Go to Www Irs GovForm1120F for the Latest Information 2021

Understanding the Schedule Entertainment Form

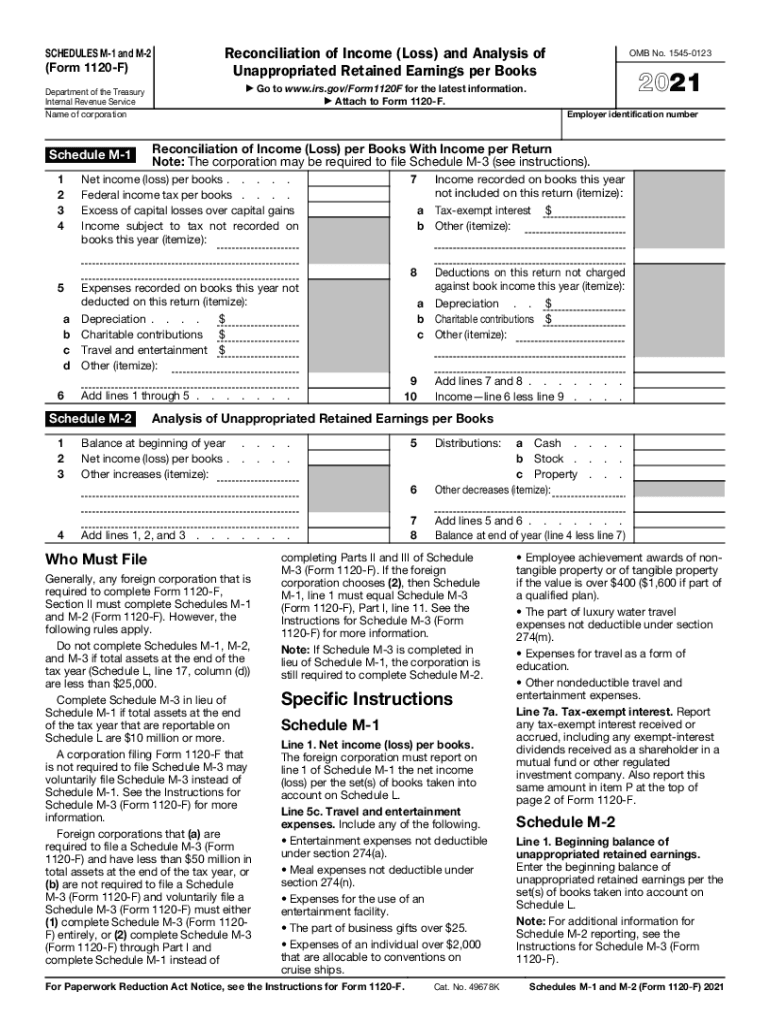

The Schedule Entertainment form is a crucial document used for reporting entertainment expenses related to business activities. It allows businesses to detail costs incurred for entertaining clients, customers, or employees. Properly completing this form ensures that these expenses are accurately reflected in tax filings, which can affect tax liability and deductions.

Key Elements of the Schedule Entertainment Form

When filling out the Schedule Entertainment form, it is essential to include specific details to ensure compliance with IRS regulations. Key elements include:

- Date of Entertainment: The date when the entertainment took place.

- Type of Entertainment: A description of the entertainment provided, such as meals, events, or recreational activities.

- Cost: The total amount spent on the entertainment, which should be documented with receipts.

- Business Purpose: A brief explanation of how the entertainment relates to business activities.

Steps to Complete the Schedule Entertainment Form

Completing the Schedule Entertainment form involves several steps to ensure accuracy and compliance:

- Gather all relevant documentation, including receipts and invoices related to entertainment expenses.

- Fill in the date of the entertainment and provide a description of the event.

- Detail the costs associated with the entertainment, ensuring all figures are accurate.

- Clearly state the business purpose for the entertainment to justify the expense.

- Review the completed form for any errors before submission.

IRS Guidelines for Entertainment Expenses

The IRS has established guidelines regarding the deductibility of entertainment expenses. Generally, only 50% of the cost of meals and entertainment directly related to business activities is deductible. It is important to keep thorough records and follow IRS regulations to avoid issues during audits.

Filing Deadlines for the Schedule Entertainment Form

Timely submission of the Schedule Entertainment form is critical. The form must be filed along with the business's tax return. Key deadlines typically align with the overall tax filing deadline, which is usually April 15 for most businesses. However, extensions may be available, and it is advisable to check the IRS website for specific dates relevant to the current tax year.

Common Penalties for Non-Compliance

Failure to accurately complete and submit the Schedule Entertainment form can result in penalties from the IRS. Common penalties include:

- Disallowance of Deductions: If the form is not completed correctly, the IRS may disallow the claimed deductions.

- Fines: Businesses may incur fines for late submissions or inaccuracies.

- Audit Risk: Incomplete or suspicious entries may trigger an audit, leading to further scrutiny of financial records.

Quick guide on how to complete go to wwwirsgovform1120f for the latest information

Prepare Go To Www irs govForm1120F For The Latest Information effortlessly on any device

Managing documents online has gained increased popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Go To Www irs govForm1120F For The Latest Information on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to modify and electronically sign Go To Www irs govForm1120F For The Latest Information with ease

- Locate Go To Www irs govForm1120F For The Latest Information and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Go To Www irs govForm1120F For The Latest Information and guarantee seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct go to wwwirsgovform1120f for the latest information

Create this form in 5 minutes!

How to create an eSignature for the go to wwwirsgovform1120f for the latest information

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

How can I use airSlate SignNow to schedule entertainment contracts?

With airSlate SignNow, you can easily schedule entertainment contracts by drafting them digitally and sending them for eSignature. The platform allows you to create templates tailored for different types of entertainment agreements, ensuring a quick and efficient signing process. This feature helps streamline your workflow and reduces the hassle of manual document handling.

-

What features does airSlate SignNow offer for scheduling entertainment events?

airSlate SignNow includes features that allow you to schedule entertainment events seamlessly, such as customizable templates and automated reminders for signatures. You can also track the status of your documents in real-time, ensuring that all parties are in the loop. This helps keep your entertainment logistics organized and on track.

-

Is airSlate SignNow cost-effective for scheduling entertainment agreements?

Yes, airSlate SignNow is a cost-effective solution for scheduling entertainment agreements. With various pricing plans, you can choose one that fits your business size and needs. This affordability, combined with robust features, ensures you can manage your entertainment contracts without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for scheduling entertainment?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRM systems and project management tools. This integration allows you to synchronize your scheduling of entertainment documents effortlessly, enhancing your overall efficiency in event management.

-

What are the benefits of using airSlate SignNow for scheduling entertainment?

The benefits of using airSlate SignNow for scheduling entertainment include reduced turnaround times and improved communication with clients and partners. You can send documents for eSignature quickly, track their status, and ensure that everyone involved in the entertainment event is in sync. This enhances professionalism and ensures a smooth planning process.

-

Is there a mobile version of airSlate SignNow for scheduling entertainment?

Yes, airSlate SignNow offers a mobile-friendly solution that allows you to schedule entertainment documents on the go. With the mobile app, you can manage, send, and sign documents directly from your smartphone or tablet. This accessibility enables you to handle entertainment agreements wherever you are.

-

How secure is airSlate SignNow when scheduling entertainment documents?

airSlate SignNow prioritizes security when you schedule entertainment documents, utilizing AES 256-bit encryption to protect your sensitive information. Additionally, it complies with industry standards such as GDPR and HIPAA, ensuring that your entertainment contracts are stored safely. This security gives you peace of mind as you manage your agreements.

Get more for Go To Www irs govForm1120F For The Latest Information

Find out other Go To Www irs govForm1120F For The Latest Information

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure