Schedules M 1 and M 2 Form 1120 F Reconciliation of Income Loss and Analysis of Unappropriated Retained Earnings Per B 2016

What is the Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B

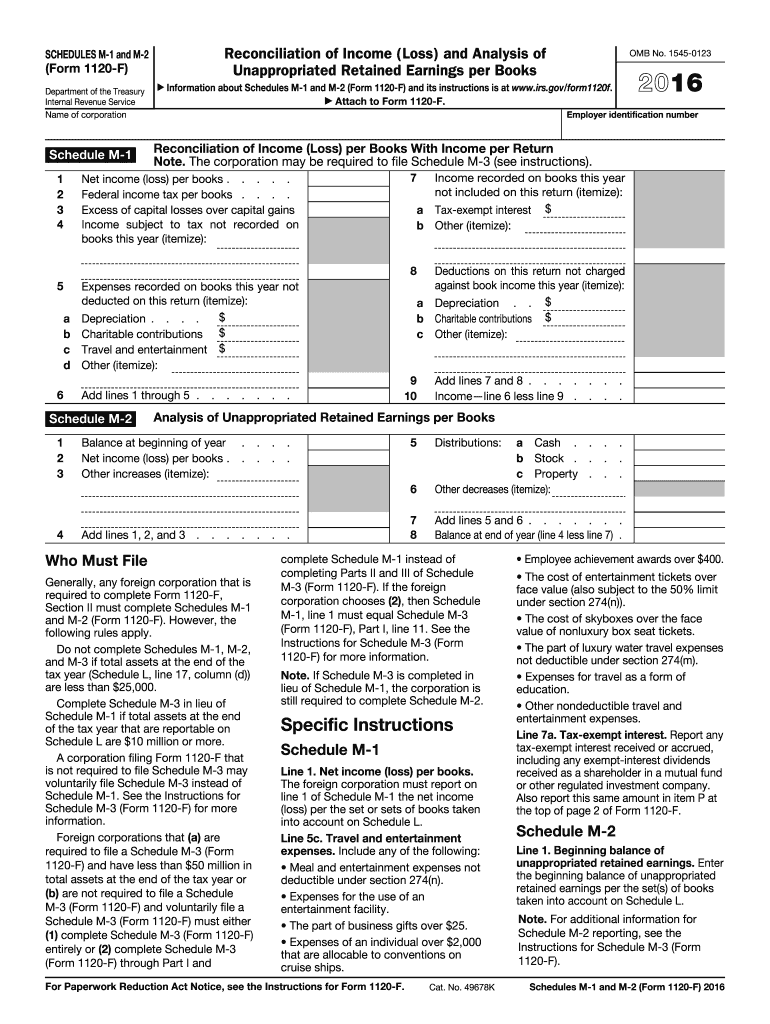

The Schedules M-1 and M-2 Form 1120-F are essential documents for foreign corporations operating in the United States. They serve to reconcile income and loss reported on the corporate tax return, specifically Form 1120-F, and provide an analysis of unappropriated retained earnings per books. This reconciliation is crucial for ensuring that the income reported aligns with the financial statements and for maintaining compliance with U.S. tax regulations.

Steps to complete the Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B

Completing the Schedules M-1 and M-2 requires attention to detail and a clear understanding of the corporation's financials. Here are the steps to follow:

- Gather financial statements, including income statements and balance sheets.

- Identify any differences between book income and taxable income for M-1, which includes adjustments for items such as tax-exempt income and non-deductible expenses.

- Complete the M-1 by listing all adjustments in the appropriate sections.

- For M-2, calculate the unappropriated retained earnings by starting with the beginning balance, adding net income or loss, and subtracting dividends paid.

- Review all entries for accuracy and ensure they align with the corporation's financial records.

Legal use of the Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B

The legal use of the Schedules M-1 and M-2 is governed by U.S. tax laws, which require accurate reporting of income and expenses for foreign corporations. These forms must be filed along with Form 1120-F to ensure compliance with the Internal Revenue Service (IRS) guidelines. Proper completion of these schedules helps avoid penalties and ensures that the corporation is accurately reporting its financial position.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedules M-1 and M-2. These guidelines outline the types of adjustments that can be made and the documentation required to support these adjustments. It is essential for corporations to familiarize themselves with these guidelines to ensure compliance and avoid potential audits. The IRS website offers resources and publications that detail these requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Schedules M-1 and M-2 coincide with the due date for Form 1120-F. Typically, this is the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. It is important to keep track of these dates to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Schedules M-1 and M-2 either electronically or via traditional mail. Electronic filing is encouraged as it often results in faster processing times and confirmation of receipt. If filing by mail, ensure that the forms are sent to the correct IRS address and that adequate postage is applied to avoid delays.

Quick guide on how to complete 2016 schedules m 1 and m 2 form 1120 f reconciliation of income loss and analysis of unappropriated retained earnings per books

Complete Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Handle Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B without any hassle

- Locate Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes requiring new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 schedules m 1 and m 2 form 1120 f reconciliation of income loss and analysis of unappropriated retained earnings per books

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedules m 1 and m 2 form 1120 f reconciliation of income loss and analysis of unappropriated retained earnings per books

How to create an eSignature for your 2016 Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books online

How to generate an electronic signature for your 2016 Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books in Google Chrome

How to generate an electronic signature for signing the 2016 Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books in Gmail

How to generate an eSignature for the 2016 Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books right from your smartphone

How to make an eSignature for the 2016 Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books on iOS devices

How to generate an eSignature for the 2016 Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per Books on Android devices

People also ask

-

What are Schedules M 1 And M 2 Form 1120 F?

Schedules M 1 And M 2 Form 1120 F are essential components for U.S. foreign corporations to reconcile income and losses when filing taxes. These forms help clarify the differences between financial accounting income and taxable income. Properly completing these schedules is crucial for accurate tax reporting.

-

How can airSlate SignNow assist with Schedules M 1 And M 2 Form 1120 F?

airSlate SignNow provides an efficient platform for businesses to prepare and eSign necessary documents, including Schedules M 1 And M 2 Form 1120 F. Our user-friendly interface allows for easy organization and management of tax-related documents, streamlining the filing process for businesses.

-

Is there a cost associated with using airSlate SignNow for Schedules M 1 And M 2 Form 1120 F?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. These plans are designed to be cost-effective while providing all the necessary features for managing Schedules M 1 And M 2 Form 1120 F. Check our website for specific pricing information and plan details.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including Schedules M 1 And M 2 Form 1120 F, streamlines workflows and enhances productivity. The platform allows users to easily send, receive, and eSign documents, reducing paperwork and saving time. Additionally, our secure system ensures your sensitive tax documents are protected.

-

Can I integrate airSlate SignNow with other software for managing Schedules M 1 And M 2 Form 1120 F?

Yes, airSlate SignNow easily integrates with various accounting and tax preparation software, making it convenient to manage Schedules M 1 And M 2 Form 1120 F. This integration allows for seamless data transfer and enhances overall efficiency in document handling. Explore our integrations to find the best fit for your business.

-

How does airSlate SignNow ensure the security of Schedules M 1 And M 2 Form 1120 F?

AirSlate SignNow prioritizes the security of your documents, including Schedules M 1 And M 2 Form 1120 F. We use advanced encryption methods and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure confidentiality and data integrity.

-

What features help simplify the completion of Schedules M 1 And M 2 Form 1120 F in airSlate SignNow?

airSlate SignNow offers features such as customizable templates, collaboration tools, and electronic signatures that simplify the process of completing Schedules M 1 And M 2 Form 1120 F. These tools allow you to draft, edit, and review documents efficiently, ensuring compliance and accuracy. Experience the benefits of a streamlined workflow with our comprehensive features.

Get more for Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B

- Arizona motor vehicle division revocation packet form

- Bca 1245 form

- Parent revoke consent for special education fillable form

- Nobo request form

- Unified court system inspector general reports form

- Non discriminationworkforce composition form for city of berkeley ci berkeley ca

- De 2501f form

- Cargo abstract form

Find out other Schedules M 1 And M 2 Form 1120 F Reconciliation Of Income Loss And Analysis Of Unappropriated Retained Earnings Per B

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free