Form M 1 2017

What is the Form M 1

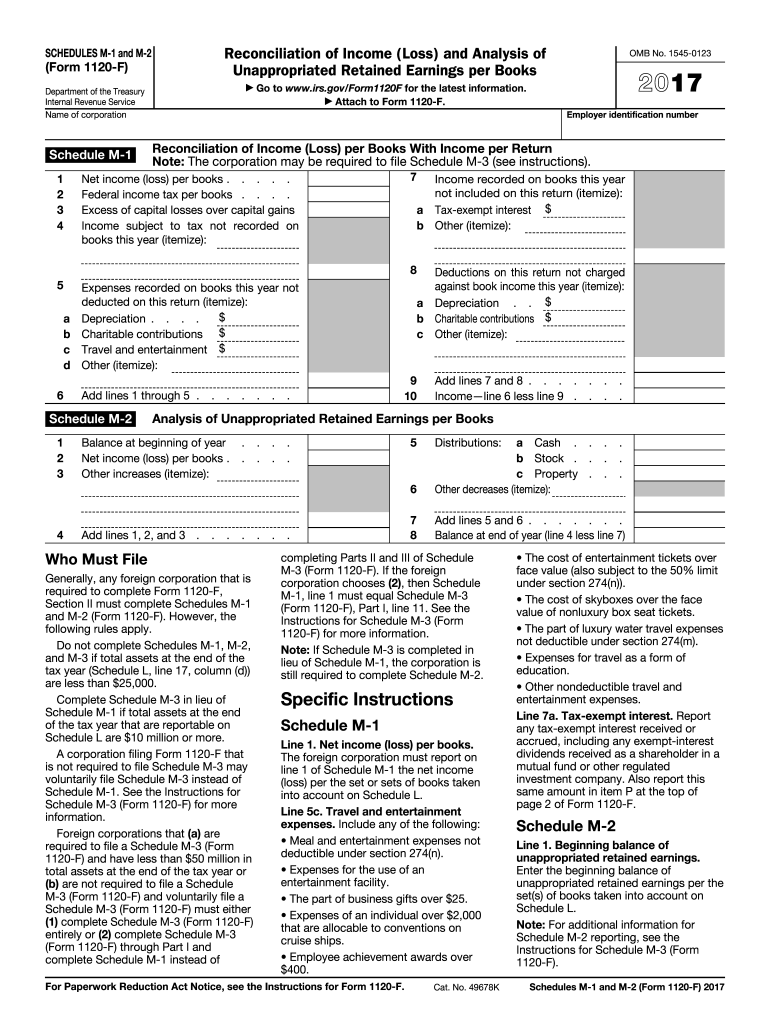

The Form M 1 is a tax form used by certain business entities in the United States to report income, deductions, and credits. It is specifically designed for multi-member Limited Liability Companies (LLCs) and partnerships that are taxed as partnerships. This form helps to ensure compliance with federal tax regulations and provides a clear overview of the entity's financial activities for the tax year.

Steps to complete the Form M 1

Completing the Form M 1 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully fill out each section of the form, ensuring that all required fields are completed. Pay special attention to the income and deduction sections, as these will impact the overall tax liability. Once the form is filled out, review it for any errors or omissions before submitting it.

How to obtain the Form M 1

The Form M 1 can be obtained from the Internal Revenue Service (IRS) website or through tax preparation software that supports business tax filings. It is essential to ensure that you are using the most current version of the form, as outdated forms may not be accepted by tax authorities. Additionally, some accounting firms may provide the form as part of their services, so consulting with a tax professional can also be beneficial.

Legal use of the Form M 1

The legal use of the Form M 1 requires adherence to IRS guidelines and regulations. It is crucial to ensure that the information reported is accurate and complete to avoid penalties or audits. The form must be filed by the designated deadline, typically the fifteenth day of the third month following the end of the tax year. Failure to file or inaccuracies in the form can lead to legal repercussions, including fines and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form M 1 can be submitted through various methods, depending on the preferences of the filer and the requirements of the IRS. Options include electronic filing through approved tax software, mailing the completed form to the appropriate IRS address, or in-person submission at designated IRS offices. Each method has its own advantages, such as faster processing times for electronic submissions, while mailing may offer a physical record of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form M 1 are critical for compliance. Typically, the form must be filed by the fifteenth day of the third month after the end of the tax year. For entities operating on a calendar year, this means the deadline is March 15. It is important to keep track of these dates to avoid late fees and penalties. Additionally, extensions may be available, but they must be requested before the original deadline.

Quick guide on how to complete 2017 form m 1

Discover the most efficient method to complete and endorse your Form M 1

Are you still spending time creating your official paperwork on paper instead of online? airSlate SignNow provides a superior approach to finalize and endorse your Form M 1 and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to manage documentation swiftly and in line with formal standards - comprehensive PDF editing, administration, protection, signing, and sharing tools all available within an intuitive interface.

Only a few steps are required to complete and endorse your Form M 1:

- Upload the fillable template to the editor by clicking the Get Form button.

- Verify the information you need to provide in your Form M 1.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Revise the content with Text boxes or Images from the top menu.

- Emphasize what is important or Conceal sections that are no longer relevant.

- Select Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and finish your task by clicking the Done button.

Store your completed Form M 1 in the Documents directory of your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides versatile file sharing. There's no requirement to print your forms when you need to submit them to the appropriate public office—do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 form m 1

FAQs

-

How does WBJEE counselling work?

WBJEE counselling procedure is very much similar to the counselling procedure adopted in JEE MAINS. After obtaining a rank in the exam interested candidates will be required to generate username and password and will have to pay the registration fee. This registration fee will be non-refundable,which is around 500. After registration candidates will be required to fill their choices online through the website. After declaration of round 1 result a candidate will be left with 3 choices. 1- accept the seat and take admission in the allocated seat.2- consider the candidate for up-gradation to higher filled choices.3- surrender the seat and pull out yourself from the counselling procedure.candidates will have to report to the reporting center within the specified period of time and will have to submit their choices failing to do so in round 1 will automatically remove you from further consideration and you will loose your seat. For choices 1 & 2, candidates will have to pay seat acceptance fee which will be returned in further rounds if you opt for choice 3( but will have to report to the reporting center,otherwise the candidate will not be able to claim it).This procedure will be repeated for three rounds and extra rounds can be introduced if the counselling team feels the necessity of it.In last round you will be forced to either accept the allocated seat or surrender your seat.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

Which private college form should I fill out as I expect to get a 155 in the JEE Mains 2017?

Before trying to fill out private college forms, have a through knowing on filling up JOSAA, hope you will land up around +/- 25k rank in jee main, so you could easily get into iiit kanjeepuram and iiit Sri City, compared to last year data.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Can the 2017 NEET forms be filled out after the last date, i.e after 1 March, 2017?

No, after 1 march you can't fill the form but if you have already filled the form n not paid fee than you can pay fee with late payment option.

Create this form in 5 minutes!

How to create an eSignature for the 2017 form m 1

How to create an eSignature for your 2017 Form M 1 online

How to create an eSignature for the 2017 Form M 1 in Google Chrome

How to create an eSignature for signing the 2017 Form M 1 in Gmail

How to generate an electronic signature for the 2017 Form M 1 straight from your smartphone

How to create an electronic signature for the 2017 Form M 1 on iOS devices

How to create an electronic signature for the 2017 Form M 1 on Android OS

People also ask

-

What is Form M 1 and how does it relate to airSlate SignNow?

Form M 1 is a document commonly used for various business processes, including compliance and reporting. With airSlate SignNow, you can easily create, send, and eSign your Form M 1, ensuring that your documents are secure and legally binding. Our platform simplifies the process, making it efficient for businesses of all sizes.

-

How much does it cost to use airSlate SignNow for Form M 1?

airSlate SignNow offers flexible pricing plans to accommodate different business needs when handling documents like Form M 1. Depending on the features you require, our plans start at competitive rates, providing excellent value for businesses looking to streamline their document management and eSigning processes.

-

What features does airSlate SignNow offer for managing Form M 1?

With airSlate SignNow, you can easily create templates for Form M 1, customize fields, and automate workflows. Our platform also includes features like real-time tracking, reminders, and secure cloud storage, allowing you to manage your documents efficiently while ensuring compliance.

-

Can I integrate airSlate SignNow with other applications for Form M 1?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage Form M 1 alongside other business tools. Whether it’s CRM systems, cloud storage, or productivity suites, our integrations help streamline your workflow and improve efficiency.

-

Is airSlate SignNow secure for handling sensitive Form M 1 documents?

Absolutely! airSlate SignNow prioritizes security, using advanced encryption and compliance protocols to protect your Form M 1 and other sensitive documents. Our platform ensures that your data is safe during transmission and storage, giving you peace of mind as you conduct business.

-

How can airSlate SignNow improve my team's efficiency with Form M 1?

By using airSlate SignNow, your team can easily collaborate on Form M 1, reducing the time spent on manual processes. The ability to send, sign, and manage documents electronically accelerates workflows and minimizes delays, allowing your business to operate more efficiently.

-

Can I access Form M 1 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is accessible on both desktop and mobile devices, giving you the flexibility to manage your Form M 1 anytime, anywhere. Our mobile app allows you to send, sign, and track documents on the go, ensuring that your business operations are never interrupted.

Get more for Form M 1

Find out other Form M 1

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation