivity, making it easier for teams to collaborate on important documents.

-

How can airSlate SignNow benefit businesses in Kansas dis?

By using airSlate SignNow, businesses in Kansas dis can improve their operational efficiency and reduce the time spent on document signing. Our solution minimizes paperwork, leading to faster business processes and enhanced customer satisfaction. Furthermore, it's a cost-effective way to manage your documentation needs.

-

Can airSlate SignNow integrate with other tools used in Kansas dis?

Yes, airSlate SignNow easily integrates with various tools and platforms that businesses in Kansas dis already use. This includes popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations help streamline processes by allowing users to manage documents without switching between applications.

-

Is airSlate SignNow compliant with regulations in Kansas dis?

Absolutely! airSlate SignNow complies with all industry standards and regulations relevant to Kansas dis, including eSignature laws. Our platform ensures that your eSignatures are legally binding and secure, providing peace of mind for businesses and their clients.

-

What support options are available for airSlate SignNow users in Kansas dis?

Our customer support team is dedicated to assisting airSlate SignNow users in Kansas dis. We offer various support options, including online resources, tutorials, and direct customer service. Our goal is to ensure you have the best experience while using our product.

Get more for DIS Kansas Department Of Revenue

- Harmless form

- Texas from form

- Warranty deed one individual to two individuals texas form

- Petition for release of excess proceeds and notice of hearing texas form

- Quitclaim deed from two 2 individuals to two 2 individuals texas form

- Lady bird deed sample 497327373 form

- Warranty deed grantee 497327374 form

- Texas deed royalty form

Find out other DIS Kansas Department Of Revenue

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding