AR DFA K 1 Form 2022

What is the AR DFA K 1 Form

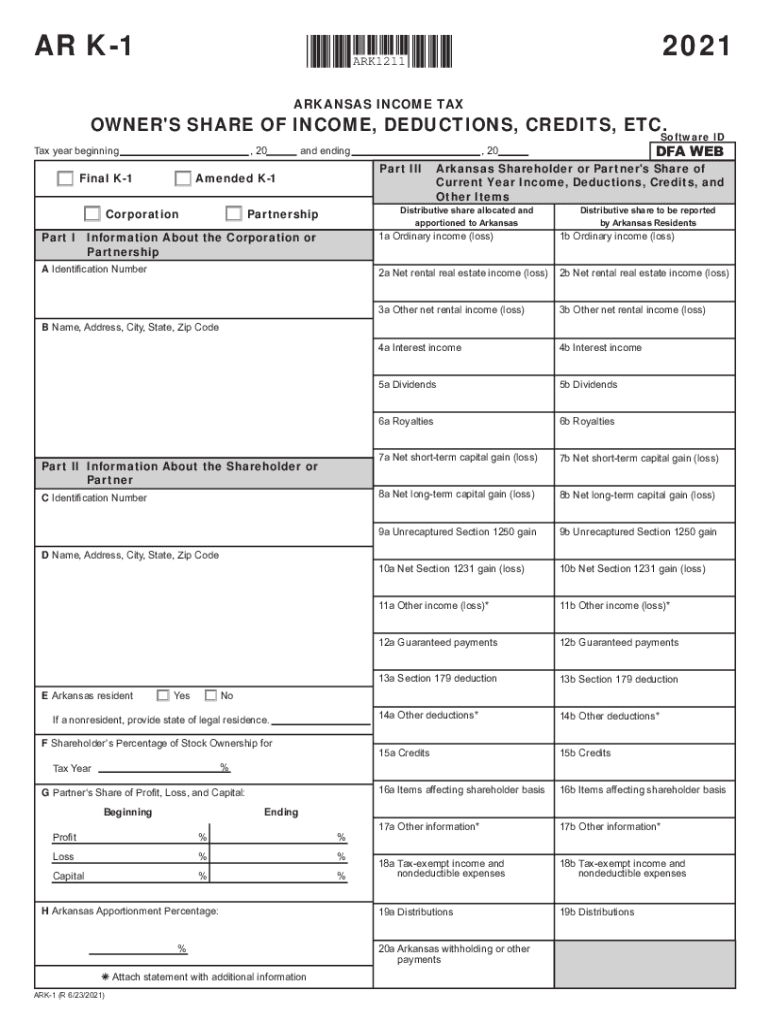

The AR DFA K 1 Form is a document used in the state of Arkansas for reporting income, deductions, and credits from partnerships, S corporations, and limited liability companies (LLCs). This form is essential for individuals who receive income from these entities, as it provides the necessary information for accurate tax reporting. The AR DFA K 1 Form includes details about the taxpayer's share of income, losses, and other tax-related items that must be reported on their personal income tax return.

How to use the AR DFA K 1 Form

Using the AR DFA K 1 Form involves several key steps. First, the entity that is generating the income must complete the form, detailing each partner's or shareholder's share of the income and deductions. Once completed, the form is distributed to the respective individuals. Taxpayers should then use the information provided on the AR DFA K 1 Form to fill out their personal tax returns accurately. It is crucial to ensure that all amounts reported align with the taxpayer's records to avoid discrepancies with the Arkansas Department of Finance and Administration.

Steps to complete the AR DFA K 1 Form

Completing the AR DFA K 1 Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary financial documents, including previous tax returns and income statements.

- Fill in the entity's information, including name, address, and tax identification number.

- Report each partner's or shareholder's share of income, deductions, and credits as per the entity's records.

- Ensure all calculations are accurate and reflect the entity's financial activities for the tax year.

- Distribute the completed forms to all relevant partners or shareholders.

Legal use of the AR DFA K 1 Form

The AR DFA K 1 Form is legally recognized for tax reporting purposes in Arkansas. It must be completed accurately to ensure compliance with state tax laws. The information provided on this form is used to determine each taxpayer's liability and eligibility for various deductions and credits. Failure to properly complete and submit this form can lead to penalties or audits by the Arkansas Department of Finance and Administration.

Filing Deadlines / Important Dates

Filing deadlines for the AR DFA K 1 Form are aligned with the overall tax filing deadlines in Arkansas. Typically, partnerships and S corporations must provide the AR DFA K 1 Form to their partners or shareholders by March 15 of each year. Taxpayers must then report the information on their individual tax returns by April 15. It is important to stay informed about any changes to these deadlines, as they can vary from year to year.

Who Issues the Form

The AR DFA K 1 Form is issued by the Arkansas Department of Finance and Administration. It is typically prepared by the partnership, S corporation, or LLC that generates income. These entities are responsible for ensuring that the form is filled out correctly and distributed to the appropriate individuals. The Arkansas Department of Finance and Administration provides guidelines and resources to assist entities in completing the form accurately.

Quick guide on how to complete ar dfa k 1 form

Effortlessly Prepare AR DFA K 1 Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle AR DFA K 1 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign AR DFA K 1 Form Smoothly

- Obtain AR DFA K 1 Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign AR DFA K 1 Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar dfa k 1 form

Create this form in 5 minutes!

How to create an eSignature for the ar dfa k 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR DFA K 1 Form and why is it important?

The AR DFA K 1 Form is a crucial document for reporting income or losses from partnerships in Arkansas. It ensures that partners accurately report their share of these amounts on their individual tax returns. Understanding and using the AR DFA K 1 Form correctly can prevent tax complications and ensure compliance with state regulations.

-

How does airSlate SignNow simplify the completion of the AR DFA K 1 Form?

airSlate SignNow offers a user-friendly platform for filling out the AR DFA K 1 Form, allowing users to easily input necessary information and share it with partners. Our digital signing feature streamlines the process, eliminating the need for printing and scanning. This not only saves time but also enhances accuracy in completing the form.

-

Is there a cost associated with using airSlate SignNow for the AR DFA K 1 Form?

Yes, airSlate SignNow has various pricing plans that cater to different user needs. Our affordable plans allow unlimited access to features designed to streamline the completion and signing of the AR DFA K 1 Form. You can choose the plan that best aligns with your requirements and budget.

-

Can I integrate airSlate SignNow with other software for handling the AR DFA K 1 Form?

Absolutely! airSlate SignNow supports integrations with popular software platforms, enhancing your workflow for managing the AR DFA K 1 Form. This allows for seamless data transfer and improved collaboration with your team and partners, making the entire process more efficient.

-

What features does airSlate SignNow offer for eSigning the AR DFA K 1 Form?

Our platform offers comprehensive eSigning features tailored for the AR DFA K 1 Form, including customizable signature fields, audit trails, and reminders. This ensures that all parties involved are notified and can quickly sign the document, speeding up approval times. Enhanced security measures also protect your sensitive information.

-

How does using airSlate SignNow benefit businesses dealing with the AR DFA K 1 Form?

Using airSlate SignNow for the AR DFA K 1 Form helps businesses save time and reduce errors in the document management process. With easy online access and electronic signatures, companies can enhance collaboration and speed up the submission process. This leads to more efficient operations and cost savings.

-

Is there customer support available for questions regarding the AR DFA K 1 Form?

Yes, airSlate SignNow provides excellent customer support to assist with any questions about the AR DFA K 1 Form. Our team is available via chat, email, or phone to help guide you through the process or troubleshoot any issues you may encounter. We aim to ensure you have a seamless experience.

Get more for AR DFA K 1 Form

Find out other AR DFA K 1 Form

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document