About Form 1120 F, U S Income Tax Return of a Foreign IRS 2022

What is the About Form 1120 F, U S Income Tax Return Of A Foreign IRS

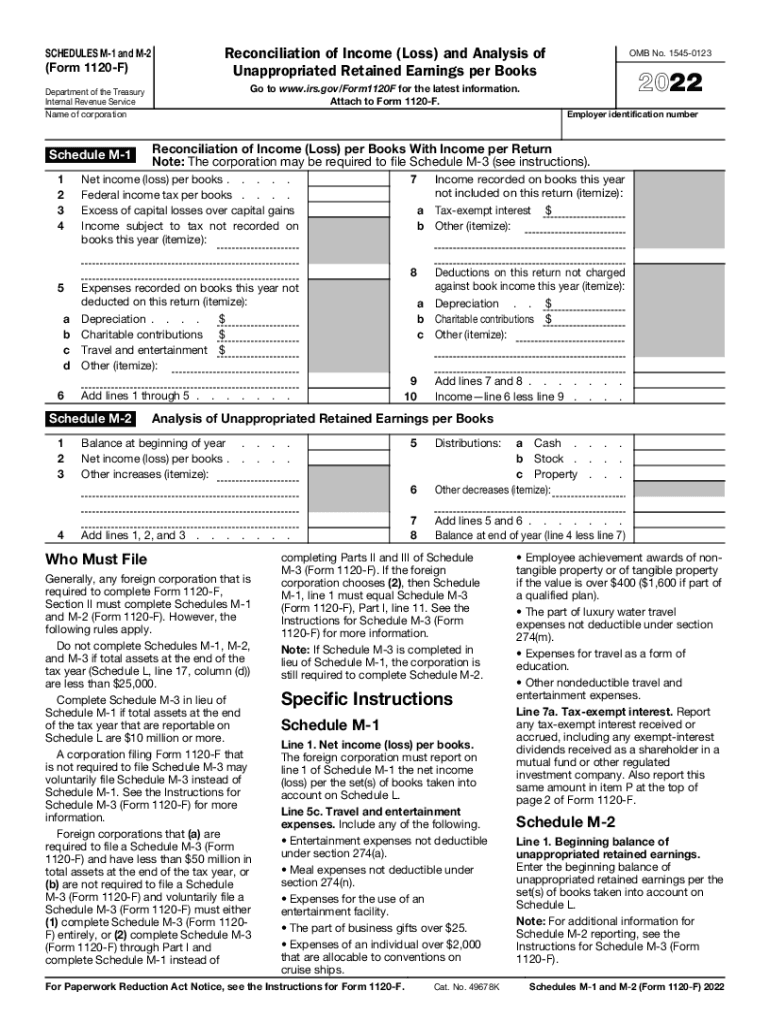

The Form 1120 F is the U.S. Income Tax Return specifically designed for foreign corporations engaged in trade or business within the United States. This form is essential for reporting income, gains, losses, deductions, and credits, as well as calculating the corporation's tax liability. Foreign entities must file this form to comply with U.S. tax regulations, ensuring they accurately report their financial activities within the country.

Steps to complete the About Form 1120 F, U S Income Tax Return Of A Foreign IRS

Completing Form 1120 F involves several key steps:

- Gather necessary documentation, including financial statements and records of income earned in the U.S.

- Fill out the form, ensuring all sections are completed accurately, including income, deductions, and tax credits.

- Calculate the total tax liability based on the reported income and applicable tax rates.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Required Documents

When preparing to file Form 1120 F, foreign corporations should have the following documents ready:

- Financial statements detailing income and expenses.

- Documentation of any U.S. source income.

- Records of deductions and credits claimed.

- Any previous tax returns filed with the IRS.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 F is typically the 15th day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by June 15. It is important to be aware of any extensions that may apply, as well as any changes in deadlines due to IRS announcements.

Penalties for Non-Compliance

Failure to file Form 1120 F on time can result in significant penalties. The IRS may impose a penalty for late filing, which is calculated based on the number of months the return is overdue. Additionally, if taxes owed are not paid, interest will accrue on the unpaid balance. It is crucial for foreign corporations to adhere to filing requirements to avoid these financial consequences.

Digital vs. Paper Version

Form 1120 F can be filed electronically or submitted as a paper return. Filing electronically offers several advantages, including faster processing times and confirmation of receipt from the IRS. However, some foreign corporations may prefer to submit a paper return for various reasons, such as lack of access to electronic filing systems. Understanding the pros and cons of each method can help in making an informed decision about how to submit the form.

Quick guide on how to complete about form 1120 f us income tax return of a foreign irs

Effortlessly Complete About Form 1120 F, U S Income Tax Return Of A Foreign IRS on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, edit, and eSign your documents without delays. Handle About Form 1120 F, U S Income Tax Return Of A Foreign IRS on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and eSign About Form 1120 F, U S Income Tax Return Of A Foreign IRS with Ease

- Find About Form 1120 F, U S Income Tax Return Of A Foreign IRS and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Adjust and eSign About Form 1120 F, U S Income Tax Return Of A Foreign IRS to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1120 f us income tax return of a foreign irs

Create this form in 5 minutes!

How to create an eSignature for the about form 1120 f us income tax return of a foreign irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the 2018 BMW M2?

The 2018 BMW M2 boasts a powerful turbocharged inline-six engine, delivering thrilling performance with 365 horsepower. It features responsive steering, a compact design, and advanced driving dynamics that provide an exhilarating experience on the road. Additionally, the M2 comes equipped with a well-appointed interior filled with modern technology and safety features.

-

How much does the 2018 BMW M2 cost?

The starting price for the 2018 BMW M2 typically ranges from $55,000 to $60,000, depending on the options and packages selected. It's essential to consider additional costs such as taxes, fees, and optional features that may enhance your driving experience. Financing options and pre-owned models might also be available for those looking to save.

-

What are the performance specifications of the 2018 BMW M2?

The 2018 BMW M2 offers impressive performance specifications, including a 0-60 mph time of just 4.0 seconds with the dual-clutch automatic transmission. It features a rear-wheel-drive layout, a finely-tuned suspension, and aggressive styling that enhances both speed and agility on the track. This makes the M2 a top choice for performance enthusiasts.

-

What advantages does the 2018 BMW M2 offer over competitors?

The 2018 BMW M2 stands out among competitors due to its combination of performance, luxury, and versatility. It provides a well-balanced driving experience with precise handling and a comfortable cabin. Additionally, the M2 offers a unique BMW driving experience that includes advanced technology and personalized options to fit the driver's needs.

-

Are there any special editions or packages for the 2018 BMW M2?

Yes, the 2018 BMW M2 has a Competition Package that enhances performance with increased horsepower, upgraded suspension, and additional features to provide an even sportier driving experience. Customers can also opt for various exterior and interior styling packages to customize their vehicle to their liking. These options can signNowly enhance both aesthetics and driving dynamics.

-

What technology features are included in the 2018 BMW M2?

The 2018 BMW M2 is equipped with a variety of modern technology features, including a high-resolution display, premium audio system, and Apple CarPlay compatibility. It offers advanced navigation tools and driver assistance features to enhance safety and convenience on the road. The integration of these technologies ensures an enjoyable and connected driving experience.

-

Is the 2018 BMW M2 suitable for everyday driving?

Despite being a high-performance sports car, the 2018 BMW M2 is designed to offer comfort and practicality for everyday driving. Its compact size makes it easy to maneuver in urban environments, while the interior provides sufficient cargo space. Additionally, features like automatic climate control enhance day-to-day usability.

Get more for About Form 1120 F, U S Income Tax Return Of A Foreign IRS

- Blue mountain cards login form

- State street retiree services 1099 r form

- Telkom business application form

- Medical records release form the university of tennessee utmedicalcenter

- Acko general insurance motor claim form

- Farm endorsement application oregon department of transportation odot state or form

- In the case of minors surname first name address if different from applicants and nationality of form

- Affidavit of non compliance i form

Find out other About Form 1120 F, U S Income Tax Return Of A Foreign IRS

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple