M 1 Form 2012

What is the M-1 Form

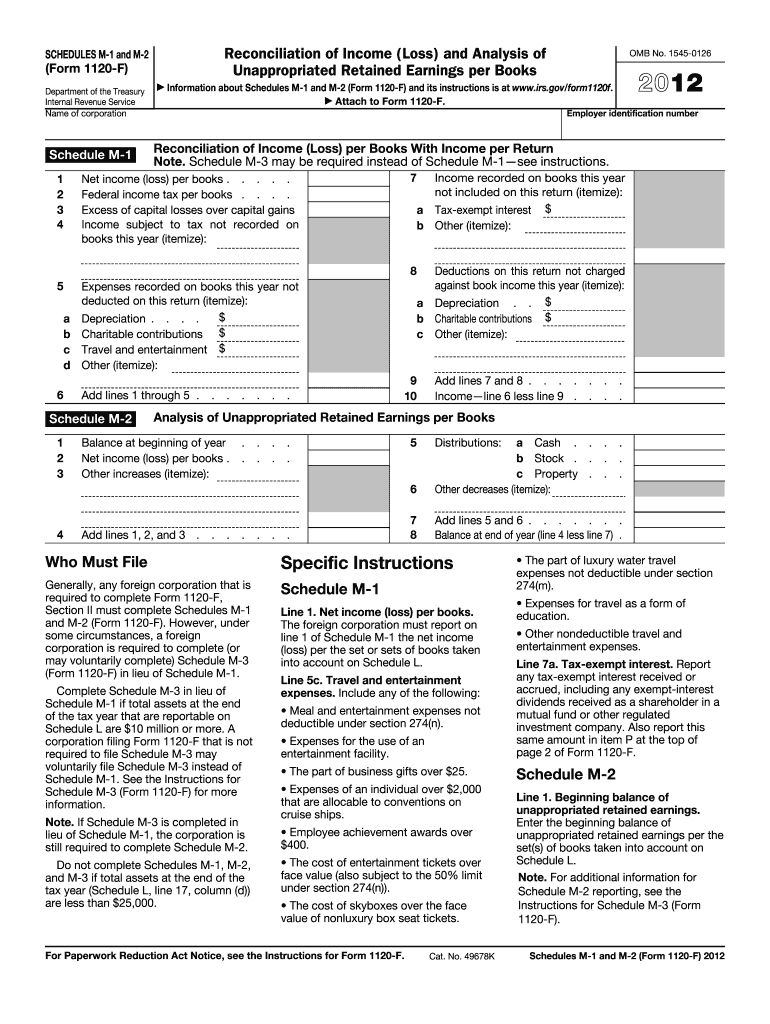

The M-1 Form is a tax document used by partnerships, corporations, and certain other business entities to report their income, deductions, and credits to the Internal Revenue Service (IRS). It is specifically designed to reconcile the differences between the financial accounting income reported on the entity's books and the taxable income reported on the tax return. This form helps ensure compliance with tax laws and provides transparency in financial reporting.

How to use the M-1 Form

Using the M-1 Form involves several key steps. First, gather all necessary financial records, including profit and loss statements and balance sheets. Next, complete the form by accurately reporting the entity's income, deductions, and any adjustments needed to reconcile book income with taxable income. It is essential to ensure that all figures are correct and that the form is signed by an authorized individual. Finally, submit the completed form along with the entity's tax return to the IRS by the appropriate deadline.

Steps to complete the M-1 Form

Completing the M-1 Form requires careful attention to detail. Follow these steps:

- Gather financial statements and any relevant tax documents.

- Fill in the entity's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income as shown on the financial statements.

- List all deductions and adjustments, ensuring they align with the entity's accounting records.

- Calculate the differences between book income and taxable income.

- Sign and date the form, ensuring it is authorized by a responsible party.

Legal use of the M-1 Form

The M-1 Form is legally required for certain business entities to maintain compliance with IRS regulations. It serves as a formal declaration of income and deductions, ensuring that the entity is accurately reporting its financial activities. Failure to complete and file the M-1 Form can result in penalties and increased scrutiny from tax authorities. It is important to follow all legal guidelines when preparing this form to avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the M-1 Form vary depending on the type of entity and its tax year. Generally, the form must be submitted along with the entity's tax return by the due date, which is typically the fifteenth day of the third month following the end of the tax year. For entities operating on a calendar year, this usually means a deadline of March 15. It is crucial to keep track of these dates to ensure timely compliance and avoid penalties.

Required Documents

To complete the M-1 Form, several documents are necessary. These include:

- Financial statements, such as profit and loss statements and balance sheets.

- Previous tax returns for reference.

- Records of any adjustments made to income or deductions.

- Documentation supporting any credits claimed.

Having these documents organized and readily available can streamline the completion process and ensure accuracy.

Quick guide on how to complete 2012 m 1 form

Manage M 1 Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to formulate, modify, and electronically sign your documents promptly without delays. Handle M 1 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign M 1 Form effortlessly

- Find M 1 Form and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details, then click the Done button to save your modifications.

- Choose your preferred method to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign M 1 Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 m 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 m 1 form

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is an M 1 Form?

The M 1 Form is a crucial tax document used by businesses to report their corporate income, deductions, and credits. Understanding the M 1 Form is essential for ensuring compliance with tax regulations and accurately reflecting your business’s financial status.

-

How can airSlate SignNow help with the M 1 Form?

airSlate SignNow streamlines the process of completing and submitting the M 1 Form by providing an easy-to-use interface for electronic signatures and document management. Our platform allows you to securely send, sign, and store your M 1 Form online, simplifying compliance and reducing paperwork.

-

What features does airSlate SignNow offer for M 1 Form processing?

With airSlate SignNow, users can take advantage of features such as customizable templates, automated workflows, and real-time tracking for their M 1 Form submissions. These tools enhance productivity and ensure that your form is completed accurately and efficiently.

-

Is there a pricing plan for airSlate SignNow that fits my needs?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of businesses. Each plan includes access to essential tools for managing documents like the M 1 Form, and you can choose the one that best fits your operations and budget.

-

What are the benefits of using airSlate SignNow for the M 1 Form?

Using airSlate SignNow to manage your M 1 Form offers numerous benefits, including time savings, enhanced security, and improved accuracy in document handling. Our platform minimizes the risk of errors and streamlines the submission process, allowing you to focus on your business.

-

Can I integrate airSlate SignNow with other software when working on the M 1 Form?

Absolutely! airSlate SignNow supports integration with various software applications to create a seamless workflow for handling your M 1 Form. This means you can connect it with your favorite accounting or document management tools, optimizing your overall process.

-

How secure is my information when using airSlate SignNow for the M 1 Form?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and secure storage to protect your information when completing the M 1 Form. You can trust our platform to keep your sensitive data safe throughout the entire signing process.

Get more for M 1 Form

Find out other M 1 Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement